The following article was written by Jasper Lawler, Senior Market Analyst at FCA regulated broker LCG.

Jasper Lawler

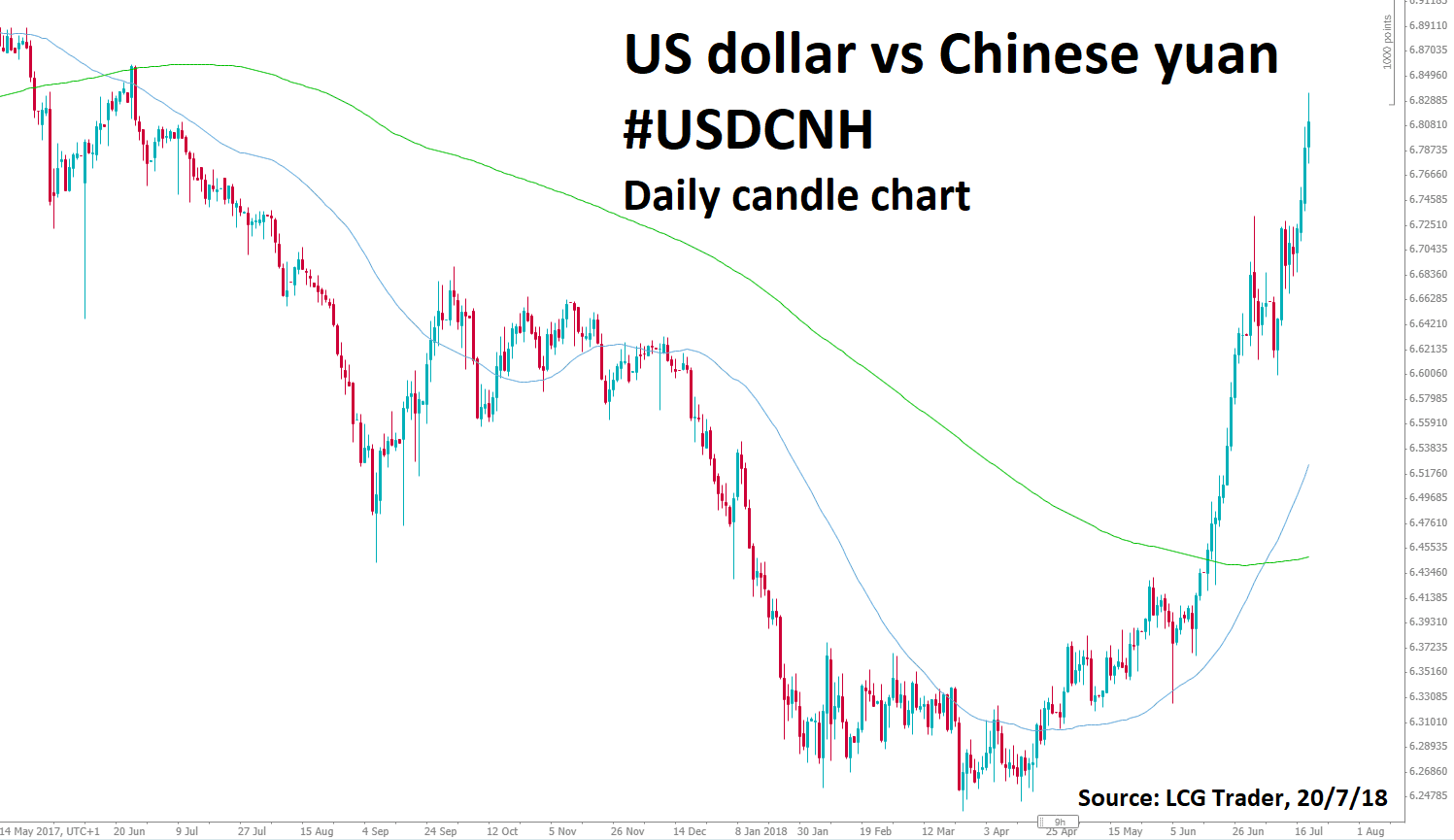

The US dollar has been on a tear against the Chinese yuan/renminbi since mid-April, and in just the past two weeks has skyrocketed to a one-year high.

