Marex Solutions, a division of global commodities broker Marex Spectron specialising in the manufacture of customised OTC derivatives, has just announced that the first Structured Product to be transacted and custodied using blockchain was successfully launched on Friday 16 March. The product, a GBP principal protected note linked to the FTSE 100 index, is registered, cleared and settled on the Ethereum blockchain.

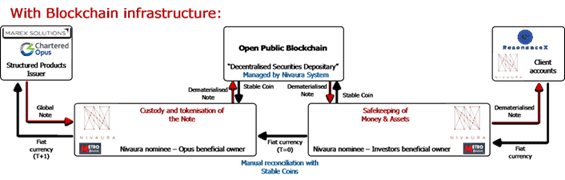

Created by Marex Solutions, in partnership with Chartered Opus, the product uses the ResonanceX multi-issuer platform developed and connected to the blockchain by Nivaura to automate price discovery, issuance and administration. Allen & Overy is supporting with the legal documentation and, as a first in this space, the product has been executed within the FCA’s regulatory sandbox.

Distributed ledger technology has the potential to disrupt the trillion-dollar structured investment product markets, which are increasingly being sold in higher volumes, but for smaller notional amounts.

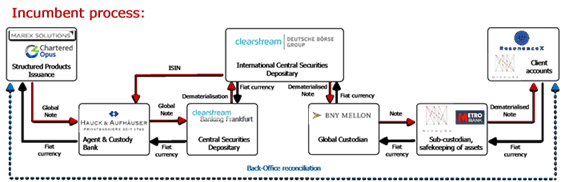

This makes the pre, post-trade and custody costs highly significant. As things stand, a few large players dominate the various elements of the value-chain, from manufacturing and distribution, to custody, clearing and registration. Blockchain opens-up this market to best-of- breed niche firms who can come together to create competitive products, a development that disrupts the traditional finance models that relied partly on centralised trust to earn revenue.

For investors, the advantages of blockchain in structured products includes:

- Reduced costs, with blockchain potentially removing intermediaries.

- Fewer opportunities for data manipulation, with blockchain acting as the database.

- Less chance of human error associated with handling such transactions.

- Faster settlement. The current settlement cycle is two-days. By using blockchain, this can be reduced to minutes, if not seconds.

- Minimised settlement risk, given the faster settlement time.

- Greater transparency, with holdings already backed by securities.

The next development is to fully tokenise issuance and administer lifecycle events and payments via smart contracts.