The following article is courtesy of AETOS analyst Ryan Chen.

Ryan Chen

Why the shift in monetary policy

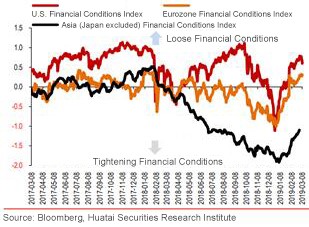

Prior to the beginning of 2019, America saw a quarter threatened by a growing crisis. On October 3, 2018, starting with Federal Reserve Board Chairman Powell’s statement that “It is still a long way before the neutral interest rate,” the collapse of the U.S. stock market led many stock indexes into technical bear market, and the assets such as Treasury inflation-protected securities and credit bonds in the U.S. were greatly depreciated. It was the same with global assets, including energy.

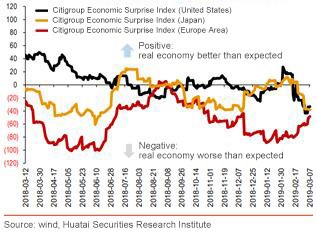

Meanwhile, the U.S. and global economies suffered a rapid downturn in the fourth quarter, as evidenced by the stalled industrial expansion, the cooling of inflation and a new low in business confidence. The Citigroup’s global economic surprise index (CESI), which reflects the difference between the actual economic data released and the market expectation, turned downward, and the CESI dropped below the zero axis with respect to the United States, the Eurozone and Japan.

Given such a backdrop, the decision makers of the Fed began to gradually change the tone. By the end of December 2018, the U.S. government was in the midst of its longest shutdown in its history, delaying the release of several key aspects of data. The Fed was caught in a dilemma, while the policy makers were becoming increasingly dovish in their belief that the economy was weakening.

In the statement after the first FOMC in 2019, the Fed deleted “gradual increase in interest rates” and “roughly balanced risks facing the economic prospect,” admitting that “market-based expectations of inflation fell,” downgraded its judgment of the U.S. economy from “robust growth” to “steady growth,” and rarely added three sections of words about shrinkage.

The postponement of key data offered the strongest endorsement of the Fed’s dovish shift:

- Retail sales data, which reflect the strength and weakness of consumer spending, which accounts for more than 70% of U.S. economic output, suffered a historical weakening. In December of 2018, the U.S. saw its retail sales fall 1.6% month-on-month, the biggest drop since September 2009. Moreover, core retail sales fell 1.8%, the biggest drop since September 2001.

- The U.S. saw its trade deficit reach $59.8 billion in December, a figure that outstripped the expectations. Given inflation, this level of deficit represented the biggest drag on GDP over the same period since the founding of the United States. The IMF expected the U.S. current account deficit to expand 26.4% year-on-year in 2019, with annual growth hitting its post-2000 peak.

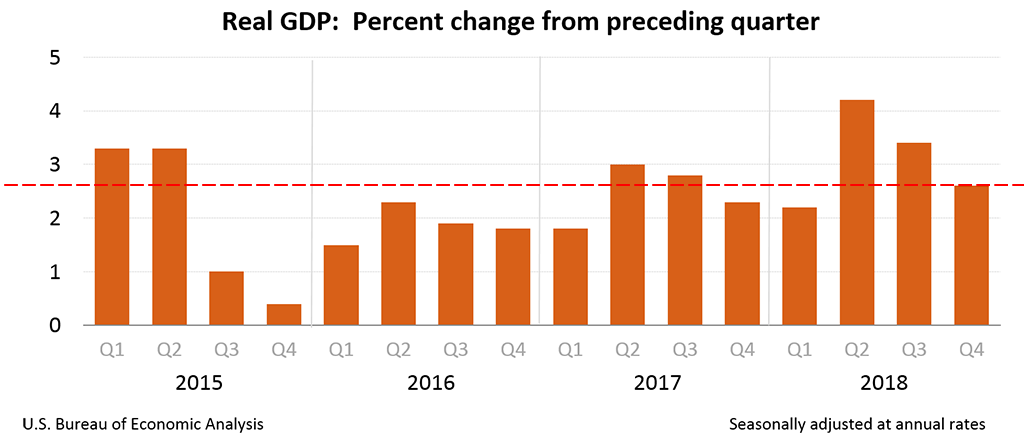

- The U.S. government’s 1.5 trillion tax reform policy has shown an increasingly clear marginal diminishing effect. The 2.2% annualized quarter-on-quarter growth rate of its GDP in the fourth quarter of 2018 was significantly slower than that in the third quarter.

