LeapRate Exclusive… Following our earlier report on the 2017 results of exchange operator Euronext NV (EPA:ENX), digging into the results LeapRate has learned that the company’s Forex ECN unit FastMatch – which Euronext bought in mid-2017 for $153 million – generated a total of €7.2 million of Revenue for the 4.6 months it was owned by Euronext during the year.

That works out to just €1.57 million of monthly Revenue, or an annualized €18.8 million (USD $23.3 million).

We had reported at the time the acquisition was announced (mid May, deal closed mid August) that FastMatch did $5.8 million of Revenue in Q1 of last year. Doing the math, it looks Revenue came in at about the same rate, $5.8 million per three-month period, after the acquisition as well.

That also means that Euronext paid a multiple of about 6.5x annual revenues to buy FastMatch. That’s quite a steep price, for a company with stagnant revenues, in a very commodity-like, uber-competitive sector such as institutional eFX.

FastMatch had been on the block for more than a year when Euronect bought it. The company was jointly owned by the FXCM unit of Global Brokerage Inc (OTCMKTS:GLBR), and by commercial banks Credit Suisse Group AG (ADR) (NYSE:CS) and BNY Mellon Corp (NYSE:BK).

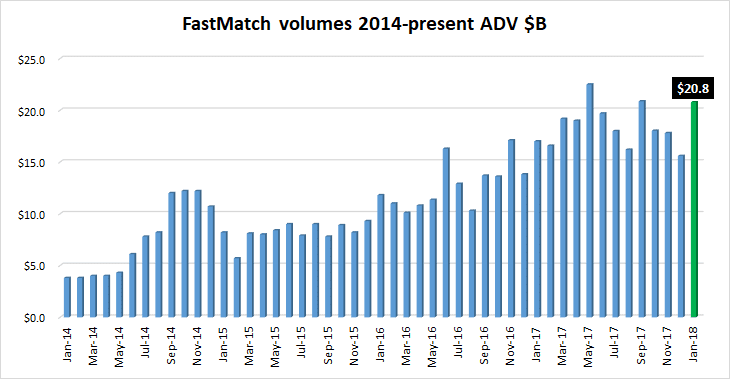

Taking a longer term view, the average daily volume on the FastMatch spot foreign exchange market was $18.4 billion in 2017, up +44.7% compared to 2016. But as noted, the margins in institutional FX are razor thin.

By way of comparison with Retail FX, FastMatch generates about $1.9 million of monthly revenue, from total monthly volumes of about $404 billion. A retail FX broker doing that kind of volume is probably looking at monthly revenues in excess of $30 million. FXCM Group, which reports both Revenue and Volume figures, did $139.2 million of Revenues in the first nine months of 2017 (or about $15.5 million monthly), on average monthly volumes of $212 billion. Again, doing about half of the total volumes that FastMatch processes, FXCM brings in more than 8x the Revenues.