The following article was written by Jens Chrzanowski, Member of the Management Board of Admiral Markets Group AS.

Hello,

Jens Chrzanowski, Admiral Markets

This week, I will write about of one of the biggest enemies of any trader – one’s own emotions. The article is inspired by a piece by Admiral Markets’ analyst and day trader, Nenad Kerkez. If you like to see him live, don’t miss our new daily webinar series – Real-Time Daily Trading Ideas – any Thursday!

Forex & CFD traders have to not only compete with other traders in the financial market but also, or even mainly with themselves. As a trader, you will most often be your biggest enemy. Being human, we are naturally emotional. Our egos need validation – we want to prove ourselves that we know what we are doing and are capable of taking care of ourselves.

We also have a natural instinct to survive. We are versatile. All our instincts and emotions can be combined to ensure trading successes every now and then. Most of the time, however, our emotions get the best of us and lead us to trading losses unless we learn to control them.

Many traders believe it would be ideal if you could completely divorce yourself from your emotions. That is only possible if you use automated trading robots called Expert Advisors (EAs). To let robots trade is the biggest benefit of any EA, but even in this case, you’ll have to act some time or another. No EA is a carefree-package to run successfully at any time, with any instrument, and in any situation. To make a long story short about trading with EAs: it can be helpful, but you’ll have to act – and manage your emotions!

So, in both trading styles, robot trading and manual trading, the best thing you can do is learn to understand yourself as a trader. Identify both your strengths and weaknesses and try to pick a trade management that is right just for you.

1. Know Your Limits

Overtrading. You have heard this word before, I am sure. In my opinion, overtrading is a term coined by the weak-minded who trade with emotion and are looking to place a label on their failure. But regardless of the definition, most day traders have to deal with it and develop discipline to overcome it… if they want to survive in the Forex & CFD industry. Novice traders might easily fall in the trap of overtrading. Even some experienced traders do.

If you schedule a trading goal for a day, week, and month, you should follow it religiously. When you make a return, stop! Step away from your PC and do not let one bad trade ruin the profits you have made. Wait for pullbacks instead of adding too much to a trade. Find a distraction like TV or social media – it doesn’t matter what you do, just take a break. Do whatever you need to do in order to keep you away from your trading platform.

2. Don’t Miss The Facts

Confirmation bias equals to looking only for the information that confirms the beliefs you already have. For example, if you believe the EUR/USD is going up, you will look for anything to support your belief, which can eventually put you in an awkward position.

Traders who over actively pursue confirmation of their potential trades tend to miss key warning signs that would normally have protected them from unnecessary losses. In an attempt to build a case for their beliefs, traders miss facts. We traders filter the information and price action we want to see and use. This is called our paradigm. Our character, our attitudes, our past, our culture, our experiences, and our beliefs all influence that paradigm. They influence our view of the world.

Ultimately, this leads to traders fighting the trend, with the smart money, and they start losing money with the bad trades they make.

Do you seek a confirmation? Ask yourself the following question: How often do I look for signs that might tell me I could be wrong in my analysis? If your answer is almost never, you need to be aware of the problem.

The best way to overcome confirmation bias is to find someone, or a group of people, you can talk to about your trading. You can always visit our webinars and educational section that will definitely help you with your trading. Hopefully, the person you talk about your trading to will not always agree with you.

Try to keep an open mind as you might catch new moves and trading opportunities. It might also help you get rid of the bad habits of holding on too long to past beliefs.

3. Emotional Support and Resistance Pivot Points

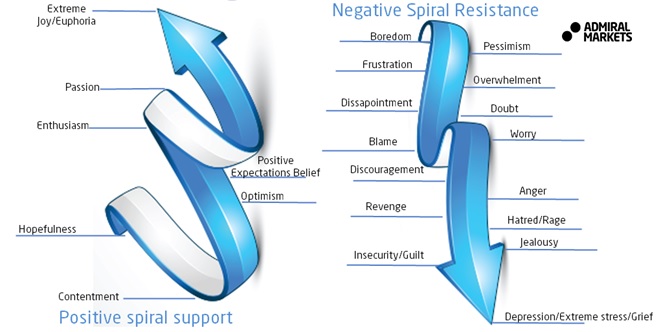

Do you feel excited when you make money? Do you feel agitated when you start losing? Have a look at the spirals above. To trade properly, your emotions should stay up. When you start making profits, your emotions will reach the stage of enthusiasm and passion. Think of it as price action.