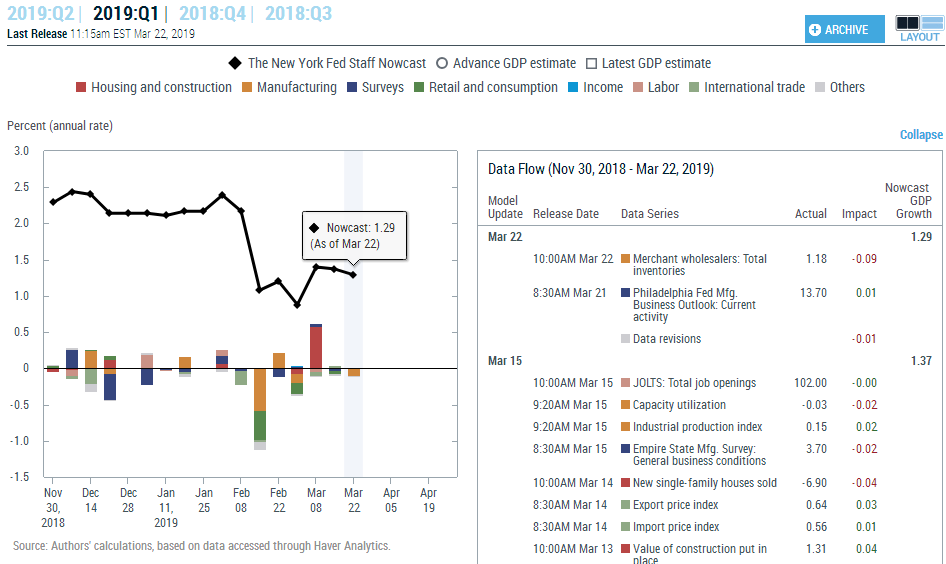

Trade and retail sales data represent a low trajectory for the U.S. economy in the first quarter of 2019, some agencies said. Forecasts for U.S. growth in the first quarter of 2019 were pessimistic, according to prediction models such as Atlanta Fed’s GDPNowcast model based on Bridge-equation integration source data and corresponding GDP subcomponents, the GDPNowcast model of the New York Fed based on Kalman filter technology and dynamic factor modeling, and the “Eight Immortals Crossing the Sea” prediction model of investment banking institutions. As of March 22, the median forecast from the leading investment banks was 1.5%, and the two Fed models were even gloomier (1.29% for the New York Fed and 1.2% for the Atlanta Fed).

Disclaimer:

The information contained in this website is of general nature only and does not take into account your objectives, financial situation or needs. Please ensure that you read the Financial Services Guide (FSG), Product Disclosure Statement (PDS), and Terms and Conditions which can be obtained on our website https://www.aetoscg.com.au, and fully understand the risks involved before deciding to acquire any of the financial products listed on this website.

AETOS Capital Group Pty Ltd is registered in Australia (ACN 125 113 117; AFSL No. 313016) since 2007 and is a wholly owned subsidiary of AETOS Capital Group Holdings Ltd, carrying on a financial services business in Australia, limited to providing the financial services covered by the Australian financial services licence.

Trading margin FX and CFDs carries a high level of risk and may not be suitable for all investors. You are strongly recommended to seek independent financial advice before making any investment decisions.

This commentary is owned by AETOS, and copying, reproduction, redistribution and/publishing of this material for any purpose in whole or in part without the prior written consent of AETOS is prohibited.