DerivREVIEW

July 05, 2024

In the 25 years it has been operating, Deriv has accumulated 2.5 million clients. The appeal of the broker is based on it getting the basics right, but also offering its clients a range of additional features designed to enhance their trading experience. The broker provides access to a wide range of markets and supports an extensive range of strategies and trading approaches.

Offering of financial instruments

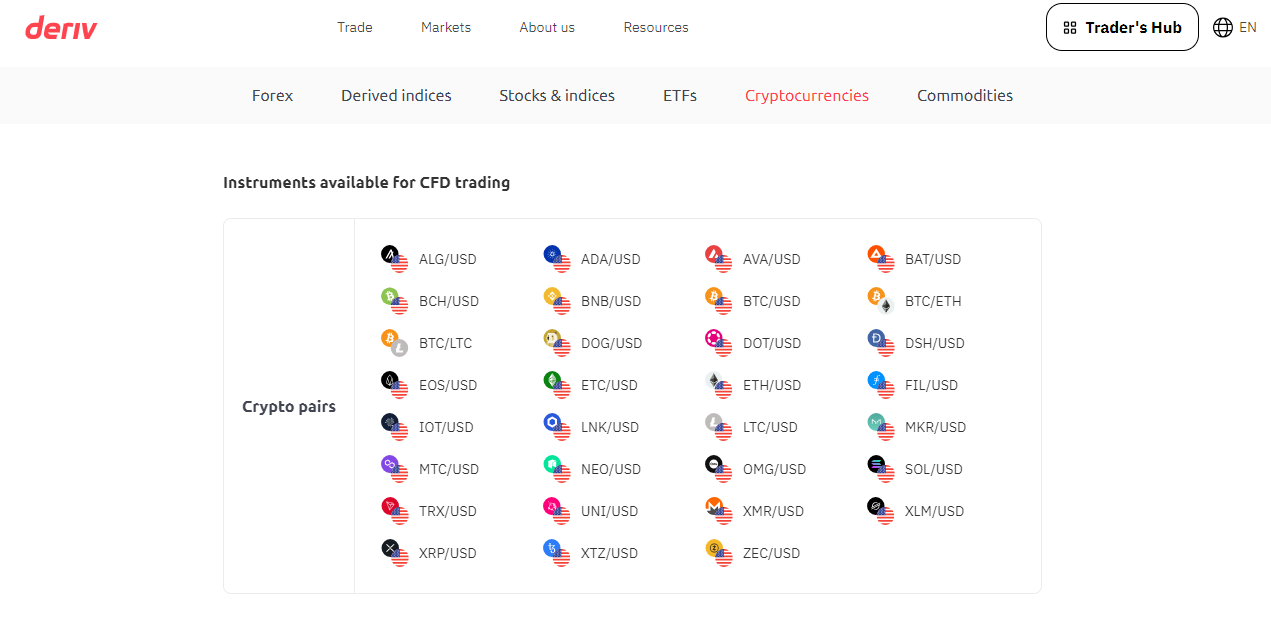

Deriv offers markets in all of the instruments that one would expect to be available at a broker with such a long track record. There are 70+ forex markets available, including major, minor, exotic and micro currency pairs. Available stocks include 58 of the world’s biggest names, and all of the major US, and European stock indices can be traded using standard index instruments or a derived index that continues to trade over weekends and holidays. There are 30+ crypto markets on offer, which means that traders can take positions not only in big-name coins, but also emerging altcoins. Commodities and ETFs are also available.

- Forex

- Stocks

- Indices

- Derived indices (24/7)

