The following article was written by Ramy Abouzaid, Head of Research at ATFX, UAE.

- Risk appetite hit as US warns of more tariffs on Chinese goods

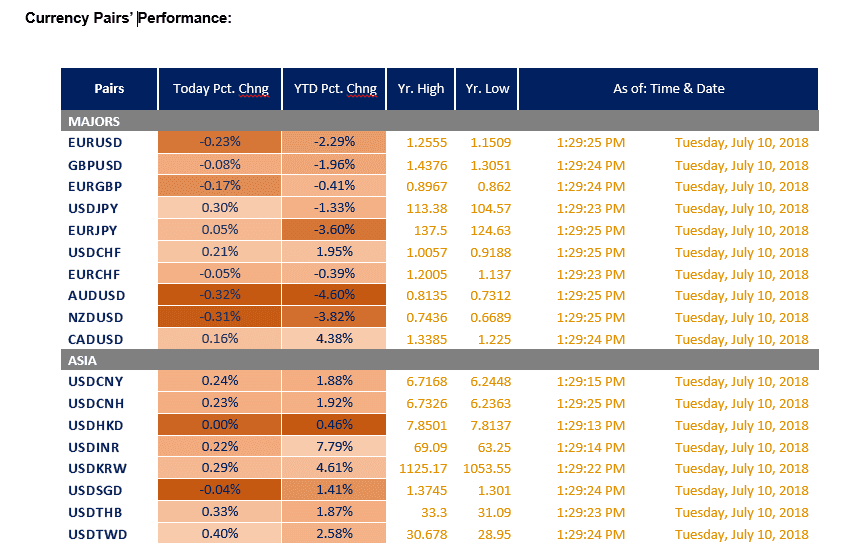

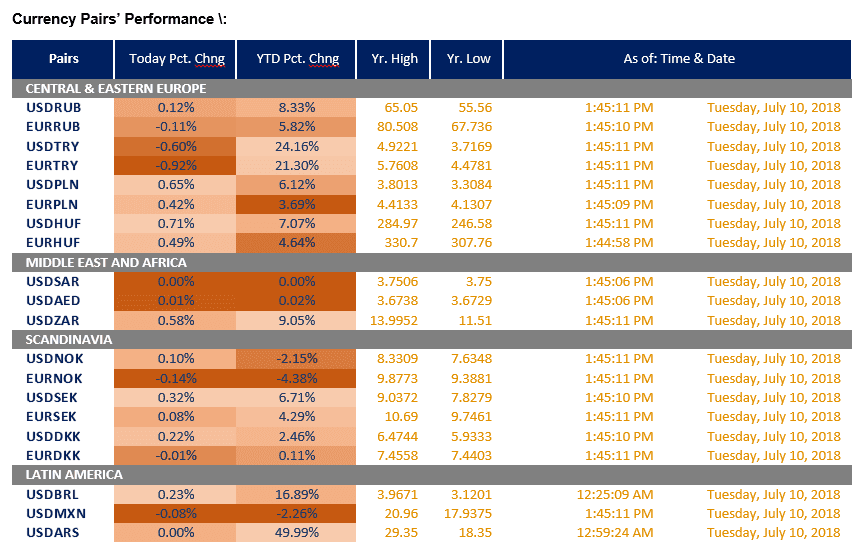

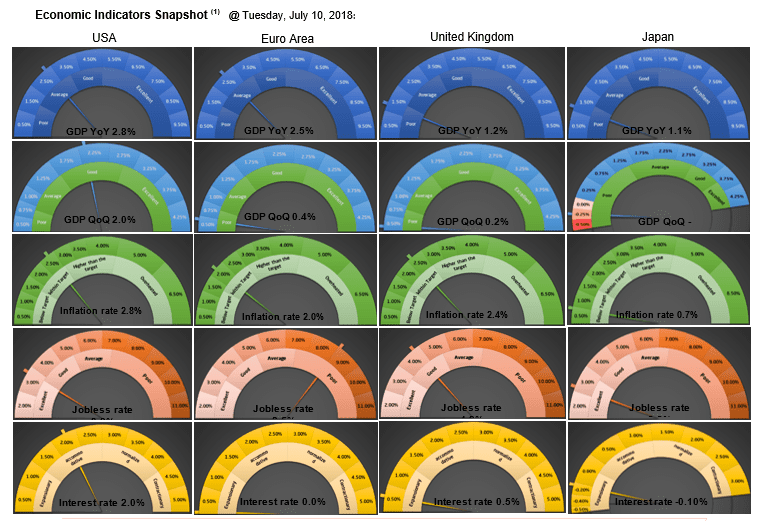

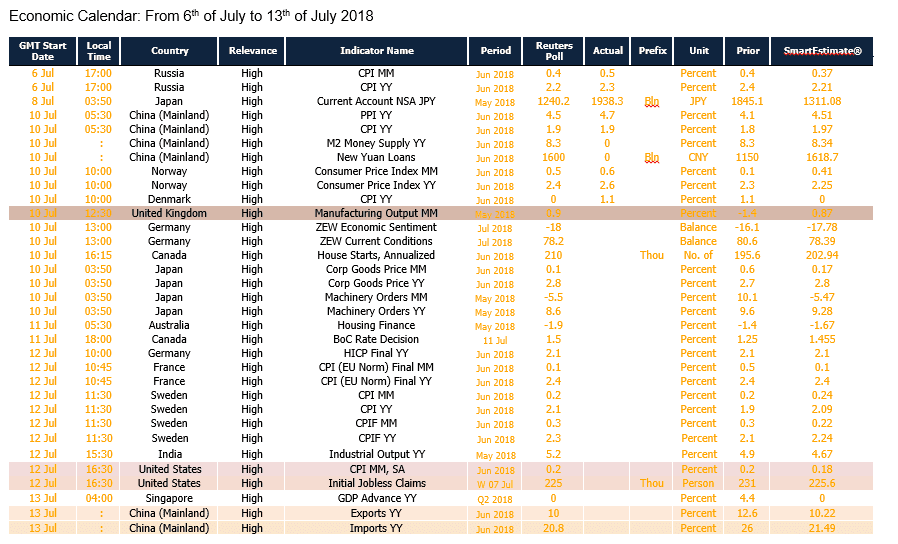

- Global Economic Indicators

- This Week’s Economic Calendar

Asian indices under pressure, yuan falling sharply against the US dollar

The United States said it would impose tariffs on an extra $200 billion worth of Chinese imports, sharply escalating the trade war between the world’s two biggest economies. That has provided a level of support to both the yen and U.S. Treasuries, aiding them somewhat.

The United States had just imposed tariffs on $34 billion worth of Chinese goods on Friday, drawing immediate retaliatory duties from Beijing on U.S. imports in the first shots of a heated trade war. U.S. President Donald Trump had warned then that his country may ultimately impose tariffs on more than $500 billion worth of Chinese imports.

And Washington decided to impose the extra tariffs after efforts to negotiate a solution to the dispute failed to reach an agreement, according to what senior administration officials said on Tuesday.

