Schizophrenia is a disorder of the mind characterised by hallucinations and delusions. This is, in my personal view, not too harsh a term to apply to the euro.

After all, it is a currency whose DNA was created in an economic experiment that sought to weld 19 diverse economies together under the rule of the “Stability and Growth Pact”.

The rules of keeping budget deficits at or below 3% of GDP and national debt-to-GDP at or under 60% have been blown apart. The cracks were apparent soon after 1999.

Overall, the Eurozone runs these metrics at 1.5% and 89.2% respectively. So even here the performance is split; one good metric and the other is well off target.

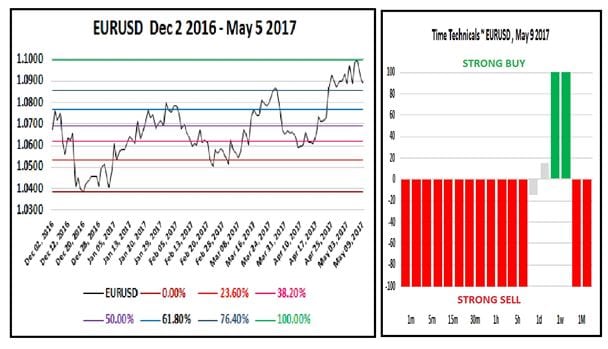

Similarly, look at the technical sentiment that prevails regarding EURUSD. The recent range has shown three reversals of direction and while most technical measures scream “strong sell”, it is punctured by a “neutral” and a “strong Buy”.

Why on earth would the euro be a buy in a week from now and then collapse back into an aggressive selling scenario?

Source: Investing.com, Spotlight Ideas

I have always been sceptical on the euro; I have been short of the currency relative to the US dollar since February 1… so I am feeling some pain. However, I am certainly not going to undergo a conversion following the election victory of Emmanuel Macron. I believe time will find him out and his promises of many things to many sectors of French society will see him overspend and increase the French budget deficit from the latest level of 3.4%.

Euro (six-year):

For too long, EURUSD has been stuck in range between 1.1600 and 1.0300. When one looks at the two economies of the Eurozone and the US on the key metrics, the US wins on every count.

Therefore, I am firmly convinced that the Federal Reserve will press ahead with the normalisation of interest rates at a pace the European Central Bank can only dream of. There are still elections in Germany to be held and although not a part of the single currency bloc, the process of Brexit is bound to impinge on the euro.

Of course, the Greek issue will keep rolling on like an open and weeping wound and I fear we have almost forgotten about the risk that lies within Italy, with debt-to-GDP at 133% and unemployment of 11.7%.

Italian spreads over Germany are completely distorted and reflect complacency cushioned by the ECB safety net. Without that net, Italy could not refinance its obligations.

So, on balance I would sell the euro. I am already short and know that the investment community are themselves split on their short-term and longer-term perspectives. I would favour the downside in both timeframes as the shine of the Macron victory will soon tarnish and the Eurozone will lag the United States in terms of economic performance and central bank activity.

Parameters (EURUSD)

Entry: sell 1.0892 (1321 GMT)

Targets 1.0765… 1.0693… 1.0620.

Stop: 1.1100.

Time horizon: medium-term.

— Edited by Michael McKenna