Background

Since leaving the gap open at 99.88 from Friday, April 21 after the initial results from the French preliminaries, the USD index has consolidated within a channel formation. This would suggest a possible flag with a bias to break lower. However, gaps also have a tendency to be closed, so signals are far from strong.

With the French polls opening May 6 at 0800 there is a likelihood that we will have a good idea of the result before the market opens Sunday night. Even if we manage to get stops in on technical views (trade ideas), there is ample scope for another gap open – or close.

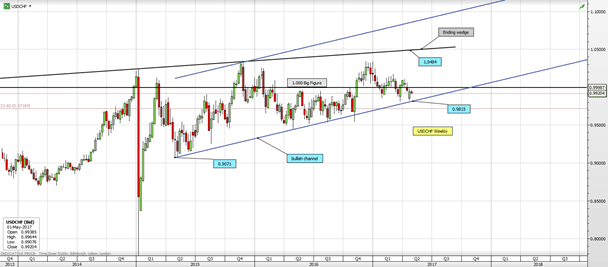

This has resulted in high-risk trades going into this weekend but USDCHF highlights a medium-term outlook that still offers good risk/reward on a Macron win

Weekly: We have consolidated around the psychological 1.0000 parity level for some time now. We are either in a bullish channel formation or an Ending Wedge pattern that has a bias to break lower. Support is seen at 0.9815. The most interesting factor here is the wedge target at 0.9071.

Daily: If we can break support then the 261.8% level for a fifth wave extension is seen at 0.9072. This offers a great long-term play.

Intraday (eight-hours): The lower highs look to be forming a descending triangle that has a bias to break lower through support at 0.9825. The Marabuzo level from yesterday is seen at 0.9933. With our bespoke resistance at 0.9934, this is the prime level for a short entry.

Create your own charts with SaxoTraderGO click here to learn more.

Management and risk description

A move through 0.9925 and we look to move stop to entry.

Parameters

Entry: selling at 0.9932.

Stop: 0.9970.

Target: this is a long-term play towards 0.9600 and 0.9100.

— Edited by Michael McKenna