UK online trading leader IG Group Holdings plc (LON:IGG) has reported its results for the first half of fiscal 2018 (i.e. the six month period ended November 30, 2017), indicating record half-year Revenues for the company. IG Group has a May 31 fiscal year end.

Beyond the numbers, IG Group also outlined a number of key initiative and changes underway in response to what has become a very volatile regulatory climate in the online brokerage business. ESMA’s proposals to reduce leverage in CFD trading and to ban Binary Options trading, new MiFID 2 rules, as well as the potential for Brexit to make it harder for UK based companies to serve UK clients, have led IG as well as some of its competitors to take a number of steps ahead of the changes.

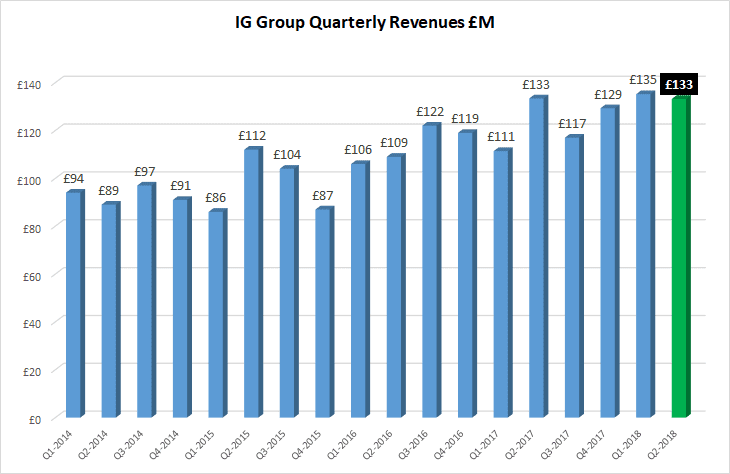

As far as the numbers go, IG had a great first half of fiscal 2018 reporting record Revenues of £268.4 million. We’d note that Q2 Revenues (which IG didn’t break out, they were calculated by LeapRate) of £133.2 million were actually slightly below Q1’s £135.2 million, but both quarters were among the busiest IG has ever seen.

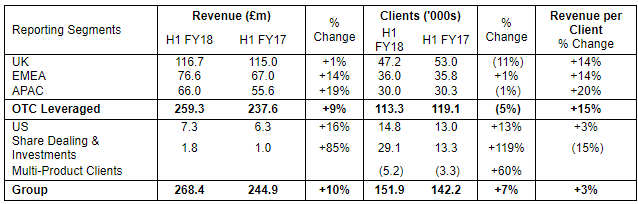

Most of the growth seen at IG so far this fiscal year was occurring in the EU (outside the UK) as well as in the Far East and Australia:

On the bottom line IG reported Profit before Tax of £136.2 million, up 29% from £105.2 million last year.

Among the initiatives IG is taking to deal with the changing regulatory and business climate:

- Reduction in the number of ‘introducers’ and institutional partners, to ensure that all clients who engage with IG through a partner will be offered the same, quality outcomes as those who maintain a direct relationship.

- Development of a multi-lateral trading facility (MTF) for the European market.

- IG stopped offering its Sprint binary product to new retail clients.

- Application filed to establish a subsidiary in the USA to address the potential in the US OTC FX market.

- Application filed to establish a subsidiary in Germany, as a response to the UK’s decision to leave the EU.

On the regulatory side on things, IG continued to call ESMA’s plans to set maximum leverage on CFD and Forex trading at 30x ‘disproportionate’, and go beyond what is needed to protect consumers from poor outcomes associated with excessive leverage. The danger of these disproportionate leverage restrictions on regulated firms is the risk that they will push retail clients to trade CFDs with ‘offshore’ unregulated firms based outside the EU, thereby harming the very clients regulators are aiming to protect.

Outside the UK, IG stated that it has identified potential in the US OTC FX market, where it believes the market is currently underserved. IG filed its licence application at the end of November to establish a new subsidiary based in Chicago, and has commenced hiring for key roles. IG is targeting a US launch in the middle of calendar 2018.

IG stated that it has also applied to BaFIN, the German regulator, to establish a subsidiary in Dusseldorf as a response to the UK’s decision to leave the EU. This office will combine the existing German sales office with key management and control positions and will serve as a regional hub for the Group’s well-established EU business. The establishment of this subsidiary will not have any impact on the Company’s UK operations.

In terms of outlook, IG stated that the business continues to perform strongly, and Revenue in the second half to date is running around 25% higher than in the same period last year. It remains difficult, however, to predict the level of revenue in the short term. Operating costs in the second half at IG are expected to be higher than in the first half, and as previously guided, operating costs excluding variable remuneration for the full year are expected to remain at a similar level to FY17.

IG believes that any financial impact from the implementation of the prohibition on binary options and the restrictions on CFDs being considered by ESMA is unlikely to be significant in the current financial year.

It remains difficult to predict what impact regulatory change may have on the business in subsequent financial years. The company believes that had the measures currently being considered by ESMA been in place throughout the previous financial year the reduction in revenue in that year (taking into account the actions being taken by the business to mitigate the impact) would have been less than 10% including the impact from lower Binary Options revenue. If such measures were implemented the company would expect to flex marketing spend and resource allocation according to opportunity.

IG Group’s full first half 2018 report can be seen here.