The main impetus of yuan weakness has been the US-China trade war. Further escalation in the trade war is likely to see the USDCNH (US dollar vs offshore yuan) rally sustained.

The USDCNH picture is just one part of the current state of the world economy, which can be summed up as follows: The US economy is unquestionably the strongest in the world at the moment, and the Federal Reserve is one of the few central banks that continues to eye rate increases.

(It looked, briefly, as if the BOE might be joining the Fed in hiking interest rates, but that prospect vanished in an avalanche of weak economic data reports for the UK, the latest of which downgraded 2018’s expected GDP growth rate from 1.8% to 1.4%. That’s less than half the current projected US 2018 GDP growth of 2.9%.)

The Trade War Continues

The trade war between China and the US continues unabated. US tariffs, followed by retaliatory China tariffs, followed by more US tariffs. President Trump did turn the heat down just a notch by saying he would not invoke emergency law against China, and would, for now anyway, allow the Committee on Foreign Investment in the United States (CFIUS) to deal with concerns about technology theft by China. The announcement sparked a sharp intraday drop in Usd/Cny and an equally sharp rally in Aud/Usd (the Australian dollar is often seen as a proxy for the yuan).

However, since then- talk of implementing tariffs on all $500bn of China exports has seen the yuan slump again.

There are not just economic factors at play, but rather some political ones too from the China side. The People’s Bank of China has apparently adopted a stance of purposely devaluing the yuan as a response to US pressure on imports from China. It followed a similar path in the summer of 2015. Alongside this, the PBOC instructed state-owned banks to add liquidity.

The best-case scenario is the US and China reasonably iron out their trade differences, to the mutual benefit of both economies. The increasingly justified fear is a protracted, although perhaps not terribly heated, trade war – an economic cold war, if you will – that could engender an abnormally lengthy period of “risk-off” conditions, eventually stifling economic growth in a world economy that is still in the process of a fragile recovery from the 2008 financial crisis.

The PBOC must manage a careful balancing act here. While a weaker yuan helps to prop up Chinese exports, it does not aid a suffering Chinese stock market. The Shanghai and Shenzhen stock indexes have been hard hit since the start of 2018.

US Hard Line Draws Hard Line Response from China

Although China may ultimately give in to US pressure (there’s no question that the current situation is far from a “fair trade” deal for the US), for now Chinese President Xi is mirroring President Trump’s firm stance. Xi has publicly warned the country to brace for an all-out trade war, and the PBOC has threatened to reduce its holdings of US Treasuries.

However, it’s questionable how realistic that threat is. Where else is China going to park over a trillion dollars? Plus, purchasing US dollars is part of China’s strategy of keeping the yuan low.

The PBOC moved this week to reduce the reserve requirement for Chinese banks. The move is expected to result in a stimulus of approximately $100 billion to help boost the Chinese economy.

The PBOC is also keeping interest rates relatively low, not following suit after the US announced a 25 basis point rate hike.

China and the US will continue to be Economic Adversaries

Regardless of how the tariff controversy eventually shakes out, the US and China will continue to fight for economic supremacy in the world.

The Current Currency Market for the Yuan

Even a cursory glance at the weekly USDCNH (offshore yuan) chart shows the pair’s dramatic rise, leaving major moving averages (shown on the chart below) far behind in the dust.

But the yuan isn’t the only currency falling in value relative to the US dollar. The dollar has been rallying strongly in 2018 against virtually every other major currency, thanks to a continual progression of good economic numbers. Therefore, the US dollar index may continue to climb for the near future.

Conclusion

If the US continues seeing favorable economic reports while other countries do not, then the US dollar rally is likely to continue. And as long as a depressed yuan continues to provide China with a favorable position in the export market, don’t expect China to be overly concerned about a bull market in USDCNH. Keep in mind that the pair traded significantly higher as recently as 2017.