The following article was submitted by Michael Stark, market analyst at Exness.

This week started on a fairly positive note in many markets. The USA and China were reported to have held ‘constructive talks’ by phone on Saturday according to China’s state-run Xhinhua. The Sino-American trade war and possible steps to a resolution are likely to remain front and centre this week for many instruments, particularly gold and oil.

One of the biggest events in markets last week was the Banco de Mexico’s decision to cut its benchmark rate by 0.25%. This is the third cut in a row and seems to have inspired some confidence in markets that inflation in Mexico might return to the target range sooner rather than later.

This week’s major economic releases come mostly from Europe and Japan. However, traders will also be monitoring Canadian inflation and the Fed’s minutes on Wednesday.

Dollar-peso, four-hour

The peso greeted the news of the BdeM’s cut by strengthening sharply against the dollar, removing nearly all of the latter’s gains in the first half of last week. Fundamentals for USD-MXN are somewhat contradictory at the moment in the absence of clear progress on trade: the peso is one of the more vulnerable currencies to the ongoing dispute.

Technicals overall suggest that this week might be somewhat calmer. The presence of price in the ‘value area’ between the 100 and 200 SMAs combined with sellers’ reluctance around the former area probably means that another major event will be awaited before there’s more large movement on this chart.

On the other hand, it’s possible that USD-MXN could post more gains this week. The slow stochastic has just completed an upward crossover, and the size of the current period’s candle might signal the return of some momentum upward. The biggest hurdles for buyers here are the 200 SMA only slightly above price, after which there are the 61.8% and 50% Fibonacci retracement areas. A daily close above these could be followed by a retest of last week’s high.

Key data points

- Tuesday 19 November, 13.30 GMT – American housing starts (October): consensus 1.31m, previous 1.26m

- Wednesday 20 November, 19.00 GMT – FOMC’s minutes.

- Friday 22 November, 15.00 GMT – Michigan consumer sentiment (November, final): consensus 95.7, previous 95.5.

Looking slightly further ahead, Mexican inflation on Monday 25 November is likely to be a crucial release for USD-MXN.

Dollar-forint, daily

The dollar has resumed its gains against the forint so far this month despite some notably better data from Hungary last week. One of the factors against HUF in recent months has been the sustained period of lower demand in neighbouring countries like Germany on which Hungary relies as export markets.

Tuesday afternoon’s meeting of the Hungarian National Bank probably won’t yield any surprises, but depending on the comments of Governor György Matolcsy it’s possible that the dollar’s gains might stall. The 23.6% Fibonacci retracement area (based on August-September’s gains) seems to be quite a strong area. Moreover, the slow stochastic continues to show a clear overbought signal, with a downward crossover last week. The first major zone to the upside here is the 61.8% Fibonacci extension area.

Key data points

- Tuesday 19 November, 13.00 GMT – Hungarian deposit interest (November): consensus -0.05%, current -0.05%.

- Tuesday 19 November, 13.00 GMT – Hungarian base rate: consensus 0.9%, current 0.9%.

- Tuesday 19 November, 13.30 GMT – American housing starts (October): consensus 1.31m, previous 1.26m

- Wednesday 20 November, 19.00 GMT – FOMC’s minutes.

- Friday 22 November, 15.00 GMT – Michigan consumer sentiment (November, final): consensus 95.7, previous 95.5.

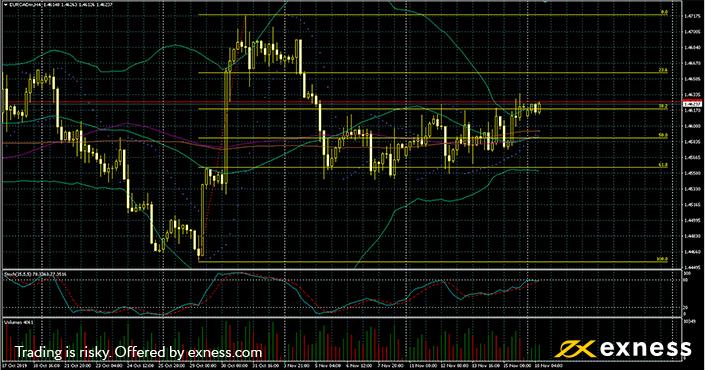

Euro-Canadian dollar, four-hour

The euro has generally continued to make gains against the Canadian dollar since the Bank of Canada’s last meeting. Governor Stephen Poloz was unusually negative about the outlook for the Canadian economy, and the price of oil has yet to move up to the extent that a bounce for CAD might be expected.

This chart clearly displays lower volatility so far this month, with Bollinger Bands having contracted significantly and all three moving averages having bunched together not far below price. EUR-CAD is probably on track to continue making small gains this week, with the area of focus likely to be the 23.6% Fibonacci retracement zone.

Key data points

- Wednesday 20 November, 13.30 GMT – Canadian annual inflation (October): consensus 1.9%, previous 1.9%.

- Thursday 21 November, 15.00 GMT – eurozone consumer confidence (November, flash): consensus -7.3, previous -7.6.

- Friday 22 November, 7.00 GMT – German GDP growth (third quarter, final): consensus 0.1%, previous -0.2%.

- Friday 22 November, 13.30 GMT – Canadian monthly retail sales (September): consensus 0.1%, previous -0.1%.

Dollar-yen, four-hour

The dollar has also been doing fairly well against the yen since the second half of last week. Some of the key drivers were Japanese preliminary GDP growth declining to 0.1% for the third quarter and American CPI ticking up to 0.4%, the best monthly gain since March. Adding somewhat to the upward pressure on USD-JPY were rumours that a trade deal or at least an ‘armistice’ of sorts between the USA and China might be approaching.

On the technical side we can see that price bounced very well last week from a classic upward crossover of the slow stochastic around the area of the 200-period simple moving average. Price might now test the 23.6% Fibonacci retracement area. However, more big gains and a test of early November’s highs around ¥109.50 are unlikely. This week’s data, especially the FOMC’s minutes and Japanese inflation, are very important for direction in the near future.

Key data points

- Tuesday 19 November, 13.30 GMT – American housing starts (October): consensus 1.31m, previous 1.26m

- Tuesday 19 November, 23.50 GMT – Japanese balance of trade (October): consensus ¥301 billion, previous -¥123 billion.

- Wednesday 20 November, 19.00 GMT – FOMC’s minutes.

- Thursday 21 November, 23.30 GMT – Japanese annual inflation (October): consensus 0.3%, previous 0.2%.

- Friday 22 November, 15.00 GMT – Michigan consumer sentiment (November, final): consensus 95.7, previous 95.5.

Disclaimer: any opinions made may be personal to the author and may not reflect the opinions of Exness or LeapRate.