Mysteries can be fun or evil, but you never get to pick beforehand. Bitcoin and altcoin hodlers are in shock. Their favorite digital assets have suddenly cratered for no oddly apparent reason, leaving everyone groping for the truth about who bombed the crypto train? Bitcoin had been coasting along at $10,000, only to plummet to $8,100, a 19% haircut. It stands now at $8,485. Altcoins faired much worse, suffering losses in the 20%+ and higher range. The “Top 20” lost 34%, as any hope for an “Alt-Season” was quickly dashed.

Cryptos continue to teeter on the edge – will they drop further or gradually crawl their way back to some semblance of respectability? There have been several academic approaches to assemble a reliable set of criteria for valuing Bitcoin. Although studious by nature, these approaches have failed to deliver creditable results, leaving the investment community only one option – investor sentiment drives the value of Bitcoin, and investor sentiment is totally dependent on the prevailing narrative at the moment. The narrative today is overflowing with negativity, a self-fulfilling prophecy that more “down” is coming.

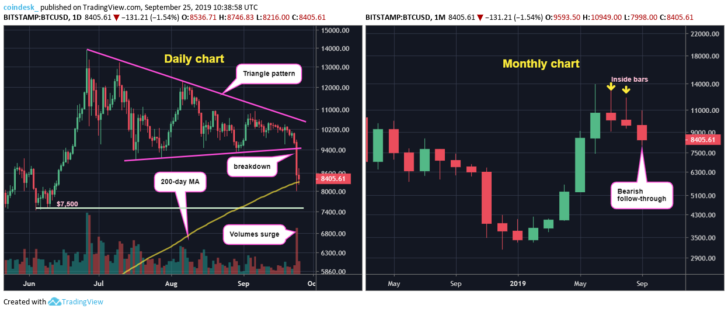

Source: coindesk

The disconcerting aspect of this crypto collapse is that there was no obvious “smoking gun”. Analysts, however, are not short on guesses, but each hypothesis requires an explanation, which suggests that the reason on its own merits fails in the long run. Then again, it could always be the old “cumulative” effect of a lot of little things, all adding up to one big body slam. The technical picture, provided above by Coindesk, is quite clear and requires no such explanation. BTC broke through the triangle pattern and has been accelerating a “bearish follow through” on a monthly basis.

With such exuberance and enthusiasm heading into this week, the cratering of cryptos came as quite the surprise, an embarrassment for sure. As one reporter at Ethereum World News put it, it was “a beating that likely caught bulls with their pants down”. As for potential reasons for the current “Who shot Bitcoin” contest, here, for your review and assessment, are a half-dozen of the prime contenders:

- Geopolitical Goop: Is it a coincidence that the S&P 500 index cratered at the same moment that BTC fell off a cliff? President Trump bashed the Chinese trade negotiations in a speech at the U.N., while impeachment inquiries were announced by Congressional heavyweights – chaos ensued;

- Bakkt Debacle: There was so much pent-up anticipation for this launch that, when only 71 BTC were traded on Day One, Bitcoin investors got scared. The avalanche of the “institutional herd” never happened. Depression was the result;

- Hash Rate Heresy: Mining power behind Bitcoin collapsed on Monday by 40%, coincident with the Bakkt opening. Max Keiser, a Bitcoin investor and analyst, has said: “Price follows hashrate and hashrate chart continues its 9 yr bull market.” The thinking now is, however, that power outages across the Russian sub-continent actually caused miners to go dark. The hash rate has recovered;

- Sorry September Sentiment: The Tie data gatherer goes through excruciating pain to compile negative and positive conversations on Twitter and then compile the results for presentation in a proprietary investor sentiment index. It peaked at “80” in early September, then gradually fell to “40” before “doomsday”, then to 23, thereafter. If sentiment is the only thing holding up crypto values, then so be it;

- $9,000 Technical Trigger: For those that believe that technical imperatives drive investor sentiment rather than the other way around, there is a line of reasoning that posits that $9,000 was far too important in the scheme of things. Once penetrated, a tsunami of sell orders from robots kicked in and wreaked havoc on exchanges, especially the ones that offer obscene leverage;

- Stop-Loss Hunting: Lastly, the fact that Whales and savvy institutional players know how to manipulate the market to their advantage cannot be ignored. If you are a “Big Player” and want a large position in the market on the cheap, the fast way to achieve your goal is a two-step process. First, enter a large sell order at a price and size significant enough to scare weak-handed investors. Second, when prices fall as they will, gobble up stop-loss orders and any other panic selling to grab the bargains you always wanted, before the market takes off again.

Do any of these reasons sound plausible to you? Take your pick, but a few optimistic analysts are claiming that this sudden move may only be temporary. Joe DiPasquale of BitBull Capital still believes that the fundamentals of Bitcoin are strong, and he “expects the price to recover back towards $10,000 in the coming days”. You be the judge.