Exchange holding company Cboe Global Markets released its results for the first quarter of 2020.

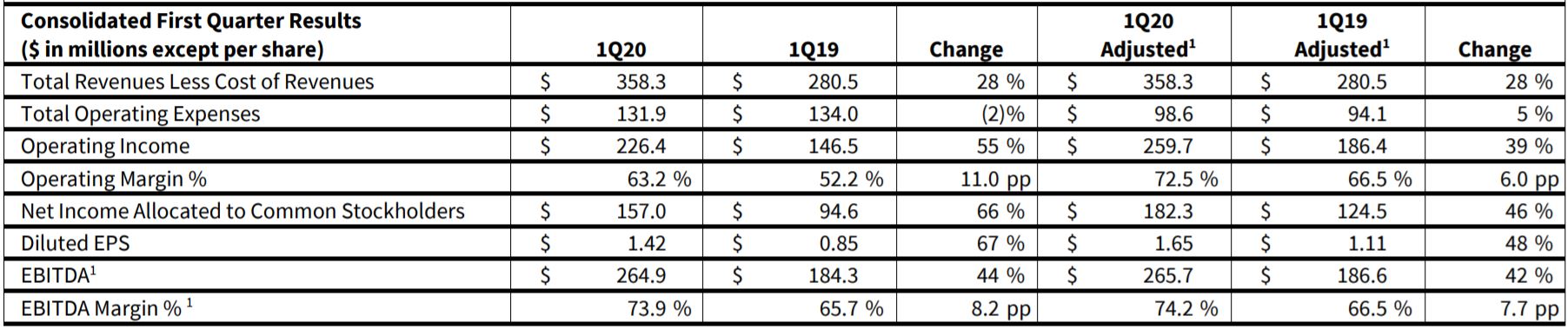

The company reports that diluted EPS for the first quarter were $1.42, up 67% from the first quarter the previous year. Cboe also reports record adjusted diluted EPS for Q1 of $1.65 with 48% increase for the same period the previous year. Net revenue reached record values with $358.3 Million, up by 28%. The company also set new quarterly heights with the total options and FX volume.

EBITDA Margin for Q1 was 73%, up by 820 bps compared to the same period the previous year. Adjusted EBITDA Margin reached 74.2%, up by 770 bps. Cboe returned $160 million to shareholders through share repurchases and dividends.