This article was submitted by Michael Stark, market analyst at Exness.

Most markets started the week without much direction as participants considered the possibility of further sanctions on Russia after more reports came out over the weekend of war crimes against Ukrainian civilians. This preview of weekly data considers AUDUSD and BTCUSD.

Central banks weren’t especially active last week, with the Fed’s greater hawkishness now seemingly a given. All participants according to CME FedWatch Tool expect at least one two-step hike by June’s meeting of the FOMC. This week sees the Reserve Bank of Australia meet early on Tuesday morning GMT, with no change in rates expected.

The most important regular releases this week are balance of trade from Australia, the USA and Canada. Germany’s trade surplus unexpectedly grew above €11 billion as announced on Monday morning. Traders are also looking ahead to Canadian job data on Friday and the Fed’s minutes on Wednesday night: the latter might give more hints on the specific direction of monetary policy this quarter.

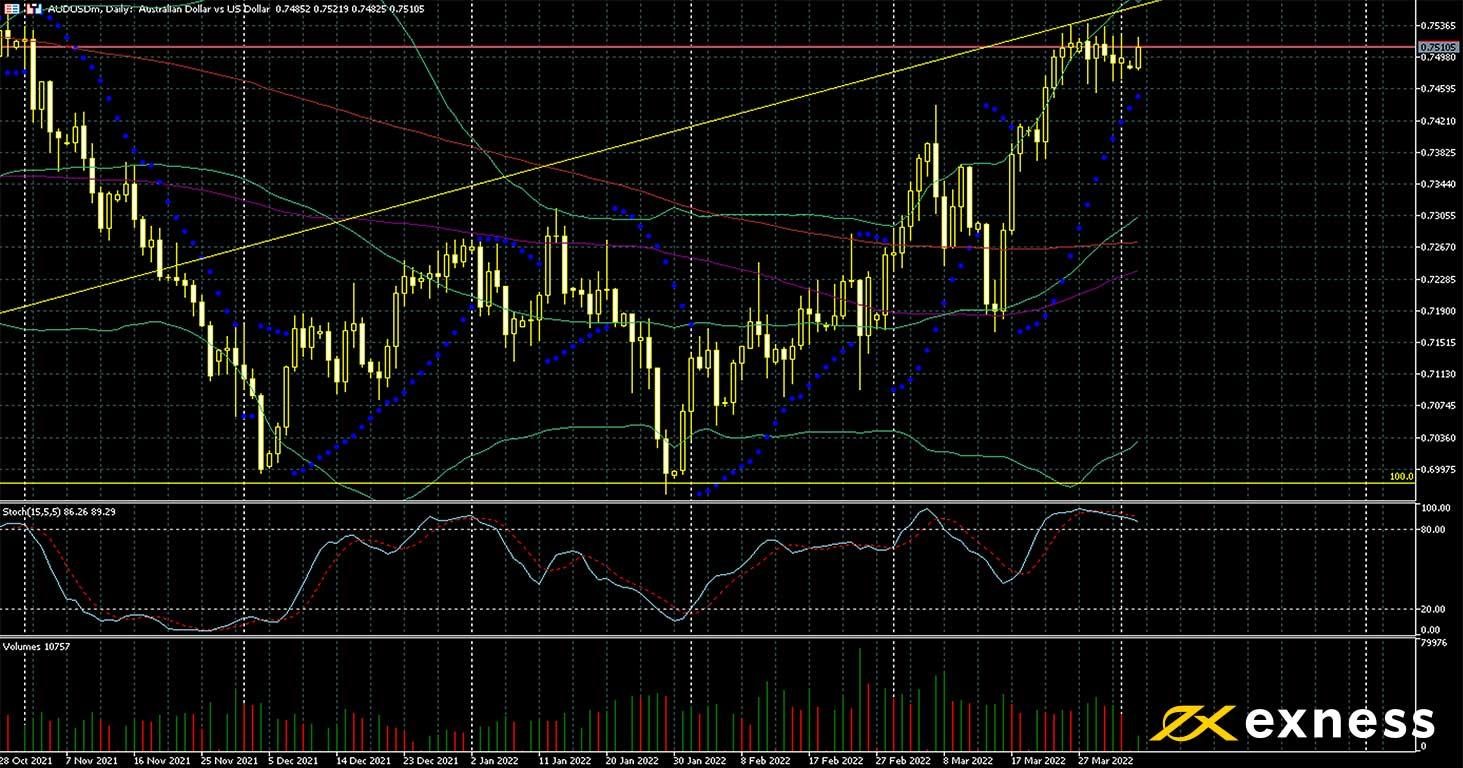

Australian dollar-US dollar, daily

The Australian dollar performed very well on the whole against its American counterpart last month as sentiment overall didn’t take a big hit from the war while surging prices of industrial commodities boosted demand to buy AUD. The Reserve Bank of Australia has so far been unusually slow to taper quantitative easing and tighten monetary policy, but hints of this changing within 2022 are possible on Tuesday morning. While annual inflation in Australia at 3.5% is above the RBA’s target of 2-3%, there is no evidence yet of the same ‘runaway’ situation as in other advanced economies such as the USA or the UK.

The daily chart of AUDUSD shows decreasing momentum since the end of last month as the price reached a plateau with a strong overbought signal from the slow stochastic. The golden cross of the 50 SMA above the 200 would usually suggest ongoing gains, but perhaps not in the immediate future with important data due this week. A lot depends on how traders perceive comments from the RBA on Tuesday morning and specifically whether hiking this summer moves from ‘plausible’ to ‘base case’.