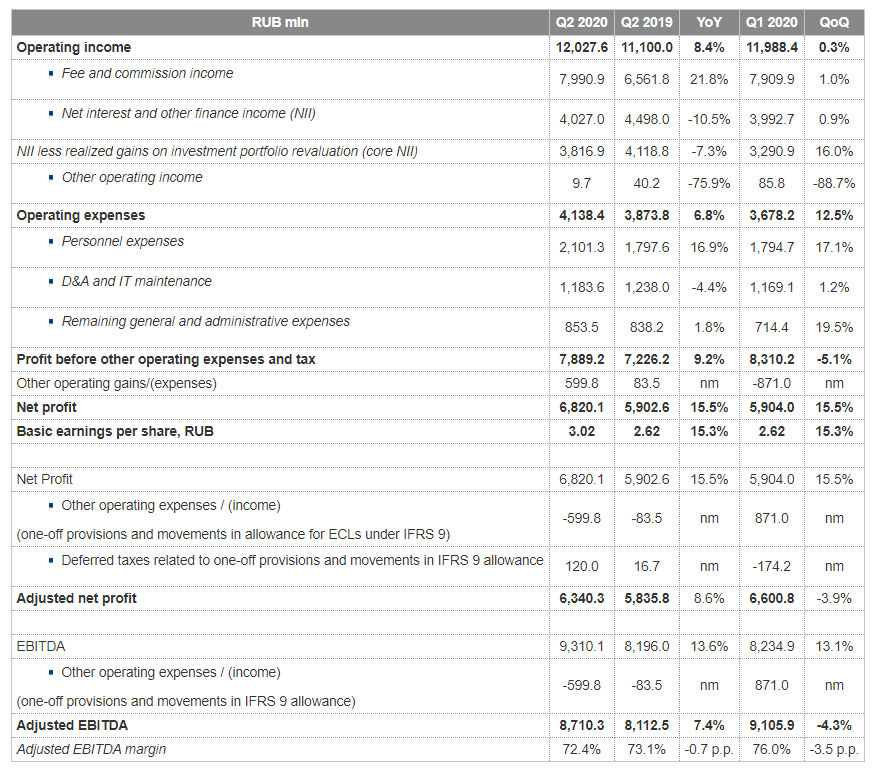

The Russian market operator Moscow Exchange Group (MOEX) reported its results for the second quarter of 2020. Record fee income from the Money Market and Depository & Settlement Services as well as strong performance by the Equities Market helped MOEX achieve all-time high F&C income for the third quarter in a row.

Highlights include:

- Fee and commission (F&C) income was up by 21.8% to RUB 7,990.9 mln, mainly driven by the performance of Equities, Money, and Derivatives Markets.

- Net interest income (NII) dropped 10.5% due to declining domestic and global interest rates, despite the larger investment portfolio.

- Operating expenses remained under control, increasing by 6.8%, which is within the FY2020 guidance range.

- Adjusted net profit was rose 8.6% to RUB 6,340.3 mln.

Max Lapin, Chief Financial Officer of Moscow Exchange, said:

We are pleased to report another strong quarter in terms of fee and commission income growth. Despite lower volatility compared to the first quarter, our total fee income reached a new all-time high of nearly RUB 8 bln. Every F&C business line posted double-digit growth except the Bond Market, which was impacted by a decline in primary offerings due to the uncertain economic outlook. Two fee and commission business lines delivered record highs in absolute terms: Depositary & Settlement Services and the Money Market. The latter surpassed the RUB 2 bln fees mark for the first time. We believe that implementation of our strategic initiatives such as extension of trading hours, new solutions for corporate clients and expansion of the product range create a strong foundation for the further growth of our business.

Despite a 22.3% increase YoY in our investment portfolio, net interest income (NII) declined by 10.5% due to lower domestic and global rates. The share of F&C in operating income was around 67%, which is close to our long-term target of 70%. OPEX growth of 6.8% was in line with our full-year guidance range for OPEX growth. As we prepare to launch our deposits marketplace platform, we are allocating more resources to this project and updating full-year OPEX growth guidance to 7.0 – 8.5%.

Other operating expenses resulted in a gain largely due to the partial release of IFRS 9 provisions, which were created in the first quarter because of the impact of Russia’s CDS rate increases on FVTOCI bond portfolio. As market conditions normalized in the second quarter, we were able to unwind these provisions.

Net profit for the quarter increased by 15.5% to RUB 6.82 bln. On an adjusted basis, which provides better comparability, net profit was up by 8.6%.