ExnessREVIEW

April 26, 2018

Exness Review

Founded in 2008, Exness is a multi-asset broker with over 1,000,000 active clients in the Middle East, North Africa, Sub-Saharan Africa, Asia, and Latin America. Users can select from a range of different account types and contract-for-difference (CFD) financial instruments, with a suite of services on offer designed to support a variety of different trading strategies. The emphasis is on the trading experience, with execution in all markets aided by access to deep liquidity pools and super competitive trading costs.

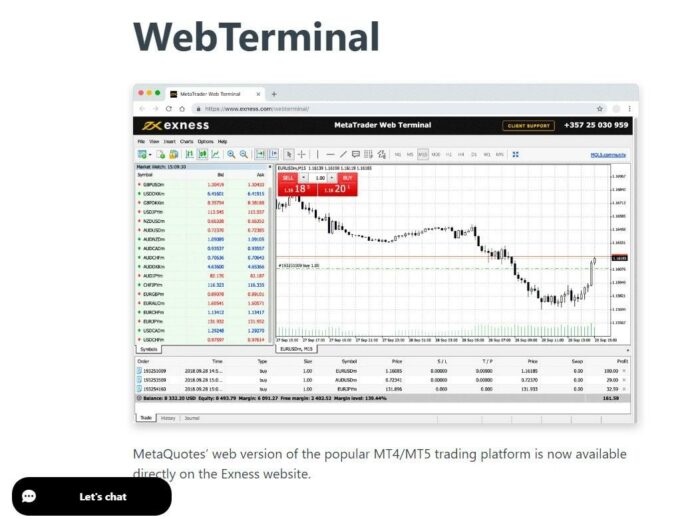

Traders who join Exness benefit from using a regulated broker that offers the market-favourite MT4 and MT5 platforms for desktop-based trading. Users who prefer web-based platforms can access the MetaTrader WebTerminal or the Exness Terminal. For traders on the move, Exness also offers MetaTrader 4 mobile, MetaTrader 5 mobile, and the Exness Trade app. Exness’s proprietary platforms have been designed in line with the firm’s overall approach to offer the best trading conditions.

Offering of Financial Investments

Exness offers a comprehensive suite of financial assets, ranging from forex to stocks, indices, and precious metals. Within its extensive forex offering, traders can access over 100 CFD currency pairs, including a wide range of Minor and Exotic pairs alongside Major currency markets.

This breadth of currency options makes Exness an ideal choice for specialist forex traders. Additionally, clients can trade over 200 instruments as CFDs, enabling multi-asset strategies with exposure to stocks, indices, commodities, and cryptocurrencies.

Pros / Cons

| Pros | Cons |

| Trade in deep liquidity pools | Limited range of non-forex instruments when compared to competitors. |

| Competitive Pricing | Limited educational materials for beginners. |

| Fast trade execution and customisable leverage | |

| Five accounts to choose from |

Exness Trading Account Types

Exness offers five different accounts, each available with swap-free options for various instruments*. Each account is designed to suit a specific trader profile or trading strategy. Taking the time to research the right one can help you optimize your trading returns.

- Standard Account ? Suitable for beginner and intermediate traders. Stable spreads, reliable execution, and zero trading commissions. Opening balance requirement ? Variable depending on the payment system used.

- Standard Cent Account ? Similar to the Standard Account but supports trading in small lot sizes. It is ideal for beginners and those testing new strategies. Minimum opening balance requirement ? Variable depending on the payment system used.

- Raw Spread Account ? Commissions charged on each trade. There is no limit on the number of open positions and ultra-low spreads. The T&Cs favour experienced traders operating short-term strategies such as scalping. Minimum opening balance requirement ? $200.

- Pro Account ? No limits on the number of positions and supports trading in small and large lot sizes. Ideal for experienced traders looking for competitive T&Cs and reliable execution. Minimum opening balance requirement ? $200.

- Zero Account ? Tight bid-offer spreads as low as 0.0 pips in most actively traded markets. Minimum opening balance requirement – $200.

* Terms and conditions apply.

Exness Commissions and Fees

Exness’ fee and commission structure vary across the five account types. Manual traders will be drawn to the flexibility and zero commissions in the Pro Account package. The Zero account is designed to issue fewer requotes and has lower slippage, making it attractive to those using algorithmic trading models and Expert Advisors.

- Standard Account ? Leverage 1: Unlimited*. No commissions, margin call at 60%. Swap-free trading is available.

- Standard Cent Account ? Leverage 1: Unlimited*. No commissions, margin call at 60%. Minimum trade size 0.01 cent lots. Swap-free trading is available. No Demo account.

- Raw Spread Account – Leverage 1: Unlimited*. Commissions up to $3.50 per lot. Margin call at 30%. Swap-free trading is available.

- Pro Account ? Leverage 1: Unlimited*. No commissions, margin call at 30%. Swap-free trading is available.

- Zero Account – Leverage 1: Unlimited*. Commissions start at $0.2 per lot, per side. Margin call is 30%. Swap-free trading is available.

*Leverage may vary depending on the region.

Exness Platforms and Tools

Exness maintains a full suite of platforms to suit any trader’s preference. Desktop users can access the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) options, while those who prefer web-based platforms can use the MetaTrader WebTerminal or the proprietary Exness Terminal. For trading on the go, users can choose between MetaTrader 4 mobile and MetaTrader 5 mobile, or the Exness Trade app.

