The following guest post is courtesy of Usman Ahmed at Investoo Group, which provides expert products for the financial trading industry.

Jan 15, 2015 was the day when a Tsunami hit the financial markets. It was the day when millions of dollars were wiped out from global financial markets and many big players of the forex exchange market suffered heavy losses while some even announced bankruptcy. On Gregorian calendar month fifteen 2015, the Swiss National Bank (SNB) suddenly and unexpectedly removed the EURCHF price peg, triggering a flash crash in the price of EURCHF currency pair which consequently affected almost all currencies and stock markets around the globe. In this article we have a tendency to area unit getting to take a glance on major factors to blame for the EURCHF crash, market reaction and its aftermaths.

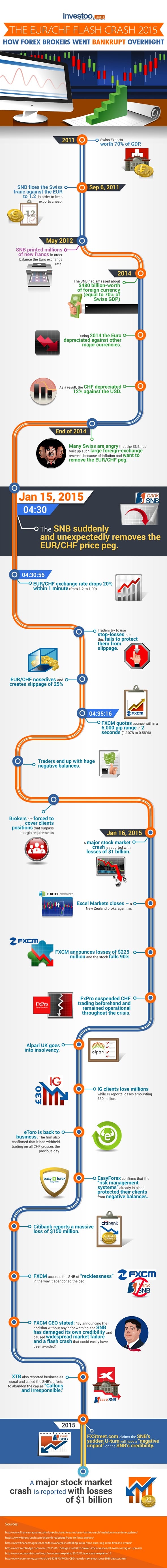

To understand the EUR/CHF crash of 2015, let’s go back to 2011 when the exports of Switzerland were almost 70% of its Gross Domestic Product (GDP). In order to keep exports cheap, the Swiss central bank made an unprecedented announcement on Sep 2015. The bank mounted land monetary unit (CHF) against the monetary unit (EUR) to one.2 and vowed to safeguard this peg with unlimited intervention in the open market. The central bank kept its promise and printed millions of new francs in order to balance the Euro exchange rate. The bank also sold billions of Francs in the foreign exchange market to keep its currency cheaper against the Euro.

In 2014, the central bank announced that it had amassed about $480 billion-worth of foreign currency – equal to 70% of the Swiss GDP. During 2014 the Euro depreciated against the major currencies and consequently CHF depreciated 12% against the USD. By the tip of 2014, surveys showed that a majority of Swiss people were angry at SNB thanks to its call to mend monetary unit against the monetary unit that diode to widespread inflation in the county.

And then comes the day – the 15th of January, 2015 when the SNB suddenly and unexpectedly removed the EUR/CHF price peg, triggering a flash crash in the price of EUR/CHF currency pair which consequently engulfed almost all currencies and stock markets all over the world. The EUR/CHF exchange rate nosedived 20% in less than a minute, dragging its price from 1.20 to less than 1.00. The flash crash of EURCHF resulted in Associate in Nursing new slippage of quite twenty fifth, leaving hundreds of thousand traders with negative balances.The event caused heavy losses to foreign exchange brokers United Nations agency suffered extraordinary slippage within the open market. A few hours once the crash, a major retail forex broker Alpari announced bankruptcy.

Another leading Forex broker FXCM reported a loss of $225 million and its stock value plunged nearly ninetieth. IG suffered a loss of £30 million throughout the event. Citibank reported a huge loss of $150 million amid EURCHF flash crash. The event caused a huge $1 billion crash in world stock markets. Financial intuitions darned SNB for the EURCHF flash crash that caused significant losses everywhere the planet.