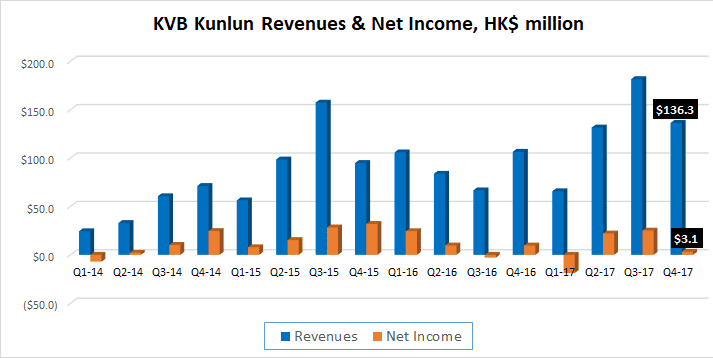

Hong Kong retail forex broker KVB Kunlun Financial Group Ltd (HKG:8077) completed what was a very up and down year in 2017 by reporting that Q4 Revenues were down 25% from Q3, coming in at HK$136 million (USD $17.4 million). The company just about broke even on the bottom line, with Q4 Net Profit of HK$3.1 million (USD $400,000).

After a fairly slow period lasting nearly two years, KVB reported record Revenues and healthy profits in Q3, but seems to have come back down to earth in Q4.

Overall for 2017, KVB reported Revenues of HK$514.9 million (USD $65.6 million), up 42% from 2016, with Net Profit of HK$31.2 million (USD$ 4.0 million), down 23% from 2016.

More than half of KVB’s Revenues (58%), or HK$299 million, were paid out in the form of Referral Expenses. KVB said that the increase in its Revenues and client trading activity in 2017 was mainly due to an increase in clients referred by services providers.

KVB is 59% owned by China’s CITIC Securities Company Limited (SHA:600030).

After year-end, as was exclusively reported by LeapRate, KVB Kunlun raised HK$200 million (USD $26 million) in capital, in an investment led by Chinese insurance and investment giant Ping An Insurance (Grp) Co of China Ltd (SHA:601318). The investment was made via a convertible bond offering. The new investors, once they convert, will own 16% of the company. CITIC will see its holding diluted from 59% to just under 51%. The bondholders will also be granted one seat on KVB’s board of directors.

KVB recently moved its share listing from the HKEX’s Growth Enterprise Market (or GEM), Hong Kong’s version of the LSE’s AIM market, to the HKEX Main Board. The purpose of the move was increase the company’s visibility, and to make the company’s shares more attractive to investors.

Back to the company’s 2017 results… KVB stated that during the year it experienced a period of ‘unfavorable trading conditions’, due to the low market volatility throughout the year. The company’s total revenue increased with an increase in the clients’ trading volume during the year, in comparison to 2016.

The year started off with the ‘Trump trade’, with the expectation of strong performance of USD and equity markets, since the US economic data had reasonable positive feedback along with Federal Open Market Committee interest rate hike several times. The market also experienced unexpected swings due to geopolitics events, such as Brexit negotiation, the North Korea crisis, and ‘Trump-Russia Ties’. In general, in periods of elevated volatility, customer trading volumes tend to increase. However, significant swings in market volatility can also result in increased customer trading losses and higher turnover.

KVB said that Gold was the most popular traded product by its customers. In FX products, EUR/USD was the most traded pair, followed by USD/JPY and GBP/USD.

As far as future plans go for KVB, the company said it plans to:

- expand operations in the worldwide overseas Chinese communities;

- increase the range of its financial services and products;

- further upgrade its online trading platform; and

- develop the high net worth and sophisticated institutional clients segment.

KVB’s full 2017 financial report can be seen here (pdf).