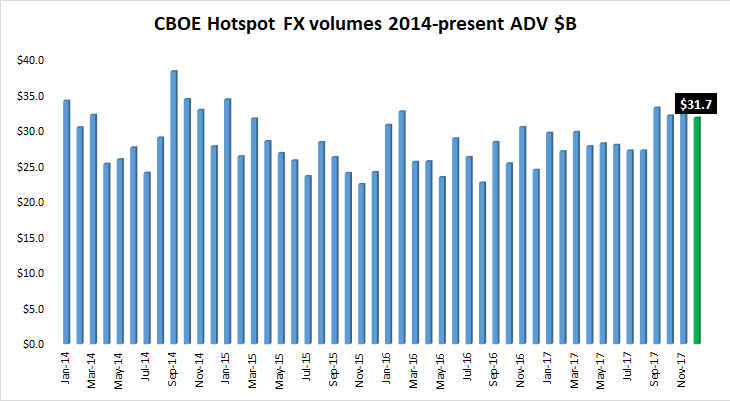

Completing a fairly strong year which included a change-of-control and a new brand name, institutional Forex ECN Cboe FX Markets – formerly known as Hotspot FX – has reported data indicating a slight 7% MoM decline in December trading volumes, $31.7 billion ADV versus $33.9 billion daily in November.

Not bad, considering that November 2017 was Cboe FX / Hotspot’s best month of 2017 and most active month since the Swiss Franc spike driven month of January 2015, when volumes hit $34.3 billion ADV. Given that December is usually a seasonally slow month – and that excluding the last week of December Cboe FX volumes would have surpassed November’s – that’s a fairly good result.

Importantly, December’s results remained well above the $27-29 billion ADV volumes Cboe FX / Hotspot had been seeing throughout most of the the year to date, through to the end of the summer.

For the full year 2017, volumes at Cboe FX averaged $29.6 billion daily, versus $27.0 billion the previous year.

December 2017 marks the tenth month that Hotspot FX was operating under the corporate umbrella of its new owner, CBOE Holdings Inc. (NASDAQ:CBOE). CBOE acquired control of Hotspot FX via its $3.2 billion takeover of Bats Global Markets Inc at the end of February. CBOE initially rebranded its Forex ECN unit as: Hotspot – a CBOE company. And now, as noted above, it has been re-rebranded as Cboe FX Markets, with the ‘Hotspot’ brand being now phased out.