EUR/GBP has seen a noticeable 4.3% gain since May 11, helped by the strengthening of EUR.

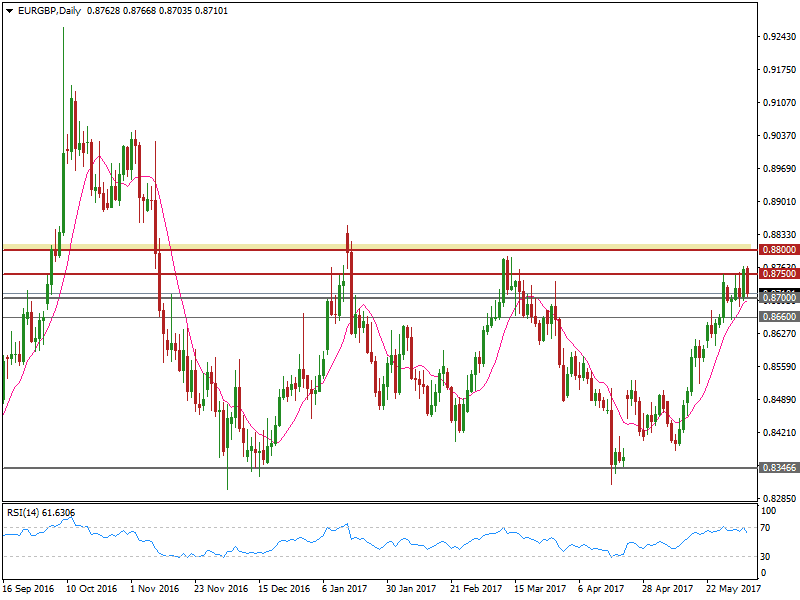

On the daily chart EUR/GBP has been trading above the downside 10-day SMA support since then.

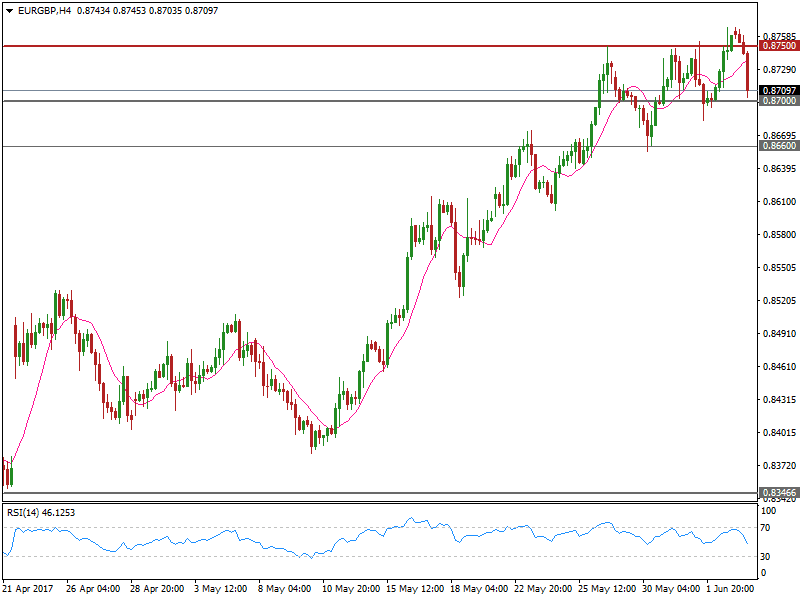

However, in early European session today, the bulls have retraced after hitting a 12-week high of 0.8766, as trading below the significant resistance level at 0.8800, where there is heavy pressure.

Currently, the bears are testing the 10-day SMA support, where another support line at 0.8700 converges, where there is a stronger support.

However, if the support zone is broken, we will likely see a further correction move.

The daily RSI indicator is heading downward from 70, suggesting waned bullish momentum.

The resistance level is at 0.8750, followed by 0.8800.

The support line is at 0.8700, followed by 0.8660.

The UK general election will be held on June 8th, which is only 3 days away. Be aware that GBP crosses will likely to be volatile before and after the release of the election outcome.