As soon as the price touches resistance, you should think about either booking your profits or protecting your trade. The same happens with the emotional guidance scale.

When you feel very excited about trades and profits, you should think about exits or protecting your trade (scaling out). Many traders simply ignore the emotional scale, become greedy, and make newbie mistakes instead of making profits.

In order to keep your emotions under control, you need to gauge your emotional scale when you start your trading day. Your emotions should be at support (as in trading), not resistance. Start optimistic. As soon as you start feeling euphoric, stop trading! Ten good trades can be totally negated by a single bad trade. That happens when you are euphoric.

Never let yourself get sucked into a spiral of doom (negative spiral resistance). It is extremely difficult to get out of it, and you will need more than a good will and a strong mind. We traders usually say, ‘Bad trades are often reactions, while good trades are usually decisions’.

4. Treat it as a Business

Treat it as a business, not a hobby. Most of the trading decisions should be clearly outlined in the trading plan. Trading is a two-step process where traders set up their trading plan beforehand and then execute their plan during the trading day. Another reason why Forex & CFD traders break the rules so often is because their trading psychology and trading strategy do not match.

What do I mean by “match”? Simply implementing the rules that go against your analysis and outlook. Every trader has a ‘natural’ way of trading. This is a method supported by their view of the markets and instinctively makes sense. When you trade a method that does not fit with ‘you the trader’, then obviously rules will be broken! Traders must create a trading plan where it is easier to follow the rules rather than break them. Otherwise, failure to implement your plan is luring around the corner every single trading day.

5. Characteristics: Confident vs. Fearful Trader

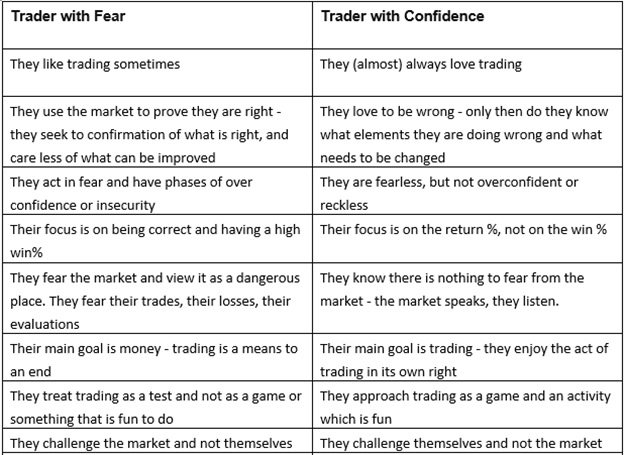

The views of confident and fearful traders obviously differ.

It is entirely up to you to judge which characteristics are good/bad and which ones can be improved. In general, we can see the following distinction between traders with fear and traders with confidence.

Most successful people actually enjoy the activity they perform in its own right, without the financial benefit. People learn a lot quicker when they enjoy something without any external benefit compared to the people who do the opposite.

Impulsive and emotional decisions are created in our own mind. Most of the time the problem occurs when a trader feels under pressure to take an immediate trading decision. However, traders should aim at staying calm and patient when trading to optimise results.

Greed, fear, hope, and impatience are the enemies of traders, while discipline, patience, perseverance, and balanced confidence are their allies.

Final Words

It’s not the first time you’ve read an article on trading psychology. All changes that occur in our minds and the actual realisation of things take time. But if you managed to reach the end of this article, you did a good job. First, read, second, contemplate.

See you next week!

Do you have any feedback, concerns, requests, maybe even compliments? I’d love to hear them. Please contact me via: [email protected].

Trading on margin carries a high level of risk, and this article should not be seen as advice or solicitation to buy or sell, but written for informational purposes.