This week welcomes three major central banks to the stage—the Bank of Japan (BoJ), the Federal Open Market Committee (FOMC [the Fed]) and the Bank of England (BoE)—with all expected to hold rates unchanged. Additionally, there are several key risk events to get our teeth into.

Week Ahead: Three Central Banks; Three Rate Decisions

BoJ, the Fed and the BoE on the Radar

The BoJ is anticipated to remain on hold at -0.10%, though a potential change in forward guidance and a tweak to the yield-curve-control programme are on the table. The central bank’s quarterly outlook will also be critical for many: the BoJ’s projections for growth and inflation. The Japanese yen will undoubtedly be in the spotlight this week, particularly with the USD/JPY currency pair recently testing space north of the widely watched ¥150.00 handle. You will see that the pair clocked a high of ¥150.78 on Thursday, though Friday, in a one-sided move, reclaimed territory back under ¥150.00.

The FOMC will be the highlight of the week on Wednesday; markets, economists and most Fed officials widely expect the Fed to pause for a second consecutive meeting, a move that would leave the Fed Funds target range at 5.25%-5.50% and help allow the central bank to let the cumulative tightening work through. Attention, therefore, shifts to any guidance delivered for the final FOMC meeting this year in December. Albeit unlikely, a small probability remains priced for a 25bp rate hike at the December meeting in view of the uncertainties. While much of the local economic data reveals a positive picture, the outlook is less upbeat and weighed by uncertainties surrounding the conflict in the Middle East. The latest economic growth release saw real US GDP for Q3 (the advance estimate) shatter market forecasts, rising 4.9% on an annualised basis, which could fuel inflation (remained unchanged at the headline level at 3.7% in the twelve months to September [nearly twice the Fed’s inflation target]). The Dollar Index is still relatively strong, but upside momentum has slowed considerably. Should the Fed signal that rates will remain in restrictive territory for longer, this could see rate cuts moved out further into 2024 and thus offer the dollar impetus to continue seeking higher levels.

Don’t miss out the latest news, subscribe to LeapRate’s newsletter

Thursday is all about the Bank of England (BoE), which is also expected to hold the line at 5.25% (15-year high) following the previous surprise pause at September’s meeting that snapped 14 consecutive rate hikes. There has been limited data to suggest that the BoE will hike this week. We will also be getting the latest projections out of the BoE (you may remember that the previous central bank’s projections showed economic growth of 0.5% in 2023 and 2024). While rates are likely to remain on hold, the fight to tame inflation, which stands at 6.7% in the twelve months to September—more than three times the central bank’s inflation target and the highest inflation in the G7—is far from over. As such, traders can expect previous guidance to remain essentially unchanged: the door to be left open for further rate hikes if needed.

Economic Data

The US employment situation release will be monitored closely on Friday at 12:30 pm GMT. The latest release saw non-farm payrolls (NFP) data come in strong at 336,000 in September versus a 170,000 median market estimate. Heading into this week’s event, markets, again, forecast around a 170,000 print for the month of October (estimate range is between 285,000 and 150,000), with the unemployment rate poised to hold steady at 3.8% and average hourly earnings from September to October set to increase by 0.3% from 0.2% in September. A stronger-than-expected print for the NFP, particularly at the upper end of the estimate range, could prompt the market to extend its rate-cut projection further out in 2024 and bolster the USD. Additional data for the US this week are the ISM manufacturing and services prints on Wednesday and Friday, respectively, the US CB consumer confidence number on Tuesday and the US JOLTs Job Openings data on Wednesday alongside the ADP non-farm employment change.

For the euro area, inflation and growth figures are important on Tuesday, following the European Central Bank (ECB) leaving its three benchmark rates unchanged. For many, the ECB might be done with rate increases, though some desks believe there’s a chance we may see the central bank attempt to squeeze through one more rate hike at the end of this year. Time will tell. Another question, of course, assuming the ECB is done and dusted with policy firming, is how long rates will remain in restrictive territory. While ECB President Christine Lagarde did not explicitly confirm that they’re finished with rate hikes and noted in one of the questions in the press conference that it would be ‘premature’ to discuss cuts, markets are currently pricing in a 25bp cut around mid-2024.

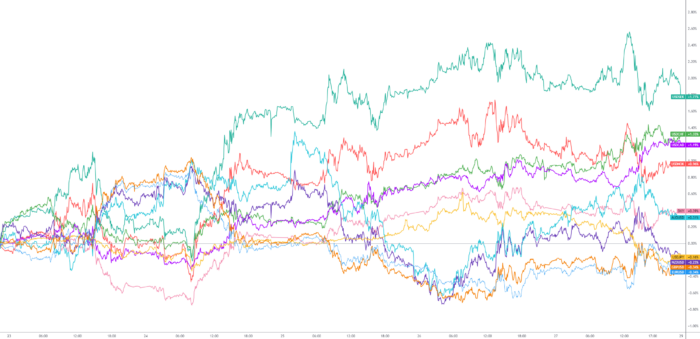

G10 FX (5-Day Change):

TradingView

DISCLAIMER:

The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only. To the extent permitted by law, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided in or omitted from this material. Features of the FP Markets products including applicable fees and charges are outlined in the Product Disclosure Statements available from FP Markets website, www.fpmarkets.com and should be considered before deciding to deal in those products. Derivatives can be risky; losses can exceed your initial payment. FP Markets recommends that you seek independent advice. First Prudential Markets Pty Ltd trading as FP Markets ABN 16 112 600 281, Australian Financial Services License Number 286354.