LeapRate has learned via regulatory filings that FCA regulated Retail Forex and CFDs broker Hantec Markets saw a decline in activity in its 2017 fiscal year (ended June 30, 2017), reversing the growth trend of the previous year.

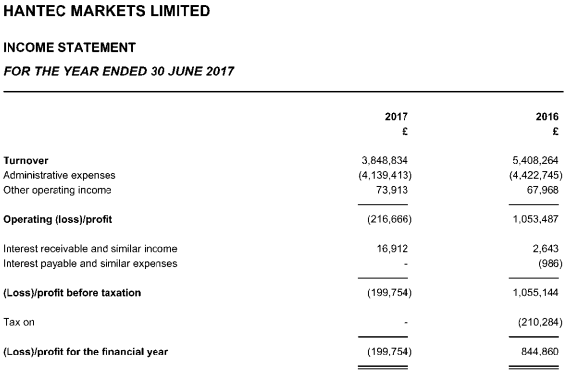

After seeing Revenues grow 62% the previous year, Hantec’s Revenues declined by 33% in 2017 to £3.8 million (USD $45.4 million) down from £5.4 million in 2016. The company booked a small net loss of £200,000 in 2017, versus a profit of £845,000 the previous year.

The company described the decline as “in line with the board’s expectations” calling the results “satisfactory”. The decline was ascribed to increasing competition and regulation in the sector.

There was some good news in the numbers. Client funds held by Hantec increased 36% during the year to £28.5 million (USD $40.1 million), versus £21.0 million last year.

Hayel Abu Hamdan, Hantec Markets

Hantec Markets COO Hayel Abu Hamdan said to LeapRate regarding the results:

While we were certainly not pleased with last year’s results, we have stuck with our strategic plan and our 2018 figures as of the end of February are substantially better both in terms of Revenue and EBIT. Our Revenue year-to-date has already exceeded total Revenues of 2017.

Hantec Markets is part of the Hantec Group, which has been a market leader in Forex trading services for over two decades with offices in London, Sydney, Tokyo, Hong Kong, Auckland, Dubai, Mauritius and Lagos. In September 2017 Hantec Markets announced a three year agreement with Premier League football club West Ham United as the Club’s new official global FX partner. Toward the end of the reported fiscal year Hantec acquired the retail client base of IKON Finance, accounting for part of the growth in client assets noted above.

Hantec Markets’ 2017 income statement follows: