Background

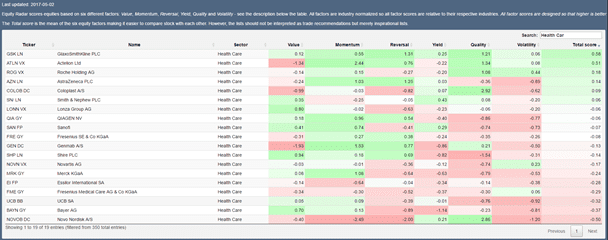

Shares in Danish insulin producer Novo Nordisk are up 7% today as the company’s first-quarter results beat revenue and net income estimates and it lifted the lower end of its previous full-year guidance. The big question is whether this is a signal to get on the bandwagon of Novo Nordisk. While the result was definitely good and maybe the turning point for Novo Nordisk, our quant model (Equity Radar) on equities now rates Novo Nordisk the least attractive among the 19 healthcare stocks in the S&P 350 Europe Index (see table below). Momentum is still weak, and the shares have outperformed the industry massively over the past month.

Equity Radar

Source: Saxo Bank Quantitative Strategies

In the top of the table, the most attractive European healthcare stock is Britain’s GlaxoSmithKline. Its shares have been under pressure lately as analysts have downgraded the outlook as a generic alternative to the company’s Advair lung drug is on the way. Mylan failed to get US Food and Drug Administration approval for its generic, but next potential approval is Hikma/Vectura with a verdict expected around May 10. If this generic is also rejected by the FDA, it could likely be a short-term catalyst for analyst upgrades as it would give GSK more time to roll out its Advair replacement Breo and less competition to Advair.

The best way to play GSK is through call options over this event as that locks in the downside in case the FDA approves a generic replacement for Advair.

Management and risk description

As we are playing this trading idea through long call options, we are locking in our downside risk. The main risks in this trade are obviously FDA approval of Hikma/Vectura’s generic or a stronger GBP which could happen if British prime minister Theresa May gains further in the polls.

GlaxoSmithKline weekly share price

Source: Saxo Bank

Parameters

Entry: we are entering the June 16, 2017 calls (44 days to expiry) with a strike at 1,550. The contract size is 1,014 so the total premium paid for one contract is £359.97 before commission and other fees. The premium translates into 2% of the underlying. The current mid price of this call option is £31p compared with the last price at £35.50p.

Source: Saxo Bank

Target: Our target is £100-110p on the call option, which, at expiry, translates into an underlying price of around £1,666-1,716p, which is around the highs seen three times the past year (see price chart in the risk management section).

Time horizon: With 44 days to expiry, the time horizon is short.

— Edited by John Acher

Non-independent investment research disclaimer applies. Read more

A compiled overview of Trade Views provided on TradingFloor.com is found here