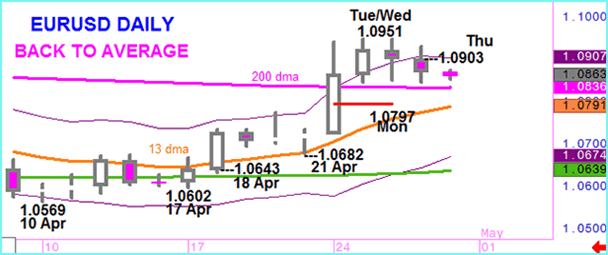

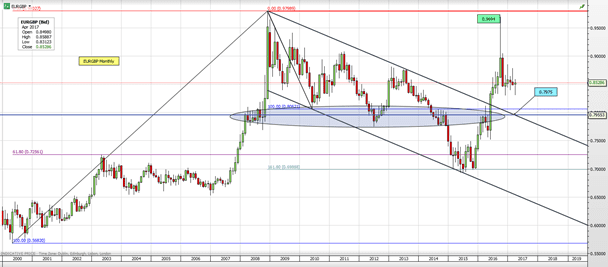

EURUSD readies for another leg up

Background The main event on the calendar today is the US Federal Reserve Open Market Committee’s monetary policy review meeting. There is only a 5% chance of any movement in the policy rate so attention will focus on the short post-meeting statement. Little change to the previous outlook is expected, although, on balance, the data…

Read more