- Crypto

- Commodities

- ETFs

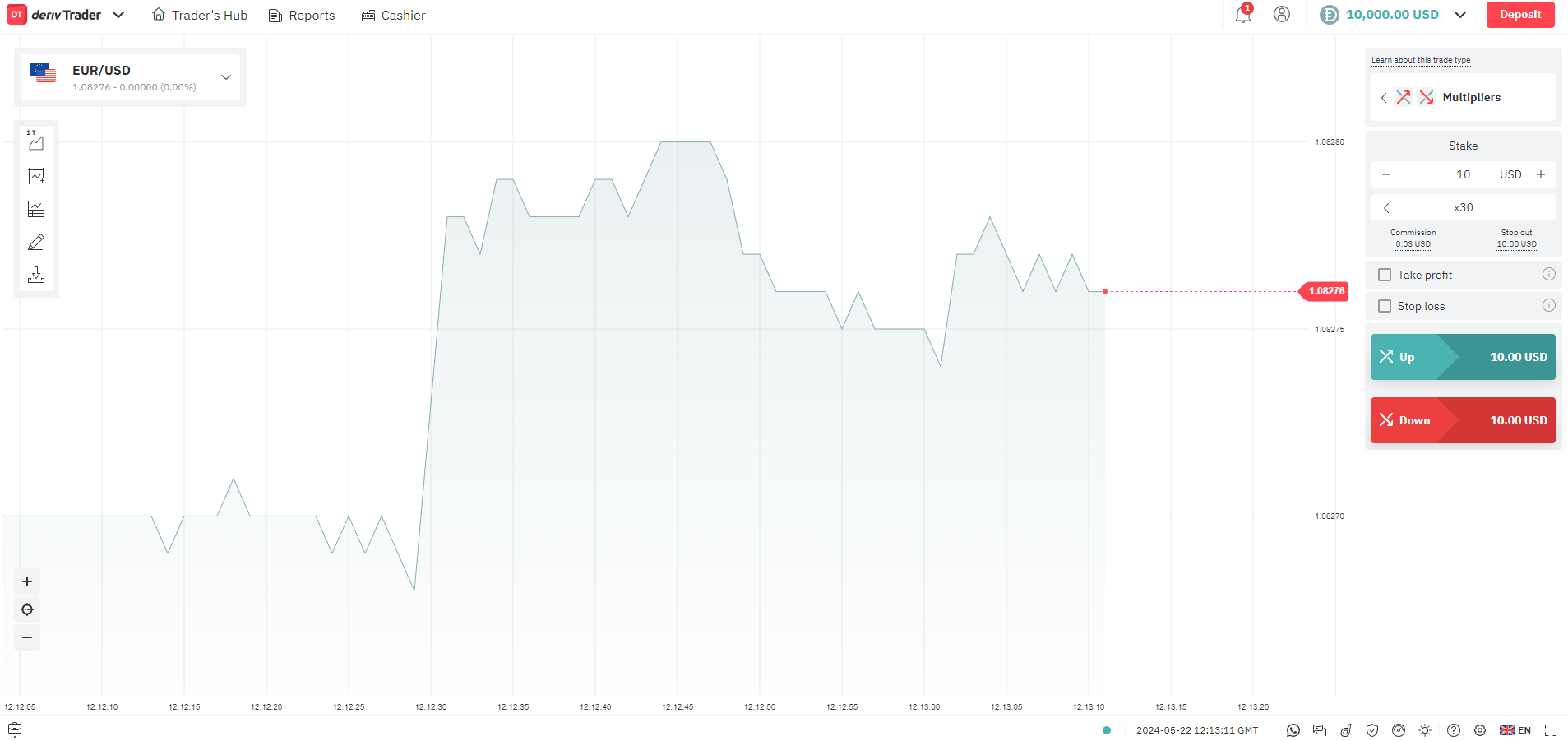

The markets can be traded using CFDs, options or the in-house-developed Deriv multiplier instruments, which are an innovative, hybrid-style product that combines features of CFDs and options.

Pros and cons

| Pros | Cons |

| Wide range of platforms to choose from | Adequate rather than extensive range of stocks |

| Supports many types of trading strategies | Not available in all jurisdictions |

| Innovative instruments such as multipliers | Acceptable rather than impressive range of research and learning materials |

| Code-free algorithmic trading | |

| $5 minimum opening balance | |

| 24/7 customer support |

Deriv trading account types

Deriv offers free-to-use demo accounts that offer risk-free trading and can be set up by simply providing an email address. There is always some benefit to be gained from signing up for one of these accounts, but this is especially the case with Deriv as they provide an opportunity to learn more about the unique Deriv multiplier product and the options markets the broker offers.

There are three types of accounts to use on the Deriv MT5 platform, with each set up to maximise the potential of some part of the Deriv offering. Financial MT5 accounts follow a market-standard format, the Derived accounts provide access to the in-house developed synthetic instrument, and it is also possible to open an account that is swap-free for trading on CFDs.

