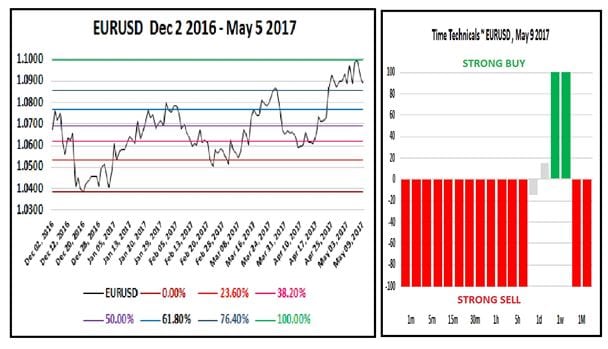

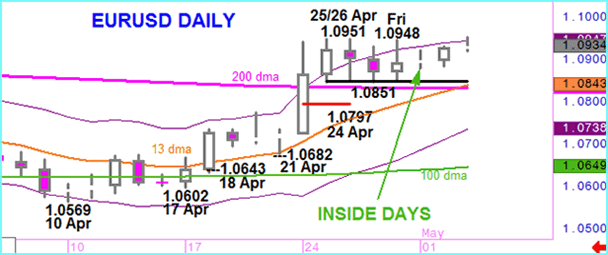

Looking for a counter-trend trade in EURUSD

We are looking to take a counter-trend trade in EURUSD this morning. Please note that European Central Bank head Mario Draghi speaks this afternoon Monthly: The move lower has been mixed and volatile, common in corrective sequences. We have seen a prolonged period of consolidation. Not a lot to take away from this timeframe; bearish…

Read more