Custody business for European ETFs grew by 25% over past 12 months / Vestima platform simplifies complex cross-border transactions for ETF issuers

Exchange-traded funds (ETFs) have been highly successful with investors in recent years. Clearstream’s latest monthly report testifies to the buoyant demand for these passively managed, flexible and extremely versatile instruments, which are meeting the needs of an increasingly sophisticated investor community.

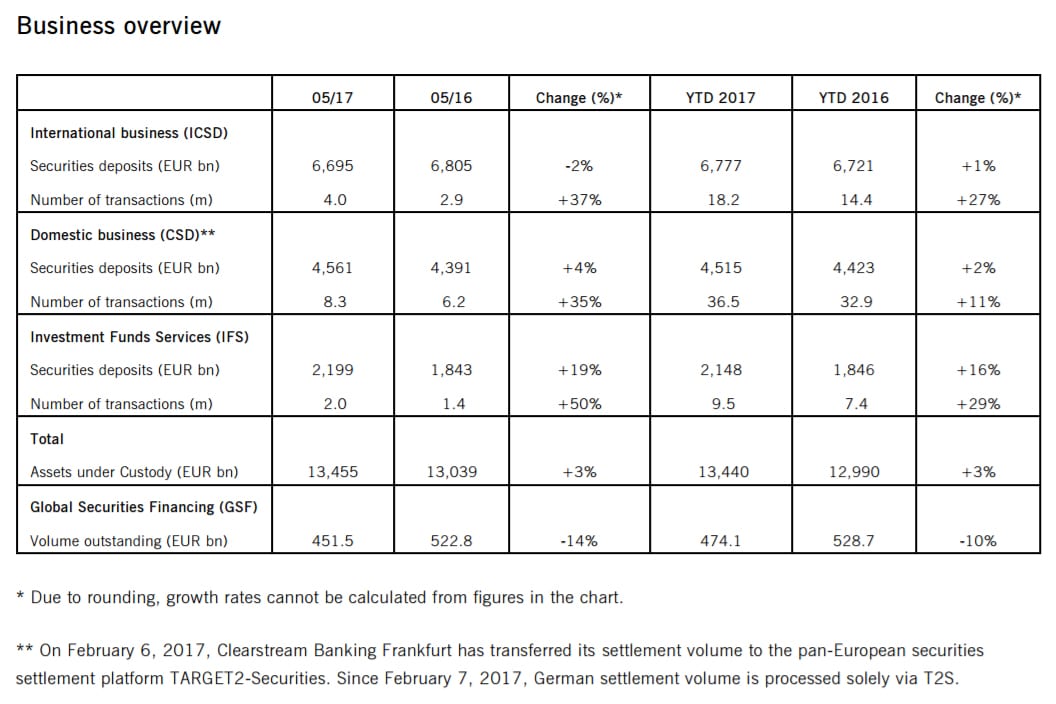

ETF Assets Under Custody rose to over €300 billion in May for the first time. Over the past twelve months, Clearstream’s custody business for European ETFs has grown by 25 percent, which means a significant increase in market share for these products in Europe.

This is not surprising, given the rapid growth of the ETF sector as well as the solutions provided by Vestima to the complex technical challenges involved in the issuance and settlement of these products, which are often listed and traded across multiple jurisdictions.

A unit of an ETF sold in Germany, for instance, has to be held in custody in that country’s Central Securities Depository (CSD), but when it is sold to a British investor, custody is also transferred to a UK CSD, a process which can result in settlement delays, glitches – even outright failures.

Clearstream’s Vestima tackled this problem last year by deploying an International Central Securities Depository (ICSD) model for major ETF issuers, simultaneously enhancing both liquidity and reducing costs. Vestima also allows for ETF issuance via the German CSD, Clearstream Banking Frankfurt, or Luxembourg’s CSD, LuxCSD. This has the advantage of providing a link into the European Central Bank’s own settlement platform, TARGET2-Securities.

Essentially, Clearstream, thanks to its domestic CSDs and ICSD connections and interoperability, simplifies potentially complex cross-border transactions when issuing via its ICSD in Luxembourg or its CSD in Germany. This means that the Vestima platform now handles ETF transactions the same way as any normal mutual fund.

Our system takes care of the complexity,” said Clearstream Banking Co-CEO Philippe Seyll. “It is low on cost and it is automated. This means that a French investor can buy into a German-listed ETF and sell it on the UK stock exchange seamlessly.”