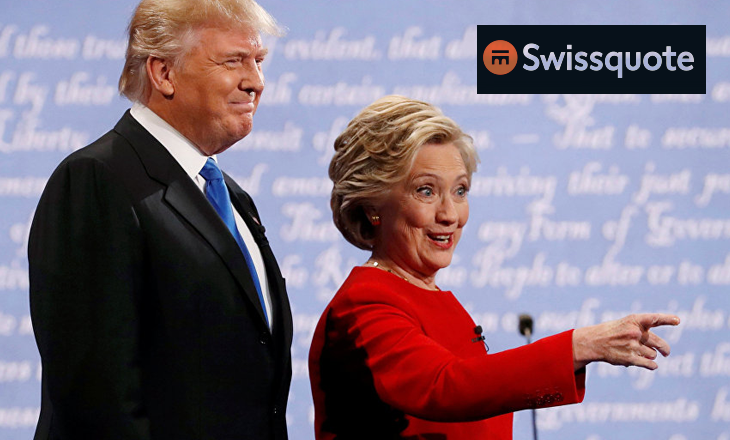

Swissquote Bank Ltd. has announced newly created investment opportunities based on the different outcomes of the US elections on financial markets. With this offering, investors and traders can now invest in a selection of stocks or currencies which are most likely to be impacted by a victory from either candidate.

Public opinion on each candidate will be tracked across the web to predict the outcome of the elections in real-time. Investors wishing to capitalize on the elections will see their investment decisions facilitated by a new predictive analytics tool, which Swissquote has developed in partnership with École polytechnique federale de Lausanne (EPFL). Poll results will be publicly available on a dedicated Swissquote website.

Unlike traditional polls, which are based on surveys, the new tool, makes use of different artificial intelligence algorithms, such as graph analysis, natural language processing (NLP) and deep machine learning, providing a poll based on nationwide online US sentiment.

Utilizing the thematic investment approach called Themes Trading, two different portfolios of stocks have been put together that will unlikely benefit from a Clinton or Trump victory.

Currencies and their exchange rates are the financial assets most sensitive to the US election, often reacting in real-time to single statements the candidates make.

Swissquote’s Hillary and Donald US Election Foreign Exchange (Forex) Baskets consist of different currency pairs, which are increasingly correlated to poll results. These include the Mexican peso, the Canadian dollar, the Chinese yuan, and the Japanese yen.

The candidates have been forced to choose extreme positions to differentiate themselves. This has increased the probability that the outcome of the election will have real effects on financial markets’, said Peter Rosenstreich, Head of Market Strategy at Swissquote. ‘For the next few weeks, we anticipate that financial markets will become increasingly sensitive to every move the candidates make, which will only increase the effect on global portfolios.

Swissquote CEO Marc Bürki

The real-time web opinion poll has the potential to become an important factor for investments decisions, whether for the outcome of a presidential election or any other investment impacted by shifts in public sentiment’, said Swissquote CEO Marc Bürki. ’By making this unique metric publicly available, Swissquote continues to lead the effort to merge traditional investment strategy with the latest financial technology.