Deriv commissions and fees

Deriv pricing schedules are laid out in a clear and transparent manner. This can usually be taken as a good sign and that a broker is confident with its position in the market. Most of the CFD markets on offer are traded commission-free, and with the bid-offer spread being the determining factor in cost evaluation, it is easy to run price comparisons. The average trading rates/costs for EURUSD, Bitcoin and gold are 0.5 pips, $52 and $0.25, respectively.

Multiplier trades do include commissions. During testing, the EURUSD market applied a commission of $0.03.

Overnight funding fees can be established pre-trade using the neat swap calculator tool, and there are no charges levied by the broker on cash deposits and withdrawals, though third-party payment providers may apply a fee. Inactive accounts are charged up to $25 per six-month period after one year of no trading taking place. Admin fees are charged on positions held in Deriv MT5 swap-free accounts for more than five days.

Deriv platforms and tools

Few brokers offer their clients a choice of platforms as extensive as the one provided by Deriv. Each dashboard has been developed to cater to a particular type of trading strategy:

- Deriv MT5 CFD platform utilising MetaTrader’s MT5 technology.

- Deriv X Proprietary CFD platform with user-friendly functionality.

- Deriv cTrader Super-fast execution speeds and copy trading services.

- Deriv GO Mobile app platform hosting Deriv’s multiplier instruments.

- Deriv Trader Desktop platform for Deriv multiplier, options and accumulator products.

- SmartTrader Easy-to-navigate options trading platform.

- Deriv Bot Code-free automated trading platform.

Each of the platforms comes with its own suite of supporting trading tools. These include graphic and illustration tools, chart metrics and trade indicators.

Customer support

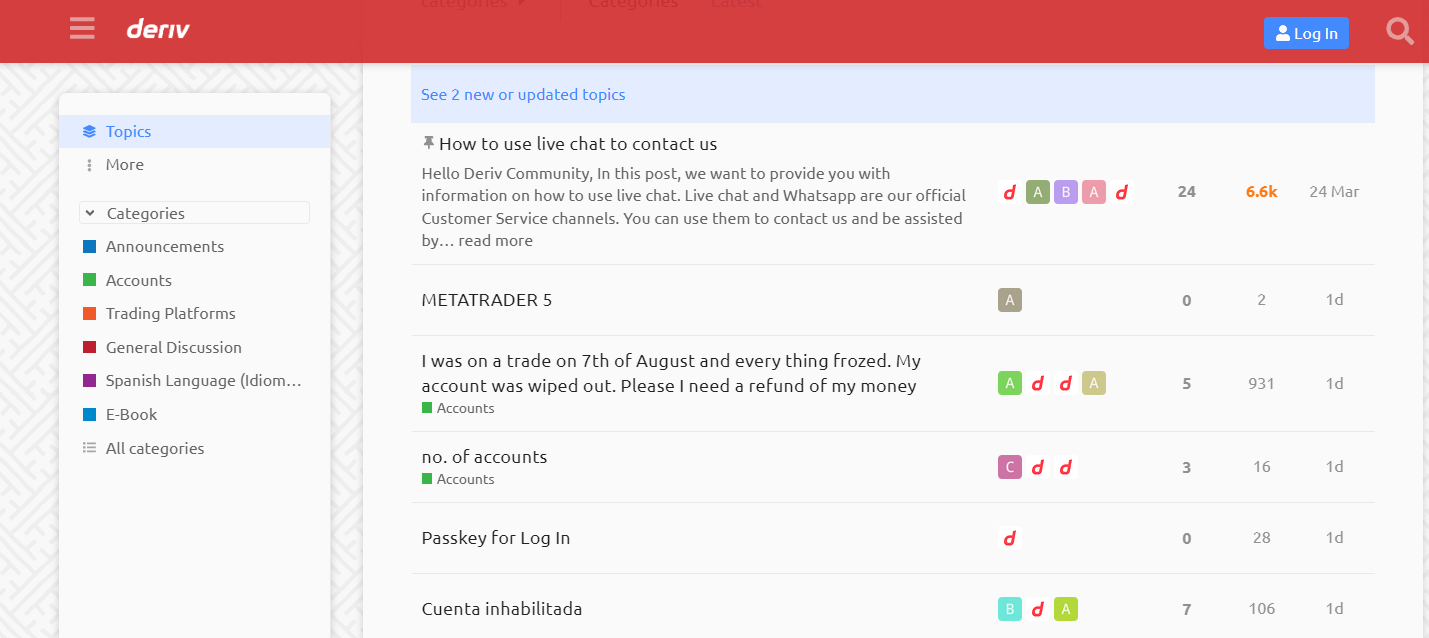

The functionality of the Deriv platforms is largely self-explanatory. This allows for the first point of customer support to be a live chat bot or the broker’s FAQ page. Both of these services can be contacted on a 24/7 basis, and contacting human support staff is possible should you have more complex matters, such as account management fees, that need to be addressed.

