Bitcoin pulled back again after beating on the $9,400 door, where ostensibly profit taking orders proliferated. BTC remained in positive territory for June, a feat few analysts predicted two weeks back, but the number crunchers were mixed, when it came to explaining why Bitcoin finally had a “sluggish” day at the trading table. There has been so much hype regarding Facebook’s reveal of its true “Libra” plans that many analysts felt that a “sell-on-the-news” was in order after a weekend run up. In another camp were those folks that reminded us that a “safe haven” can be a double-edged sword. Equities were up sharply for the day, suggesting a capital shift out of Bitcoin was in order.

Whatever the case may be, nothing much has changed on the long-term front. Monthly charts confirm that a major breakout from a descending wedge formation is still in progress, a sign that bulls had finally made up their minds to take control of the market with a flourish. The chart below is just one depiction of this phenomenon:

Bitcoin crossed over the $9,000 threshold on Sunday and has managed to close above that level for the past two days. It trades now at $9,070, catching its breath, as it assesses its next move in the market, whether up or down. Down is not out of the realm of possibilities. Skeptics still note a bear divergence on shorter termed indicators, a signal that bulls might be a bit exhausted from this all out assault on upper regions, supposedly filled with a multitude of profit-taking orders.

After all is said and done, Bitcoin did establish a new high for the year of $9,409. Tom Lee, an accomplished Wall Street strategist and the Head of Research at Fundstrat Global Advisors, is back in the news today, claiming that BTC is primed to “take out its all-time highs”. As we reported back in April, Lee was one of the first to assert that BTC had formed a bottom and would eventually take out its all-time high in 2020. He has not backed away from his prediction:

I think bitcoin is easily going to take out its all-time highs of $20,000, and has the potential to run to $40,000 if its use cases grow. We’re deep into a bull market, and people are pretty silent about it.

Tom also had a few words to say about the Facebook developments:

The Facebook announcement is a complete validation that mainstream is now focused on cryptocurrencies. I think it really destroys those arguments that say, ‘I believe in blockchain, not bitcoin’. I think it is more targeted at stablecoin and creating a new kind of banking system, and it’s very complementary to bitcoin. So I think this is actually a really bullish development for bitcoin. I think it’s really bad for stablecoins and anyone who’s been trying to do decentralized finance.

Jon Pearlstone, publisher of the newsletter CryptoPatterns, is focusing on the futures markets for his clues of “What’s next”. XBT futures, which are cash-settled contracts for Bitcoin, have revealed a few insights:

The XBT Bitcoin futures were showing some bullish patterns not seen in recent months, and these patterns broke out above the $8600 mark. This is a good indicator that larger Bitcoin traders and investors are showing bullish sentiment which has set Bitcoin up for a test of the key $10,000 level.

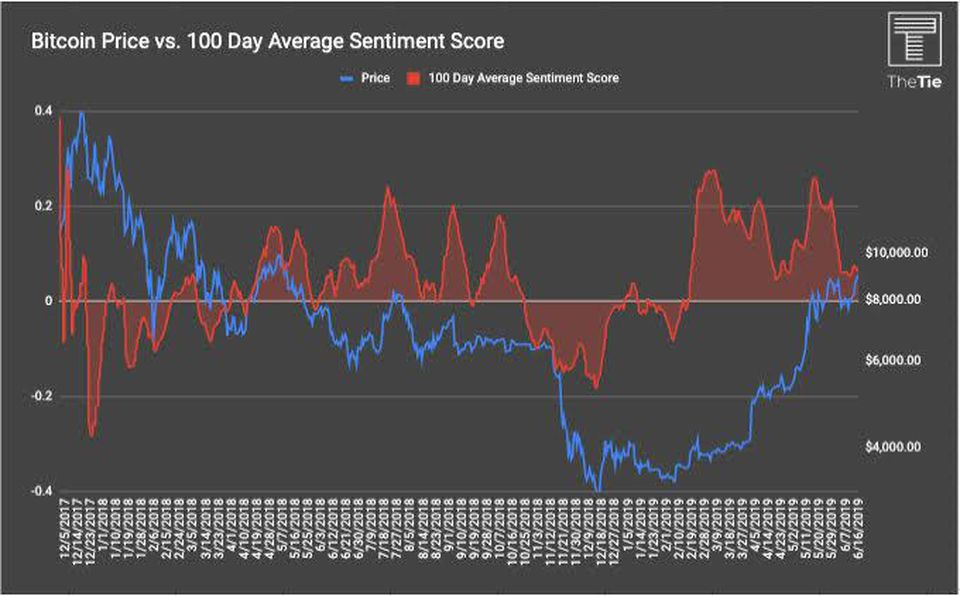

From another perspective, Joshua Frank, cofounder of digital analytics platform TheTIE.io, has developed a proprietary measure of investor sentiment by measuring activity on social media. His chart appears to be a good leading indicator of what might happen next:

Per Frank:

We are currently [experiencing] the most prolonged period of positive long-term sentiment (100-day moving average) since mid-2017, which led up to Bitcoin hitting $20,000. Bitcoin’s 100-day average sentiment score turned positive on February 17th 2019 when Bitcoin’s price was at $3,673.11 and has remained positive for 120 consecutive days. Since turning positive the price of Bitcoin has more than doubled.

Is confidence building in the background for the world’s favorite cryptocurrency? Many analysts believe so, but we must always remember that Bitcoin beats to its own drummer, like no other before it. In a recent report released by Grayscale Investments, their take on BTC was that, “Bitcoin has a distinct set of properties unlike any other asset, which allow it to perform well over the course of normal economic cycles as well as market disruptions”.