LeapRate Exclusive… LeapRate has learned from several industry sources that Eurex Group, a unit of Deutsche Boerse AG (FRA:DB1), has been experiencing some serious latency issues in the execution of orders in several of the exchanges which it runs, including its main derivative exchange. Eurex’s European Energy Exchange (EEX), Eurex Bonds and Eurex Repo are apparently not affected.

The problems are apparently also affecting Deutsche Boerse’s Xetra trading system. About 90 per cent of all trading in shares at all German exchanges is transacted through the Xetra trading venue.

Deutsche Boerse also licenses/sells the same technology to multiple other exchanges. We are unsure if the latency issues are being experienced on those other exchanges.

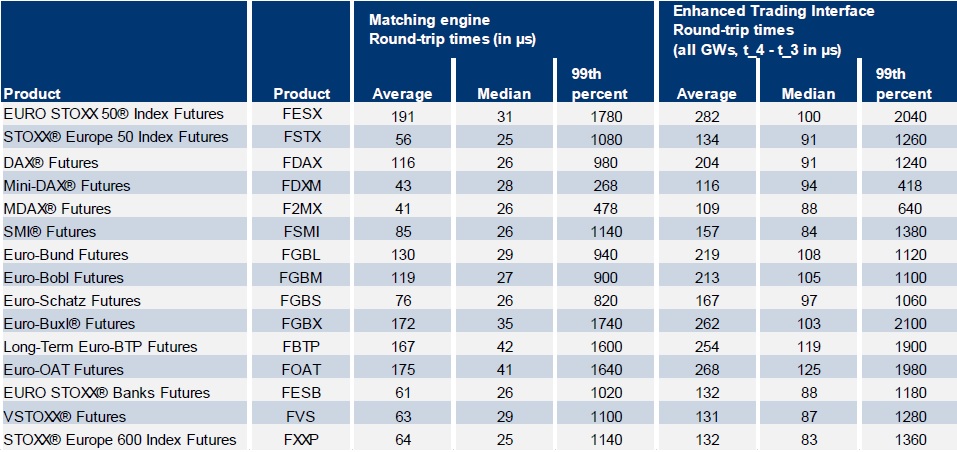

One trader has informed LeapRate that they are seeing latencies of 45 milliseconds on order execution at Eurex. To put things in context, that is in contrast to the typical exchange matching latency of 0.2 to 0.4 milliseconds, or roughly 100-200x the average/median latency. Previously, 0.2-0.4ms (200-400 microseconds) is what the particular trader had observed before the problems surfaced this summer, and also what Eurex publishes (see below).

In correspondence with one of the affected traders (see more below), the Eurex technical people indicate that the issue will require serious additional network reconfigurations and updates, with the next fix not scheduled until the weekend of October 14, in about two more weeks.

LeapRate reached out to Deutsche Borse representatives, and we were sent the following official response and explanation:

Eurex users currently experience futures order latencies of more than 40ms on a very rare basis, e.g. just about 600 out of 13 million Eurex futures transactions – 0.005% – in one typical trading day. Overall, the vast majority of transactions are executed at the same lowest latency level our users are used to, on average 150-400 microseconds. Nevertheless, we work intensely to resolve the issue. A technical upgrade is currently scheduled for October 14 to address the issue.

The following is an excerpt of correspondence between one of the traders affected, and the exchange’s technical team:

Sent: Wednesday, September 20, 2017

To: ***@deutsche-boerse.com

Subject: RE: Ticket **** Open confirmation – Order Latency

We really need some priority placed on resolving these unacceptable latencies on orders. We are regularly seeing exchange latencies of in excess of 45 milliseconds and need to understand why the variation between orders in markets/products that are not particularly busy is so great. We cannot work with the current inconsistent levels without proper consideration placed upon a long term fix or acknowledgement that there are serious problems on a regular basis.

Please can you advise what is being done and what progress is being made to address these repeated issues?

From: *****@deutsche-boerse.com

Sent: Thursday, September 21, 2017

Subject: RE: Ticket **** Open confirmation – Order Latency

We are very aware of the seriousness of this problem and solving it is currently one of our highest priorities with higher management heavily involved. Many customers are affected and there is unfortunately no fixed pattern which and how many Gateway/Matching Engine combinations are affected when the problem occurs. All T7 HF, LF GWs for both Xetra and Eurex seem to be affected.

First configuration changes were applied on 23rd and 24th August to reduce the probability of such events, but the problem was not completely fixed, as you have noticed.

To resolve the issue will require serious additional network reconfigurations and updates. Currently, the next fix is planned to be rolled out on the weekend of 14th October in Production.

We apologize for the inconvenience this is causing.

Kind regards,

Technical Key Account Management

The following is from a Eurex presentation on expected latencies in its various products:

Orders/quotes – detailed performance data for futures

Our transparency

For the top 15 futures products, daily statistics about the matching engine processing times as well as Eurex Enhanced Transaction Interface gateway processing times are provided via the ‘Member Section’ on Eurex Exchange’s website. The ETI round-trip times are calculated based on t_4 – t_3 (gateway SendingTime – gateway application start). Since EOBI integration into the matching engine median and average round-trips have slightly increased.