ActivTrades’ Market Analysts have prepared for LeapRate their daily commentary on traditional markets for January 17, 2020. This is not a trading advice. See details below:

FOREX

Friday’s trading session began with optimism taking over the market sentiment. The positivity came mainly from China, where industrial production and retail sales both exceeded the forecast, appearing to signal the turn of a corner for the growth of the Chinese economy. This good news, together with American retail sales above forecasts, compounded the lingering positive feeling left by the signing of a trade deal between the US and China earlier in the week. Therefore, it comes as no surprise that both the yen and the Swiss franc are losing ground to the euro and other risk-related currencies.

Ricardo Evangelista – Senior Analyst, ActivTrades

GOLD

There is little volatility on gold, with the price dancing just above the key support level of $1,550. It is clear that investors are waiting for further market movers, after tensions between the US and Iran have eased and Phase One of the trade deal has been closed. The bearish pressure has now moved into a lateral or consolidation phase after the huge rally, with the price steady between $1,550 and $1,560 and looking for a clear direction.

Carlo Alberto De Casa – Chief analyst, ActivTrades

OIL

The support level of $58 generated a reaction on the price of oil, with WTI trying to rebound after a week of declines. Positive US macro data and stock markets in green are lifting the recovery of barrel, which is also benefiting from a graphical point of view by the strong support placed at $58.

Carlo Alberto De Casa – Chief analyst, ActivTrades

EUROPEAN SHARES

European shares climbed on Friday alongside US futures and Asian equities as market sentiment has been given fresh boost by reassuring economic data from both China and the US. Investors who already welcomed the fact that US retail sales strengthened in December have also been surprised by solid Chinese data which topped estimates. Despite an unchanged GDP for Q4 2019, solid improvements in Industrial Production and Retail Sales have driven benchmarks to record highs at the end of the week.

However, today’s game isn’t finished yet as investors will now switch their focus to the inflation report from the eurozone due later today, where many investors will get the ability to guess what could be the next monetary move from the ECB.

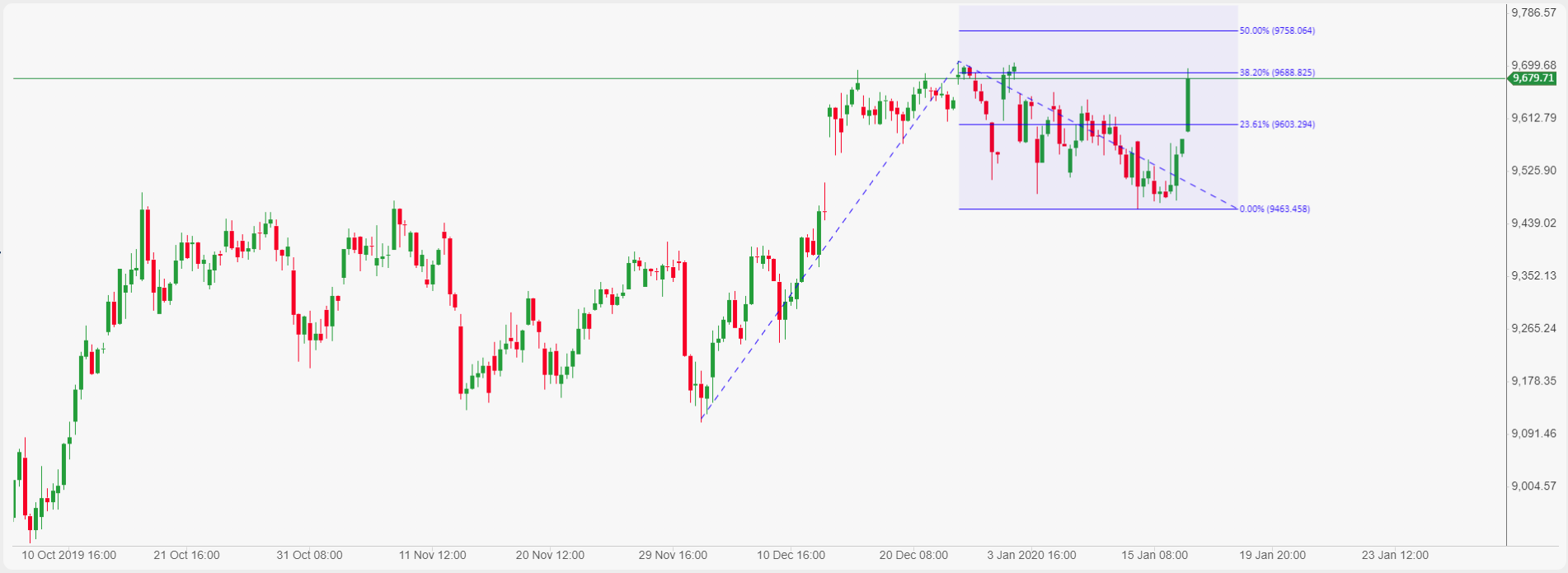

The IBEX-35 from Madrid is currently the best performer in Europe with the market now challenging its first resistance at 9,690pts. A break-up of this level could extend the current rally towards 9,760pts on a short-term basis.

Madrid IBEX-35 index chart

Pierre Veyret– Technical analyst, ActivTrades