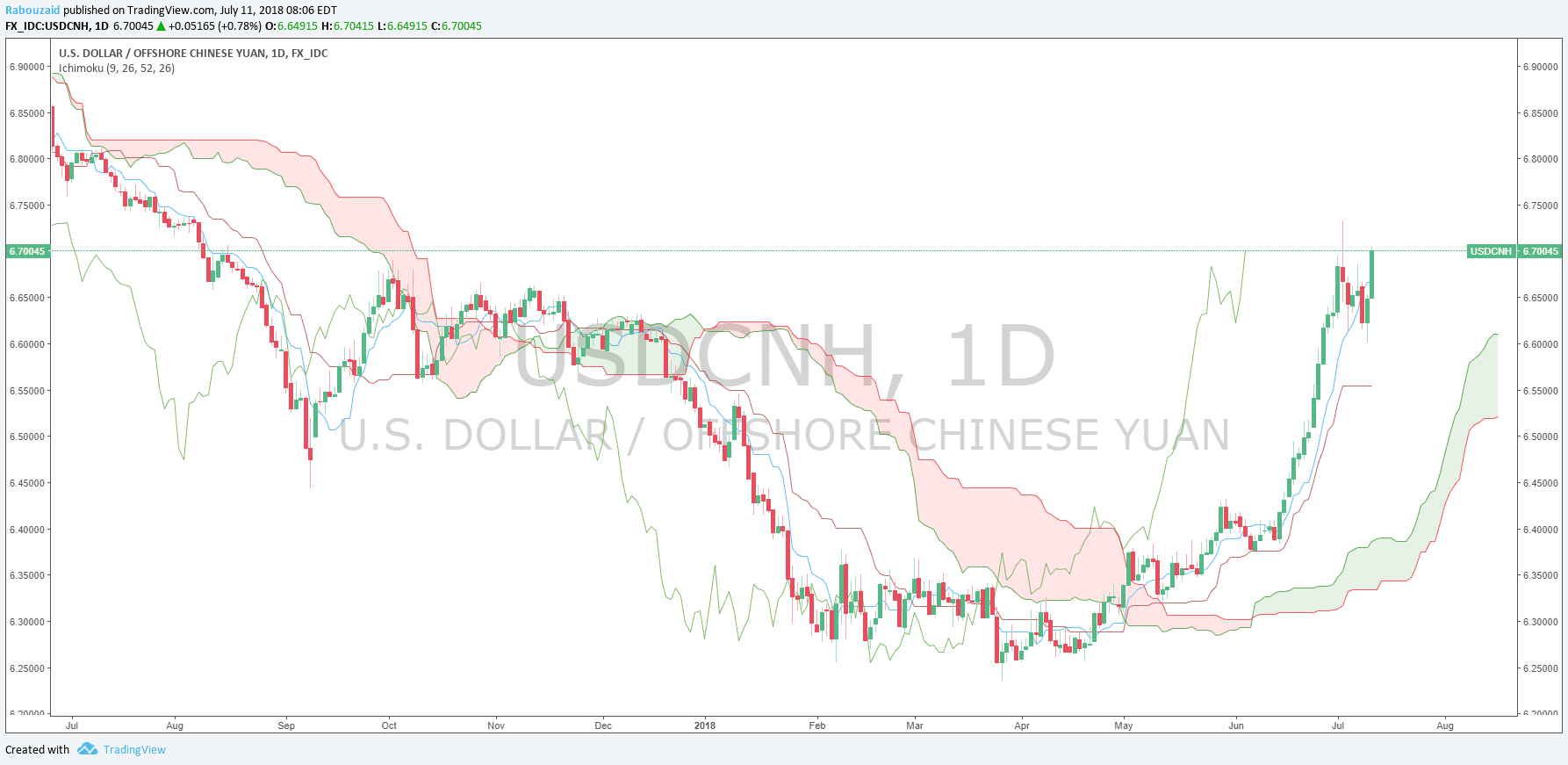

Because of the dramatic increase in tensions, we saw a sharp drop in the Chinese yuan against the US dollar over the past two days, as shown on the graph attached above. The USDCNH pair is now very close to the 6.7333 level, which was last recorded on July 3, 2018 when tensions started to increase.

Going above this level may give the pair the momentum to continue the uptrend trend towards higher levels starting from 6.85, 6.91 then 6.9670.

(1) Data sources & references:

• Thomson Reuters Eikon.

• Investing.com

• TradingEconomics.com

• forexfactory.com

Disclaimer – This document is for information and illustrative purposes only and are not indicative of future results. It is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only and are subject to change without notice. Reasonable people may disagree about the opinions expressed herein. In the event any of the assumptions used herein do not prove to be true, results are likely to vary substantially. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate its ability to invest for a long term especially during periods of a market downturn. No representation is being made that any account, product, or strategy will or is likely to achieve profits, losses, or results similar to those discussed, if any. No part of this document may be reproduced in any manner, in whole or in part, without prior written permission.

This information is provided with the understanding that with respect to the material provided herein, that you will make your own independent decision with respect to any course of action in connection herewith and as to whether such course of action is appropriate or proper based on your own judgment, and that you are capable of understanding and assessing the merits of a course of action. Owing to the long term and high-risk nature of the investments, the strategy may not be suitable for all investors. By accepting this material, you acknowledge, understand and accept the foregoing. High Risk Investment Warning: Contracts for Difference (CFDs) are complex financial products that are trading on margin. Trading Foreign Exchange (Forex) and CFDs is highly speculative, and carries a high level of risk, and may not be suitable for all investors, and therefore you should be aware of all the risks associated with trading these products and trading on margin. You may sustain a loss on some or all your invested capital, and therefore shouldn’t speculative with capital that you cannot afford to lose.

Past performance is not a reliable indicator of future results. AT Global Markets (UK) Limited is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom. FCA Registration number 760555. Registered Office: 1st Floor, 32 Cornhill, London EC3V 3SG, United Kingdom. Company No. 0982709. AT Financial Market Ltd (ADGM) is regulated by the Financial Services Regulatory Authority, FSRA Permission Number 170006. Registered Office: 8th Floor, Al Maqam Tower, ADGM Square, Al Maryah Island, Abu Dhabi, UAE, and only communicates this information for Professional Clients only, with no other persons acting upon it.