Background

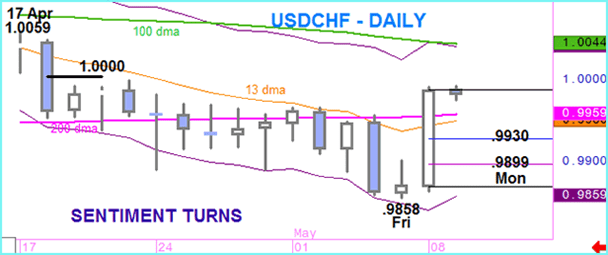

Monday saw strong upside in USDCHF. Friday’s minor upside was not only continued, but accelerated with gains of more than a big figure.

This fresh demand took the currency pair aggressively through the 13 day and 200 day moving average area, and to the most positive levels traded for three weeks. The speed and scope of gains means immediate signals for sentiment are overbought but we currently look for intraday setbacks to remain modest and temporary.

Management and risk description

A move to 1.0007 means the stop can be raised to break even.

Parameters

Entry: Buy in 0.9980/85 area and a dip to 0.9959.

Stop: 0.9930 offered.

Target: 1.0007, 1.0040 or even 1.0072.

Time horizon: intraday, ending 1500 GMT.

Sentiment turns

Overbought

Long-term trend

All charts from CQG. Create your own charts with SaxoTrader; click here to learn more.

For more on forex, click here.

— Edited by Robert Ryan

Non-independent investment research disclaimer applies. Read more

A compiled overview of Trade Views provided on TradingFloor.com is found here