The following article was written for LeapRate by Giles Coghlan, Chief Currency Analyst at HYCM

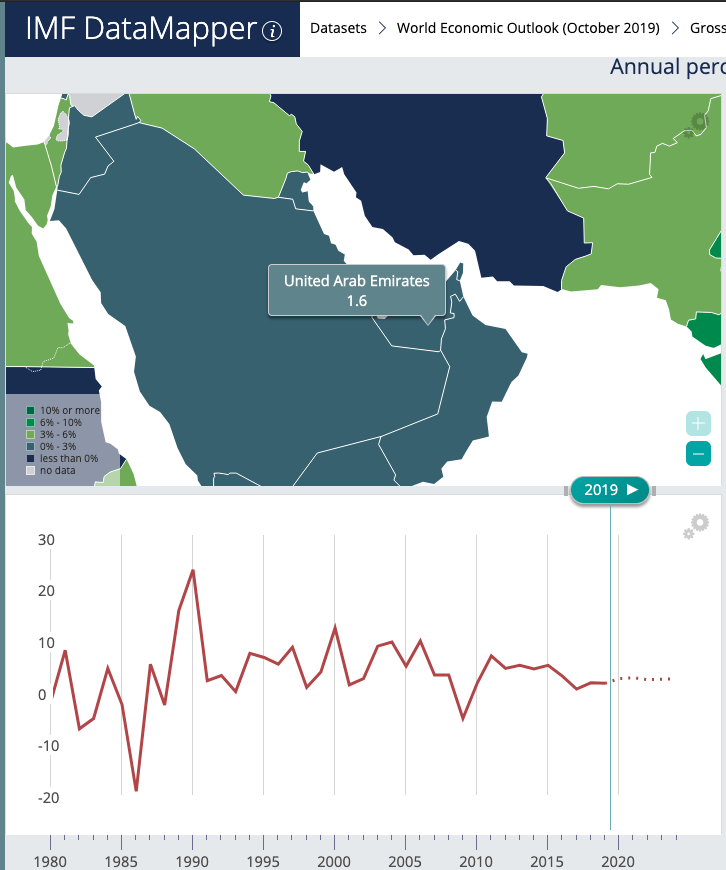

The UAE’s growth outlook was lowered from 2.8% in April 2019 to 1.6%

The International Monetary Fund (IMF) has revised the outlook of the UAE downward in line with cuts across the globe. As well as reductions to this year’s growth the IMF cut 2020’s projections by 0.8% to 2.5%. The projections for growth over the next five years are now at 2.5% until 2024.

Source: imf.org

Why has the UAE’s growth forecasts been reduced?

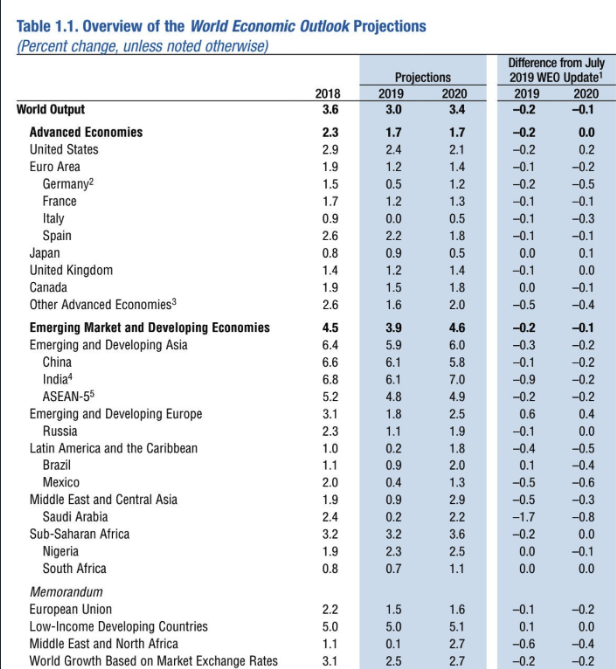

The reduced growth forecast for the UAE is simply due to a broader, global slowdown. In the IMF World Economic Projection charts below from October 15, 2019, you can see the considerable reduction in GDP growth across the world’s economies:

Looking at the right-hand column and the difference from the July 2019 World Economic Forum update you can see that virtually every region has had their growth forecasts revised downwards. The entire globe’s economy is expected to slow down. So, why has this global slowdown begun?

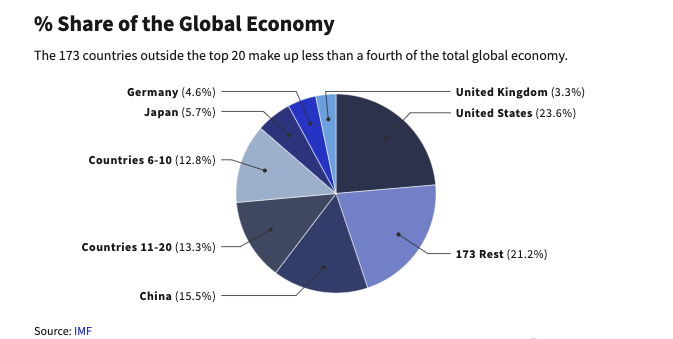

US and China trade war/deal to set the global tone

Take note of China and the United States’ projections. US growth was cut to 2.4% (previously 2.6%) and 2020’s projections were cut to 2.1% (previously 2.3%). China’s 2019 growth forecast was reduced to 6.1% (previously 6.2%) and 2020’s figures were cut to 5.8% (previously 6.0%). US and China are the top two world economies, with the US providing around 23.6% of the world’s GDP and China about 15.5%. That means that nearly 40% of the world’s GDP comes from just these two economies. If you look at the IMF chart below on the % share of the global economy, you can see that the 173 countries outside of the top 20 countries only make up 21.2% of the world’s GDP. So, US and China set the growth pattern for the whole world.

What does this mean?

We can draw three conclusions from the above:

- The UAE is the second-largest economy of the Middle East behind Saudi Arabia and is ranked as having the 29th highest GDP in the world. This means that the UAE’s growth forecasts are impacted strongly, as is the rest of the world, by US and China GDP growth.

- The US and China trade war has dragged not only their own economies but virtually all countries in the world, both directly and indirectly. Therefore, the US-China trade war will have the most impact on the world economy and its recovery in growth. If the US and China really do strike a deal, then the rest of the globe’s growth will pick up too.

- More than 85% of the UAE’s economy is based on oil exports. When global growth slows, so does demand, and therefore the price of oil. In order for UAE’s growth forecast to rise, a pickup in global growth is needed to support higher oil prices, which in turn will support the UAE’s oil export-dependent economy.

What impact does this have on the markets?

Slowing global growth concerns result in investors seeking fixed income returns. High-grade government bonds are popular fixed income returns as investors seek the comparative safety of bonds with their guaranteed yield.

By contrast, equities are generally less attractive as countries around the world expect to experience a slowdown as investors are less attracted to shares that may be affected by the US-China trade dispute weighing on prices. A resolution in the dispute will support global equity prices. However, equity prices are mixed since low-interest rates and QE programs are supportive of companies’ growth and allow companies to finance loans at low-interest rates.

Gold

As central banks around the world have lowered their interest rates and bond yields (due to popularity) have become lower, Gold has once again become attractive to investors. If these current narratives remain then Gold should remain bid in the near term. Medium- to longer-term prices will depend on how the US-China trade discussions go for Phase 2 and if indeed the US-China Phase 1 deal is signed. Copper is also a key commodity used for growth in construction, so a slowing global economy will see Copper prices falling. Similarly, with Iron Ore.

JPY and CHF

Whenever concerns about global growth emerge between the US and China, we see instant bids into the JPY and the CHF. AUDJPY is particularly vulnerable to downside on global growth concerns because approximately 30% of Australia’s GDP consists of trade with China. Therefore, AUDJPY remains a popular “risk-off” currency for investors as the AUD loses value while the JPY gains value.

AUD and NZD

High beta currencies, like the AUD and NZD, are positively exposed to global risk. When global growth is slowing, or there are risks that global growth is slowing, then expect to see the AUD and NZD pressured.

Oil

When global growth slows, so too does the demand for Oil. The International Energy Agency has revised its forecasts down for world oil consumption recently to reflect these growth concerns.

High Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.