TickmillREVIEW

December 01, 2019

Tickmill Forex Broker Review

Introduction

The Tickmill Group is a multi-asset forex, CFD and Exchange Traded Derivatives (Futures & Options) trading services provider, established in 2014.

In terms of where Tickmill fits within the online brokerage market, it is currently a mid-sized broker, with around 250 employees spread across a global network of offices. To date, Tickmill has serviced more than 327,000 customers, executing over 538 million trades in doing so. Tickmill primarily caters to the needs of both individual and institutional traders, and generally appeals to alltraders from beginner to intermediate experience levels and professionals.

Tickmill offers a variety of trading products, with a particular focus on forex, CFDs on Stocks, Indices, Commodities, Cryptocurrencies, Bonds as well as Exchange Traded Derivatives, Futures and Options, which are available only to clients of Tickmill UK Ltd*.

* Product variations apply per Tickmill entity.

Product Offering

Tickmill offers trading CFDs on forex, stocks, stock indices, commodities, cryptocurrencies, German government bonds and Futures and Options across 7 global exchanges. Potential clients should note, that the CFD selection covers the most popular stock indices, commodities, bonds, crypto CFDs and 500 Stocks and ETFs.

In total, the selection offered covers around 637 different types of CFDs. Although not the most extensive selection around, for beginner to professional traders this should provide a variety to diversify your trading portfolio. If you want to see how this selection might impact your own trading goals, we recommend opening a Tickmill demo account so that you can get a better idea of what is on offer.

Tickmill Trading Account Types

Tickmill has a fast and easy account opening procedure, with new accounts generally getting verified within one business day. The account set-up process is very straightforward and shouldn’t cause too many issues.

The quick account opening times are helped by the level of Tickmill support available, which allows accounts to be verified quickly. Trading on the Tickmill platform is delivered through a number of different account types, each of which comes with specific benefits in terms of pricing.

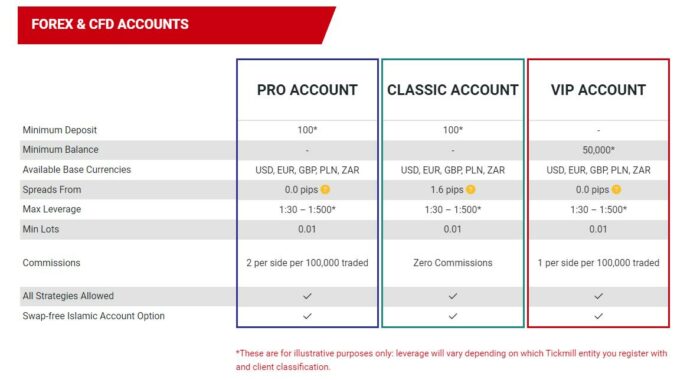

Regardless of whether you are a beginner, intermediate or more advanced trader, there is an account type on offer for you. The Tickmill account types are: Classic, Pro, VIP, and an Islamic swap-free account. Of these, the VIP account is the most competitive, though it will require higher trading volumes and account balances. Spreads start from 0.0 pips, execution times averaging 0.20 seconds, and there are zero requotes. Note that there is currently a $50,000 minimum balance for the VIP account and a minimum deposit amount of $100 on the Classic and Pro account.

Trading conditions:

- Execution model: Hybrid model STP and Market Making

- Account currency: USD, EUR, GBP, CHF, PLN*

- Execution type: Market execution

- Average execution speed: 0.20 second

- Margin call/Stop out: Margin call level is 100% while Stop Out levels vary depending on the Tickmill entity and client classification

*Available currencies vary per Tickmill entity

Visit Broker Site *73% of retail CFD accounts lose money

When it comes to leverage trading, Tickmill Ltd leverage rates for retail clients are capped at 1:500. Clients of Tickmill UK Ltd and Tickmill Europe Ltd are capped at 1:30. If you qualify for a professional trader account (check Tickmill’s website for more information), you can also trade with higher leverage, up to 1:500 (Tickmill UK Ltd) or up to 1:300 (Tickmill Europe Ltd).

