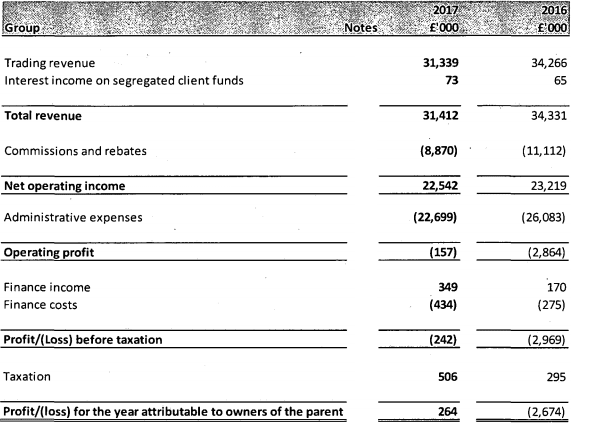

LeapRate Exclusive… After posting a loss of £2.7 million in 2016 which was then followed by the departure of longtime CEO Andrew Edwards and the subsequent appointment of Arman Tahmassebi to the company’s top management spot, LeapRate has learned that FCA regulated broker ETX Capital was able to turn things around in 2017, posting a modest profit of £264,000 for the year.

Arman Tahmassebi, ETX Capital

The results, posted by ETX Capital parent company Monecor (London) Limited, indicate that Revenues actually declined by 8.5% from 2016, £31.3 million versus £34.3 million. However the decline was caused mainly by a change in strategy at ETX Capital, which included severe spending cuts and a renewed focus on high net worth clients, and clients with higher levels of trading activity.

The company, despite the drop in Revenues, saw a large jump in Client Assets held, up to £129.6 million as at year-end 2017 – more than double the £58.4 million ETX held at the beginning of the year.

ETX restructured its arrangements with non regulated introducers during the year, such that they no longer receive tail payments. These arrangements were altered to either an upfront payment for the customer introduction, or the IB relationship was simply terminated.

As a result of the company’s aforementioned focus on higher net worth clients, the number of active customers fell by 29% in 2017, but spread-per-customer rose by 24%. Spread revenue represented 67% of overall ETX revenues in 2017, down slightly from 70% in 2016.

Revenue from ‘professional’ customers rose by 28%, from £8.7 million in 2016 to £11.1 million in 2017. Revenues from customer equity trading represents over 50% of this income stream.

Revenue from retail CFD and spread bet customers fell by 23%, from £24.2 million in 2016 to £18.8 million in 2017.

On the expense side, total commission paid to introducing brokers fell 15% from £6.6 million in 2016 to £4.7 million in 2017. Marketing, affiliate and top up bonus expenditure fell 33% from £6.1 million in 2016 to £4.2 million in 2017, as marketing became more focused and promotional offers were scaled back, as we noted above.

ETX launched a leveraged crypto offering in October 2017, and said that Q4 saw a strong uptake of crypto trading.

2017 was the first year in several that ETX didn’t make a significant acquisition. In 2015 it won the auction for Alpari UK’s client list, and in 2016 acquired the client list is of PipIndex, an MT4 broker which was effectively operating as an introducing broker (IB) of turnkey broker solutions provider Finsa Europe.

ETX Capital runs both its own proprietary iTrade HTML5 platform, as well as MT4 and the MarketsPulse binary options trading platform.

ETX remained a very UK-centric broker during 2017, with 62% of CFD and spread betting Revenue coming from its UK home market (versus 54% last year), and more than 95% coming from the UK and Europe.

The 2017 income statement for ETX Capital parent Monecor (London) Limited follows: