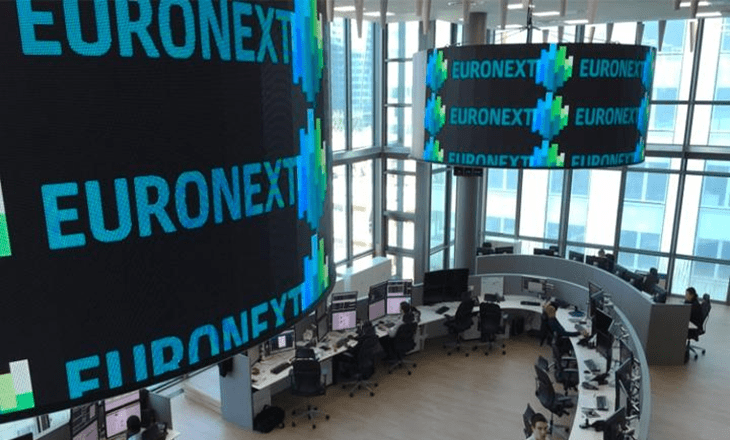

LCH offers clearing services on Oslo Børs Derivatives Market

Christophe Hémon, CEO, LCH SA, commented: We’re delighted to be extending our relationship with Euronext to offer clearing for Oslo Børs Derivatives Market. This is a significant step for us as we continue to expand the number of products and trading venues available to our clearing members. Øivind Amundsen, CEO of Oslo Børs, added: LCH…

Read more