CBOE Holdings, Inc. (NASDAQ: CBOE) has today reported September monthly trading volume and average revenue per contract (RPC)/net revenue capture data.

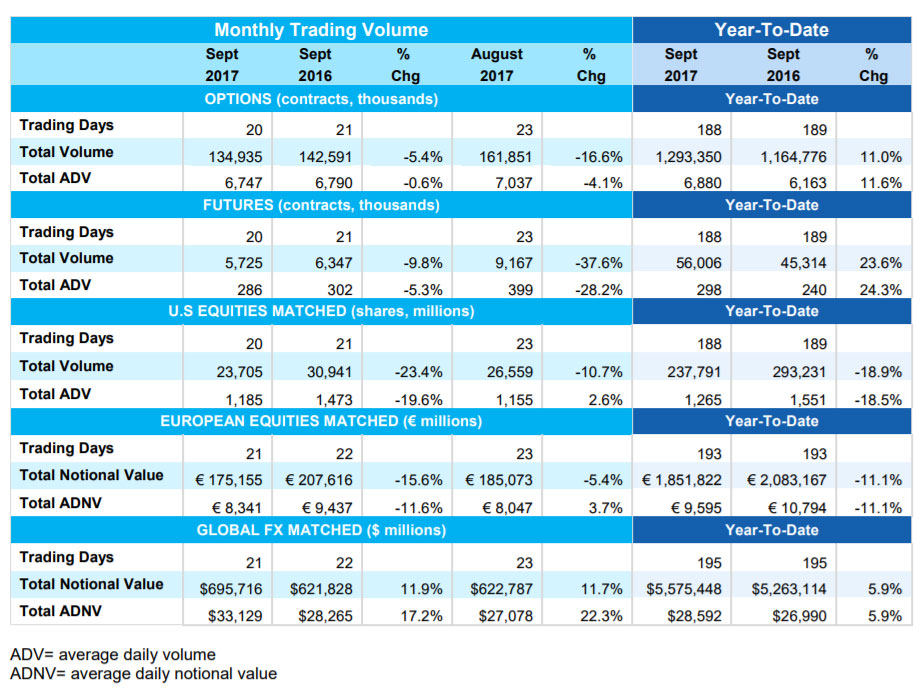

For comparability and informational purposes, the table below presents trading volume on a combined basis, as of January 1 of each year, to reflect information pertaining to Bats Global Markets, Inc., which was acquired by CBOE Holdings, Inc. on February 28, 2017.

VIX Options Set New Daily Volume Record

Trading volume in options on the CBOE Volatility Index® (VIX®) reached a new all-time high on Monday, September 25, with 2,612,952 contracts traded, surpassing the previous single-day record of 2,538,121 contracts traded on Thursday, August 10, 2017. Four of the ten busiest single days ever for trading VIX options have occurred in 2017.

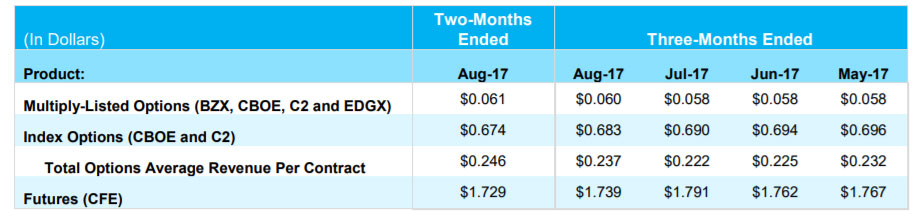

Third-Quarter 2017 Selected RPC Guidance

The company currently expects average revenue per contract (RPC) for the third-quarter of 2017 to be in line with the amounts noted below for the two-months ended August 31, 2017. These expectations are estimated, preliminary and may change. There can be no assurance that our final RPC for the three-months ended September 30, 2017 will not differ materially from these expectations.

The following represents average RPC based on a two-month and a three-month rolling average, reported on a one-month lag. The average RPC represents total transaction fees for CBOE, C2, BZX, EDGX and CFE recognized for the period divided by total contracts traded during the period. Average transaction fees per contract can be affected by various factors, including exchange fee rates, volume-based discounts and transaction mix by contract type and product type.