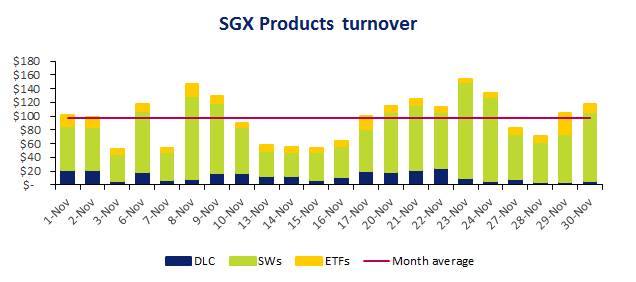

In the month of November, Singapore Exchange (SGX) listed Structured Warrants, Daily Leverage Certificates (DLCs) and Exchange Traded Funds (ETFs) generated a combined daily average turnover of S$97 million with Structured Warrants contributing S$74 million (+163% YoY) of the total. More highlights include:

- DLCs generate a total turnover of S$282 million in November and a total turnover of S$1.55 Billion since its launch. Turnover on the HSI DLCs showed the strongest growth in turnover with a 261% increase m-om while the HSCEI DLCS increased 110% MoM.

- ETFs traded S$10.4 million on average a day in the month of November, up 35% m-o-m. The top 5 traded ETFs include iShares MSCI India, SPDR® STI ETF, DBXT MSCI AC Asia ex Japan ETF, SPDR® Gold Shares and the newly-listed Lion-Phillip S-REIT ETF.

Structured warrants generated a total turnover of S$1,624 million in November with majority of the turnover in the warrants with Hang Seng Index underlying.

The DLCs have generated a total turnover of S$282 million in November and a total of S$1.55 Billion since its launch.

The DLCs are designed to be traded on a short term basis where investors can use them to capture intraday trends in the market or trends over a few days. See an extract from the daily newsletter by SocGen below showcasing the product returns on one of the more active days this month, 21 November. The largest intraday DLC move was in the HSCEI that day with more than 14.5% gain or loss.

Investors should note that the 5 times leveraged performance in the DLC is calculated on a close-to-close basis and performance of the DLC will vary from 5 times when held for more than one day due to the compounding effect.

ETFs traded S$10.4 million on average a day in the month of November, up 35% from the month before.

The top 5 traded ETFs include iShares MSCI India, SPDR® STI ETF, DBXT MSCI AC Asia ex Japan ETF, SPDR® Gold Shares and the newly-listed Lion-Phillip S-REIT ETF.

The iShares MSCI India has produced an YTD return of 30.45%. Shares of Britannia (BSE), Vakrangee (BSE) and Petronet LNG (BSE) were trading higher after these stocks were included in the MSCI India index with effect from December 1, 2017.

The SPDR® STI ETF has produced an YTD return of 22.51%. SGX lists 2 ETFs that tracks the Straits Times Index – SPDR® STI ETF and NikkoAM STI ETF. The Lion-Phillip S-REIT ETF started trading on SGX on 30th October 2017. As of 30th November 2017, the ETF produced a return of 2.7%, as the ETF closed at $1.027, up from the initial launch price of S$1.00.

Structured warrants and Daily Leverage Certificates are examples of Specified Investment Products (SIPs). The MAS has introduced measures for intermediaries to safeguard the interests of individual investors investing in SIPs, which are products with features that might be more complex in nature.