A lot has changed in global commerce in 75 years, but there is one thing that has not – the dependence of global trade on the U.S. Dollar. As World War II was ending, one monumental meeting resulted in the formation of the World Bank, the International Monetary Fund, and the establishment of the U.S. Dollar as the world’s “international reserve currency”. All manner of goods, commodities, and credit terms were fixed in USD equivalents. Countries had to maintain two month’s worth of USD reserves, based on trade expectations, in order to trade. China, Russia, and Europe would like a change.

The history of this event is interesting on its own, as related by NPR.org:

In 1944, almost exactly 75 years ago, more than 700 representatives from 44 nations traveled to the Mount Washington Hotel, a secluded resort in the mountains of Bretton Woods, N.H. With World War II coming to an end, they arrived to hammer out a new financial system for the global economy.

The result was the Bretton Woods arrangement.

During the post-war era, the United States had the strongest economy, the most stable currency, and controlled the majority of the world’s Gold bullion reserves. It promised to pledge $35 of per ounce of Gold for every USD, and then other countries would set their exchange rates to the Dollar. Eventually, the U.S. could not hold up its end of this bargain, as deficits and Gold reserves dwindled. Forex traders know what happened next. In 1971, President Nixon did away with the Gold standard, and we soon had a free-floating currency system for major currencies. USD remained the reserve currency.

Deficits have continued to rise over the years. Greg Kaplan, an economist at the University of Chicago, explained to NPR that: “Here in the U.S. we have this privilege of being able to issue debt at much lower rates than other countries.” Since other countries are willing to hold our Treasury bills and we are the only country that can borrow in its own currency, we can easily devalue our currency, and in so doing, devalue our debt, a source of friction over time. The French coined a contemptuous phrase to express their increasing irritation by stating that the U.S. Dollar has an “exorbitant privilege”.

Fast forward to today, and any country with trade sanctions would prefer to have an alternative to the USD for settlement. U.S. banks control the financial apparatus around the world. There is no escaping it. Russia, Iran, and China would like a change, one of the reasons each country has hinted at developing a digital version of its own domestic currency. The issue goes back to the fact that the United States is indirectly in control of the global financial system. Countries that do not wish to submit to the censorship of U.S. policy have been pushing behind the scene for change for years.

Anne Korin of the Institute for the Analysis of Global Security recently spoke on CNBC’s “Squawk Box” segment to provide an update on this de-dollarise debate and on who the major movers are behind the scene. It continues to be Russia, China, and Europe that are trying to “ditch the Dollar”, and Korin believes the current situation is growing more “unsustainable”. The “censorship” issue is anathema to these countries, especially when the trade in question has nothing to do with the United States.

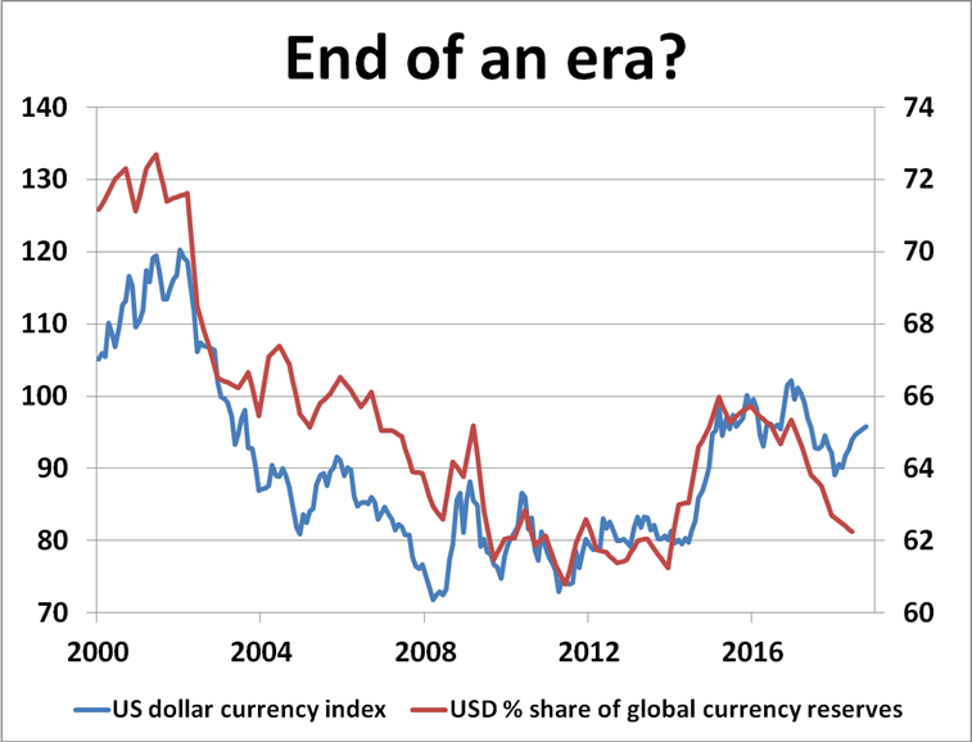

Bitcoin or any other digital asset is obviously free from this censorship problem, but it would be a huge leap to contend that it could substitute as the exchange medium for international exchange. The strength and stability of the U.S. economy has been the primary reason for today’s “status quo”. Central banking reserves are heavily held in USD, some 62%, while the Euro has only managed about 20%. It has changed over time, as indicated in the chart provided by NPR, but has averaged this 62% figure for nearly fifteen years, correlating closely with the USD Index:

The current “barometer” of progress in changing the USD status, as noted by Korin, has been the oil situation. China has pushed hard for Yuan-denominated crude oil futures, but in spite of this and other efforts, the USD still is used in 90% of oil trades. Although small, Korin’s “unsustainable” hypothesis cannot be ignored:

If you have a sort of a beginning to crumble away [at] the dominance of the dollar over oil trade, that’s a nudge in the direction of de-dollarisation.