The UK watch-dog Financial Conduct Authority (FCA) has been investigating more than 150 Coronavirus-related scams since the outbreak began.

The data, obtained under the Freedom of Information (FOI) Act by the Parliament Street think tank’s cyber research team, reveals the extent to which financial services organisations and banks have been targeted by financial criminals during the pandemic.

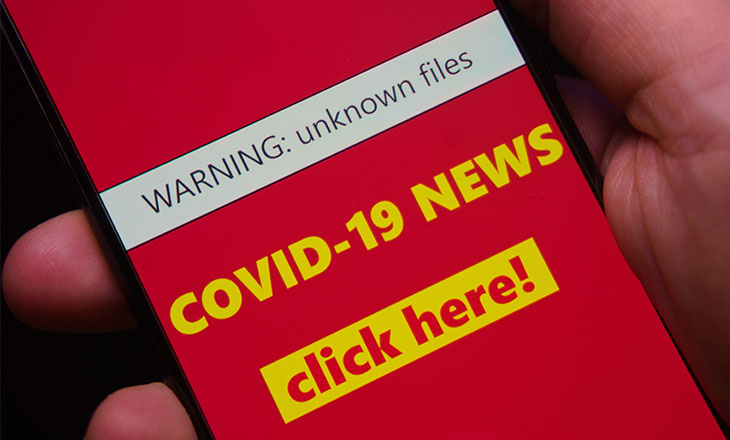

The total number of suspected scams reported to the FCA over the last five months is 165, including email, phone calls, text messages, letters, and social media scams.

One time, fraudsters pretended to be from HM Revenue and Customs (HMRC) and targeted company owners seeking Coronavirus relief grants to help manage their finances throughout the crisis.

Other scams included a targeted effort to steal the log-in credentials of HSBC customers with business accounts, and seeking to obtain the passport details of financial services workers.

Experts have warned that the rise in sophisticated Covid-19 related scams could leave financial services firms open to the risk of financial crime, especially with increasingly stringent Anti-Money Laundering (AML) legislation in the pipeline.

Max Worrall, General Markets Sales Manager, Encompass Corporation commented:

The Covid-19 pandemic has seen a rapid increase in the number of financial crime scams entering circulation.

There have been numerous reports of company owners and directors receiving highly realistic scam emails, requesting usernames, passwords, and bank details from workers.

These risks are a reminder of the threats posed to regulated firms seeking to enforce Anti-Money Laundering (AML) measures and customer verification checks. These processes often involve reviewing personally identifiable information and documentation, something criminals are always seeking to get their hands on, by any means necessary.

It is therefore vital that companies have in place the necessary anti-financial crime systems, as well as the ability to identify and confirm that the customer is who they say they are.

Other recent news from the FCA can be seen below: