The following article was written by Luis Aureliano, a business writer and financial analyst. With over 15 years of experience in global finance and an MBA in economics and management, Luis’s areas of expertise include business, marketing, communications, personal finance, macro economics, stocks and emerging markets.

European Union law will no longer be the law of the land in Britain.

While the world has been focused on the repeal & replace of Obamacare with the American Healthcare Act, Britons are focused on a repeal & replace of another kind. The purported Great Repeal Bill will put to an end European Union law in the British Isles. However, there is some give-and-take with current legislation, and it appears that EU legislation will remain influential long after the Brexit has taken place. In other words, all laws formed by the European Court of Justice and the British Supreme Court will be equal under British law.

How is the great repeal bill affecting trading activity?

The UK government released a white paper on the Great Repeal Bill, and it considers European Court of Justice and European Union law to be legally binding until UK domestic laws have been altered by legislators. Additionally, all obligations and legal rights for Europeans should remain in the United Kingdom, wherever possible. This is a monumental undertaking in Britain, and lawmakers are being thrown into a tizzy, scrambling to fine-tune legislation to dovetail with the new realities in Britain. From a currency trading perspective, the GBP/USD pair reversed from 1.24 and rally towards 1.2450 recently.

This is a remarkable show of strength for the sterling, given the massive volatility it is subject to. Of course, the reason the GBP is showing such remarkable strength is weakness with the EUR. Currency traders have been shorting the EUR en masse, sending the GBP into the stratosphere. It should be borne in mind that any long-term strengthening of the GBP is unlikely. While Brexit proceedings are underway, currency traders will be carefully eyeing economic data for signs of multinational corporations leaving the city of London in favor of alternatives like Frankfurt, Paris, Rome and elsewhere.

USD Likely to Rally in April

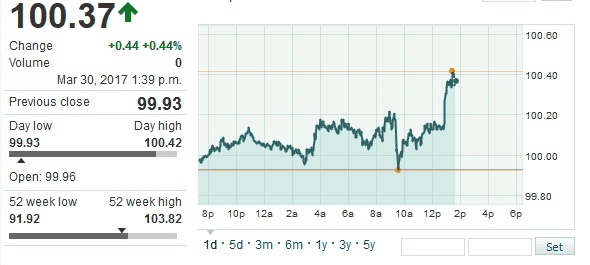

Overall, trading activity tends to confirm a shorting of the USD against the sterling, but the long-term forecasts are definitely bearish. Some of the most important levels to consider with the cable include 1.2478 on the high-end, and if the cable breaks through that level, the next level will be 1.2500. On the flip side, a move towards 1.2420 or 1.2413 would herald new weakness for the GBP/USD pair and cause accelerated movements towards 1.2360, perhaps even 1.2356. For now, the GBP/USD pair is trading in a range between 1.2338 and 1.2500. We are seeing some positive movements with the USD however. The DXY is currently trading at 100.36, for a move of + 0.43%, up 0.43 points from the previous day’s close on Wednesday, 29 March 2017 at just 99.93. This is a strong upside move, and the USD is slated for strong gains in the first week of April.

Effect of the White Paper

The White Paper was released 24 hours after the UK triggered Article 50 of the Lisbon Treaty. This marks the official beginning of Britain’s extrication from the European Union. The UK has just 2 years to transpose all European Union laws into UK law before April 2019. It is a monumental undertaking that will put tremendous pressure on lawmakers in the United Kingdom, but one that Britain is certainly likely to overcome. Meanwhile, European legislators are deeply concerned that the UK will do everything in its power to make it an attractive tax destination for companies around the world. This would jeopardize the EU’s ability to compete with the UK. However, Prime Minister May has assured EU ministers that a level playing field would be maintained to maintain regulatory synchronicity.