Online gaming and financial trading company Playtech PLC (LON:PTEC) has issued a Trading Update for Q3 (technically, for the period since June 30, 2018), indicating that overall not much has changed since 1H results were reported in August. The company stated that it remains on track to achieve adjusted EBITDA for 2018 in the range of €320 million to €360 million.

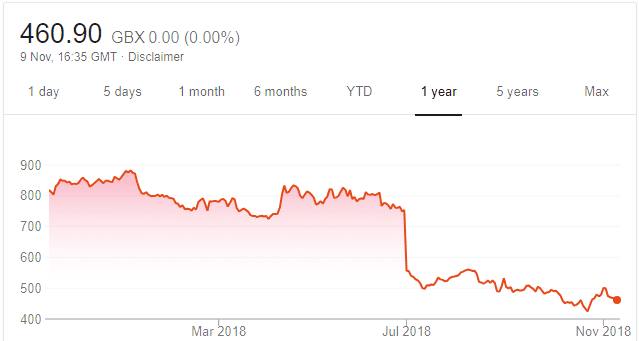

When those expectations were first announced by the company in a trading update issued in early July Playtech’s shares tumbled by 26%, and they have fallen by a further 17% since. The main issue was a significant slowdown reported in Playtech’s gaming business, particularly in Asia, due to what the company termed an “aggressive pricing environment from new entrants to the market”. Playtech did state in the current Trading Update that revenue from gaming in Asia has stabilised at an annualised revenue run-rate of approximately €150 million.

Playtech one year share price graph. Source: Google.

Interestingly, Playtech stated that in its financials group TradeTech, which includes the acquired CFH Clearing and Alpha Capital Markets institutional businesses and the Markets.com retail forex arm, underlying KPIs have continued to display positive momentum during the second half of the year, although market movements favoured customers particularly in September and October. Playtech didn’t specify if that meant a loss in the TradeTech business during Q3, but it sure sounded like that.

Playtech’s full Trading Update follows:

12 November 2018

Playtech plc (‘Playtech’ or ‘the Company’ or ‘the Group’)

Trading update

Performance in line with expectations & full-year guidance reiterated

Playtech (LSE: PTEC) today announces its trading statement for the period since 30 June 2018. Overall performance is consistent with the expectations at the time of the half year results announcement in August and the Group remains on track to achieve adjusted EBITDA for 2018 in the range of €320 million to €360 million.

B2B Gaming Division

Trading in the B2B Gaming Division has continued in line with the trends reported at the interim results in August with good revenue growth outside of Asia. Revenue from Asia has stabilised at an annualised revenue run-rate of approximately €150 million.

B2C Gaming Division

The momentum reported in H1 2018 by Snaitech has continued into the second half of the year with the business continuing to trade in line with the Group’s expectations. The remainder of the B2C division also continues to perform in line with the Group’s expectations.

TradeTech Group

TradeTech’s underlying KPIs have continued to display positive momentum during the second half of the year, although market movements favoured customers particularly in September and October.

Financial Position

The Group’s financial position remains strong. During the period Playtech continued to improve the efficiency of its balance sheet with the sale of its stake in Plus500 and successfully completing a €530 million bond offering. The net proceeds of the offering, together with Playtech’s existing cash resources, have been used to repay all amounts outstanding under the bridge facility utilised for the purposes of the acquisition of Snaitech, to fund the redemption of the outstanding high-yield bonds issued by Snaitech and to pay for other transaction-related costs and expenses.

Event for investors and analysts on 14 November 2018

Playtech will be hosting an event for investors and analysts on Wednesday 14 November 2018 in Milan, Italy. The focus of the event will be on Snaitech, the leader in the Italian gaming and betting market which was acquired by the Group earlier this year, with presentations from the Snaitech management team. In addition, there will be presentations from the B2B Gaming business covering Playtech BGT Sports, regulation and Responsible Gambling.

No new material financial information will be disclosed at the event.