Tickmill Commission and Fees

Currently, there are no Tickmill fees on deposits or withdrawals.You can make payments using bank transfer, credit/debit cards, or a range of electronic wallet services depending on the Tickmill entity you register. Tickmill Ltd accepts Bank Transfer, Crypto Payments, Visa, Mastercard, Skrill, Neteller, SticPay, FasaPay, UnionPay, WebMoney. Tickmill Europe Ltd accepts Bank Transfer, Visa, Mastercard, Skrill, Neteller, Przelewy24, PayPal and Trustly. Tickmill UK Ltd accepts Bank Transfer, Visa, Mastercard, Skrill, Neteller, Przelewy, Sofort, and PayPal. These options can be used for both deposits to and withdrawals from your Tickmill trading account.

Tickmill Platforms

In terms of how trading is delivered, Tickmill offers both the MetaTrader 4 (MT4) and MetaTrader 5 platforms as well as the WebTrader platform. Through both platforms, traders are given access to one-click functionality to open and close trades, tools for risk management strategies, as well as a range of charting and analysis tools. Additionally, hedging, scalping and arbitrage trading strategies are all supported on the platforms. To get a feel for the platform before committing any funds, we recommend that you open a free Tickmill demo account.

Tickmill Tools and Education

Tickmill provides powerful trading tools and a wealth of educational sources.

Autochartist, a chart pattern recognition tool, Signal Centre, a human and AI analysis tool and sentiment monitor Acuity Trading are just some of the trading ideas that the broker offers. Tickmill Ltd has recently added a copy trading platform, Tickmill Social Trading. Tickmill has its own blog where it offers asset-driven navigation on its most popular instruments traded, market sentiment, the latest calendar events and a variety of analyses. It also launched the Bright Minds Podcast where guests from different fields offer a new way to look at trading.Tickmill also offers webinars in various languages, live sessions, seminars, eBooks and video tutorials for beginners, intermediate and advanced traders.

Pros

- Autochartist integrated

- Great analysis written by Tickmill experts

- Great economic calendar

Cons

Should I trade with Tickmill?

Based on the findings of our Tickmill review, we would recommend it as a platform so start the Tickmill sign-up process and begin trading!

The Tickmill package is generally quite good.

From the trader’s perspective, Tickmill is very competitive when it comes to pricing, and Tickmill regulations are monitored by several authorities globally, so you can feel confident that it is a trustworthy brokerage.

Tickmill offers safe, regulated trading, with plenty of instruments for CFD and forex traders. The broker also offers a lot of free deposit/withdrawal options.

Traders of all levels will ultimately be attracted by the competitive fees and favourable trading conditions. We would therefore recommend getting started with the Tickmill sign in process and trying out a free demo account.

Visit Broker Site *73% of retail CFD accounts lose money

FAQs

Is Tickmill regulated?

Tickmill UK is authorised to operate as a financial services provider and is regulated in the UK by the Financial Conduct Authority (FCA) and the Dubai Financial Services Authority as a Representative Office.

Tickmill Europe is authorised and regulated in Cyprus by the Cyprus Securities and Exchange Commission (CySEC).

Tickmill Ltd is regulated in the Seychelles by the Financial Services Authority (FSA).

Tickmill Asia Ltd is authorised and regulated by the Labuan Financial Services Authority.

Tickmill South Africa (Pty) Ltd is authorised and regulated by the Financial Sector Conduct Authority (FSCA).

How to open a Tickmill account?

To open a Tickmill MT4 or MT5 trading account and trade in forex and CFDs, you must first register online. To do this, head over to the Tickmill homepage and follow the account creation process.

Once completed, you will receive a confirmation email from the broker, which will provide you with a verification link. Click this link to complete the verification process and then follow the Tickmill login process to the client portal. If you need any advice, you can request support through the Tickmill contact page, via phone, email or online chat.

In order to start trading, you must first make a deposit. When registering for your client portal, you will be prompted to select a Tickmill entity according to your country of residence.

Are the client funds safe?

Client funds are held in segregated accounts with top-tier banks. All customers dealing with Tickmill UK Ltd are protected by the FSCS up to the value of £85,000 per client in the event of default by Tickmill UK Ltd.

Those who are dealing with Tickmill Europe Ltd are protected by the Investor Compensation Fund up to ?20,000 per client in the event of default by the company.

Based on these assurances, we consider Tickmill trustworthy, and there is nothing to indicate the existence of a Tickmill scam of any description.