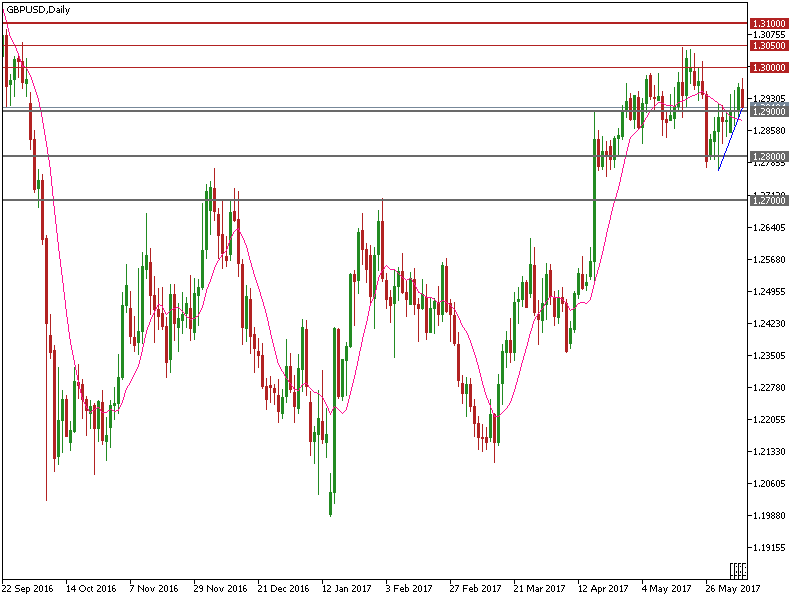

Market Concerns over Uncertain Outcome Drives GBP/USD Lower

GBP/USD has rallied around 3.14% since Theresa May announced a snap general election, as markets largely priced in a Tory victory. GBP/USD has been trading above the downside uptrend line support since May 31st. Today is the market-focused UK general election. The Tories are expected to remain in power, however, now it is hard to…

Read more