Customer Support

Exness provides multilingual support via email, phone, and live chat through the Exness Trade platform. English, Thai, Chinese, Vietnamese, Arabic, Bengali, Hindi, and Urdu support is available 24/7, while additional support is provided in French, Swahili, Indonesian, Korean, Portuguese, and Spanish.

Traders can also access the Help Centre, and registered users can submit support tickets through the support hub.

Payment Methods

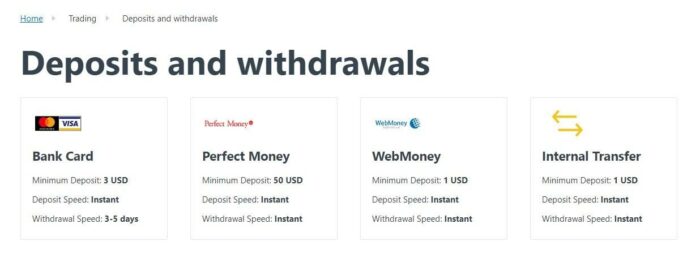

Exness offers various payment methods, including international and local payment systems, internal transfers, bank cards, cryptocurrencies, and e-payment agents such as Neteller. The broker states that it is positioned to process payments and withdrawals 24/7, however, third-party payment agents may not provide an equivalent around-the-clock service..

Minimum Deposit in Exness

Exness doesn’t charge clients for deposits or withdrawals, though third-party agents may levy a fee. The standard minimum account opening balance for all five accounts is in line with industry standards.

- Standard Account: Variable depending on selected payment system but can be as low as $10.

- Standard Cent Account: Variable depending on selected payment system but can be as low as $10.

- Raw Spread Account: $200.

- Pro Account: $200.

- Zero Account: $200.

Exness Research

Exness offers an extensive library of clearly written articles detailing how to start trading using its platforms. It also has a comprehensive blog feature targeting more experienced traders. And in-depth insights and analysis articles from market specialists on its dedicated Insights site.

However, very little information is offered in video format, and while the instruction sheets on how to set up are easy enough to understand, offering learning materials in a multi-channel format would make the broker more user-friendly in this area.

Exness Mobile Trading App

The MetaTrader 4 and MetaTrader 5 mobile apps are available for Android and iOS devices, while Web-based MetaTrader is also accessible on mobile browsers wherever an internet connection is available.

The proprietary Exness Trade app is also available and supports on-the-go trading and account management, making it easy to manage your account’s administrative side.

Should I Trade with Exness?

There are many plausible reasons that Exness could be the best multi-asset broker for you.

- Free in-house VPS hosting – Exness offers a free in-house VPS so that trading activity can be hosted closer to currency exchanges. That enables clients to take advantage of two of the main attractions of Exness ? deep liquidity and super-fast executions. It is free to clients who deposit a minimum of $500.

- Instant Deposits and Withdrawals – Deposits and withdrawals of client funds are processed instantly by Exness, with the broker not applying any fees on either type of transaction. Internal transfers between accounts are instant as well, giving Exness clients complete control over all their funds on a 24/7 basis.

- Tight trading spreads – Exness spreads in currency markets start from 0.00 pips in the commission-based Zero account.

- Flexible Leverage – Traders using any of the Exness accounts have access to margin trading. Leverage can be set according to your strategy requirements, and the absence of a cap on leverage terms means those traders who want to do so can scale up on risk return.

- Regulatory protection – Exness is regulated by a number of different global financial institutions, including the Cyprus Securities and Exchange Commission (CySEC) and the Seychelles Financial Services Authority (FSA). It should be noted that whilst the Financial Conduct Authority regulates one entity of the Exness group, the broker does not accept retail clients from the UK.

Summary

Exness offers everything you need to trade the markets effectively. Its competitive pricing policy is supplemented by excellent trading conditions and some neat additional extras. The service might be weighted towards intermediate and experienced traders; however, beginners who are confident they’ll be able to get up to speed would fast-track their development by signing up with Exness.

FAQ section

- Is Exness safe and reliable?

Companies within the Exness group are licensed in several jurisdictions around the world. Details of where each entity is registered are provided clearly and transparently, allowing traders to ensure they are protected as per their requirements. New clients must conduct due diligence research, but the information on the company’s website outlines when protective measures such as Negative Balance Protection (NBP) might apply.

Traders with an inquiry or account issue can contact the broker’s customer support 24/7 via email or phone (in any of the languages supported) and live chat.

- Who regulates Exness?

Exness (SC) Ltd is authorised and regulated by the Seychelles Financial Services Authority (FSA) with license number SD025. Exness (VG) Ltd is authorised by the BVI Financial Services Commission (FSC) under Licence number SIBA/L/20/1133. Exness B.V. is authorised and regulated by the Central Bank of Curaçao and Sint Maarten (CBCS) under Licence number 0003LSI.

Other licenses that Exness operates under are the Cyprus Securities and Exchange Commission (CySEC) with license number 178/12, the UK Financial Conduct Authority (FCA) under the Financial Services Register number 730729, the FSCA in South Africa as a Financial Services Provider (FSP) with FSP number 51024, and the Financial Services Commission (FSC) of Mauritius with registration number 176967. Please note that Exness does not accept individuals or retail clients in the UK and Cyprus.

- What’s the smallest amount I can deposit in order to start trading?

If you sign up for a Standard Cent Account, you can deposit as little as $10 to get started in the live markets, but you can also create a free demo account to test the ecosystem and its capabilities.