An interesting and effective alternative source of information is the Deriv Community feature. This is an index of queries raised by other users and the replies posted by those with a better understanding of what solutions might be available. This crowd-sharing approach covers all aspects of the Deriv service, from trading limits to cash transfer protocols.

Payment methods

Payments can be made to a Deriv account using credit card, debit card, bank transfer, crypto, e-wallets, mobile payments, vouchers and crypto on-ramp/off-ramp processes. In all, there are multiple ways to make deposits and withdrawals, which compares exceptionally well to the market average.

Fiat cash deposits and most e-wallet payments are processed instantly. Other payment methods such as crypto take longer to process and withdrawals tend to take one to three days to process due to the broker being required to carry out regulatory compliance checks before releasing funds.

Minimum deposit at Deriv

The minimum deposit requirement when using fiat currency is $10. Those using e-wallets fare even better, with the minimum deposit in those instances being $5. The minimum withdrawal amounts are equally low.

If a deposit is made using Bitcoin, Litecoin, Ether, USD Coin or Tether, then there is no minimum balance requirement imposed by the broker.

Deriv research

Deriv provides a range of user-friendly tools such as margin, swap and pip calculators that enable traders to run a full cost-benefit analysis of a trade prior to execution. There are also several other ways that can provide traders with educational material such as Deriv Academy or a Youtube channel. However Deriv does not provide traders with any investment advice.

The Deriv Blog, which runs in parallel to the main platform, includes a market news section that offers an intermittent, high-level guide on major macro announcements, and the video section of the blog site includes demonstrations on how to trade different markets. While the research and analysis materials offered directly by Deriv are underwhelming, it is, of course, possible to explore trading ideas using alternative sources and return to the Deriv platform once a strategy has been finalised.

Mobile trading app

Deriv clients can access all of the available markets and instruments using a choice of few mobile apps such as cTrader and Deriv X app, the MT5 and Deriv Go app. The MT5 platform can be accessed using the MetaTrader app or any web browser, and the Deriv Go app supports trading in the bespoke multiplier instruments and accumulator options markets.

Both apps are free to download and during testing proved to be reliable and effective. The Deriv Go app stands out thanks to its easy-to-use features and crisp aesthetics that make it easy for the user to navigate to their preferred market and execute trades.

Summary

The additional synthetic instruments available at Deriv are much welcomed and allow the broker to stand out in a competitive sector. Used wisely, they provide an opportunity to enhance strategy planning and effectively manage risk-reward. The rest of the Deriv package also stands up against the broker’s competitors. Traders will make their own mind up regarding the strength of regulatory protection that applies in some jurisdictions, but operating under licence from more lenient regulators is an inherent part of being able to offer such innovative products.

FAQs

- Who regulates Deriv?

Deriv has a global client base, and trading on it is regulated by a range of different financial institutions. The domicile of clients is the determining factor regarding which one their account is protected by, with the organisations involved including the Malta Financial Services Authority, Labuan Financial Services Authority, British Virgin Islands Financial Services Commission and Vanuatu Financial Services Commission. - What are Deriv multipliers?

The Deriv multiplier is a synthetic financial instrument that can be used to trade different markets. It was developed by Deriv with the intention of providing clients with a way of trading that takes some of the best features from CFD and option markets. As with CFDs, it is possible to use leverage and buy long or sell short, but like options, there is a cap in place that limits losses to the size of the initial stake. - Is Deriv a trusted broker?

Deriv has been operating for 25 years and operates out of more than 20 offices. The BVI and VFSC regulators are considered Tier-2 rather than Tier-1 grade, but the MFSA has a strong and developing reputation in the financial services industry. Looking at the overall picture, there is little reason to believe that using Deriv carries any significant operational risk.