The following article is courtesy of AETOS analyst Ryan Chen. Part I of the report can be seen here.

Ryan Chen

Reality not as silky as ideal

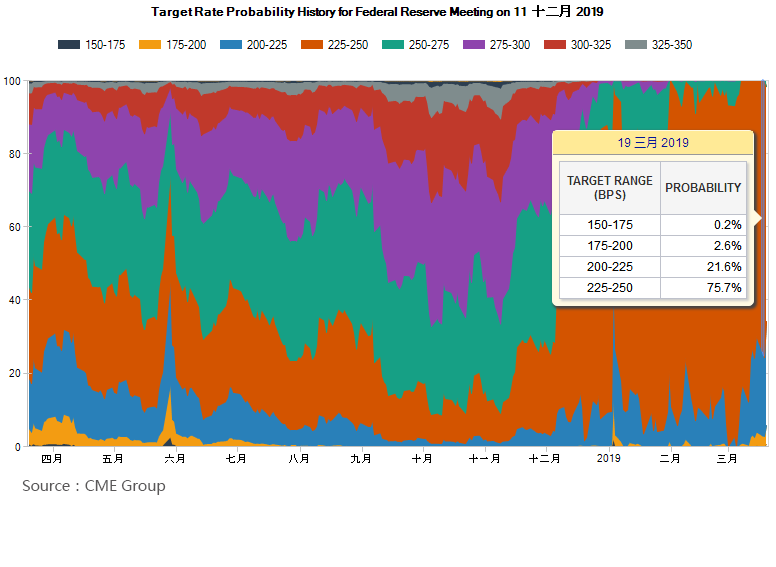

As early as the end of 2018, there was sign that the Fed was shifting to dovish monetary policy. Fed Chairman Powell said, in a speech at the end of November 2018, that interest rates were “just below” the neutral range, as opposed to a former statement that “it is a long way before the neutral interest rates.” The subtle changes in his rhetoric, however, elevated concern in the market. Institutional investment banks almost immediately recognized that the Fed’s tightening monetary policy was coming to an end. At that time, the prevailing view among institutional analysts was that the Fed would raise rates two more times in 2019 following the one in December 2018, and that this would mark the end of the interest-rate rise cycle.

The truth, however, is that reality can never be as silky as ideal.

Since January 2019, almost all of the Fed’s policymakers have given speeches or published papers that were more cautious and dovish than their original positions. Among them there are former New York Federal Reserve Bank President Williams, who previously was a monetary hawk, advocating that “slowdown is the new normal, and QE and negative interest rates will be considered if necessary”; Cleveland Federal Reserve Bank President Mester, whose argument was that “if inflation doesn’t pick up, the Fed could stop raising interest rates this year,” and Boston Federal Reserve Bank President Rosengren, who said, “Whether more rate hikes are needed depends on the economy.”

Market expectations of the number of the Fed’s rate hikes for this year and next have cooled sharply. A look at the probability charts reflected by the CME FedWatch tool shows that the market had all but downplayed the likelihood of a Fed rate hike in 2019 on the eve of the Fed’s March meeting. The boldest analysts even pointed out that the Fed’s next move would not be a rate hike but would instead be a cut.

The threshold for dovish modification of the Fed funds rate is undoubtedly higher than that of the conventional monetary policy instrument, and the signal of a shift in monetary policy is stronger.

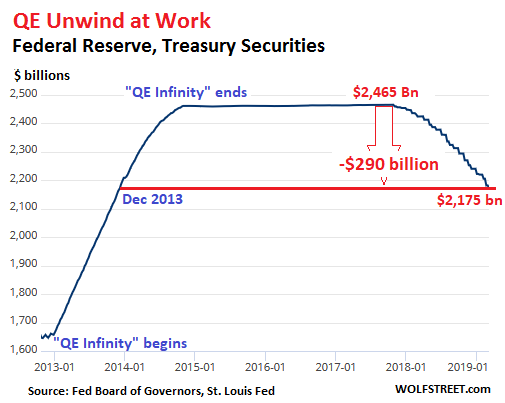

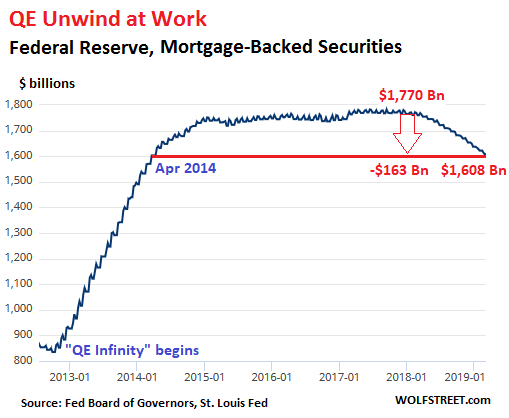

By the time QE stopped at the end of 2014, the Fed’s balance sheet had reached a frightening $4.5 trillion. According to the Fed’s balance sheet released on March 7, 2019, Fed had cut $290 billion in Treasury bonds, $163 billion in MBS and $48 billion in other assets since October 2017, when its downsizing was rolled out. Such asset reductions are unprecedented in its history.

The Fed’s position is clearly one in which it will end its 24-month balance-sheet “squeeze plans” at the end of the third quarter. Certainly, this represents an early time node in all the mainstream market expectations. The result, in other words, is that the Fed’s balance sheet will be “fuller” than previously expected.

Disclaimer:

The information contained in this website is of general nature only and does not take into account your objectives, financial situation or needs. Please ensure that you read the Financial Services Guide (FSG), Product Disclosure Statement (PDS), and Terms and Conditions which can be obtained on our website https://www.aetoscg.com.au, and fully understand the risks involved before deciding to acquire any of the financial products listed on this website.

AETOS Capital Group Pty Ltd is registered in Australia (ACN 125 113 117; AFSL No. 313016) since 2007 and is a wholly owned subsidiary of AETOS Capital Group Holdings Ltd, carrying on a financial services business in Australia, limited to providing the financial services covered by the Australian financial services licence.

Trading margin FX and CFDs carries a high level of risk and may not be suitable for all investors. You are strongly recommended to seek independent financial advice before making any investment decisions.

This commentary is owned by AETOS, and copying, reproduction, redistribution and/publishing of this material for any purpose in whole or in part without the prior written consent of AETOS is prohibited.