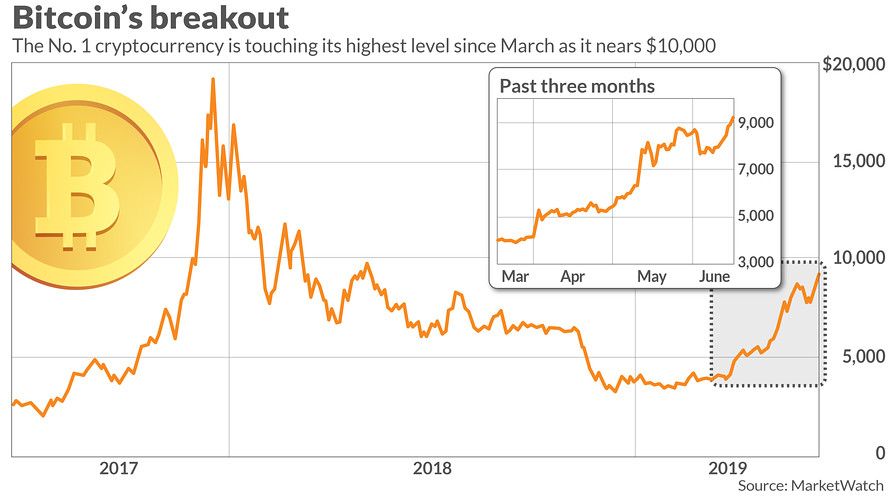

Bitcoin is on fire again, if this weekend’s trading is any sign of things to come in the near term. Today’s trading has almost been a repeat performance, with BTC hovering over $9,000, bouncing down twice from resistance at $9,400, and now nestling in at $9,250. The sudden spurt caught most everyone off guard, but to listen to the ensuing dialogue, advocates and independent observers alike are brimming with newfound confidence, almost beside themselves with accolades and positive pronouncements. To hear this group talk, $10,000 is now a foregone conclusion. The stars are aligned.

Barry Silbert, CEO of Digital Currency Group, is one case in point. Silbert’s flagship Bitcoin trust boasts $2 billion in asset valuations, and his group recently started a firestorm in the Gold community by running an ad campaign that basically implored investors to “Drop Gold” and invest in digital assets. Gold Bugs have been on the offensive, fearing a loss of market share, but Bitcoin’s alarming rise of late has left Silbert in a talkative mood:

The asset class is here to stay…I think it’s now being looked at potentially as an important part of a diversified portfolio…I think the asset class is really ready for the next phase.

The general feeling is that institutional investors are playing a much larger role in this year’s record pace. According to Michael Moro, CEO of Genesis Global Trading, an OTC digital currency trading firm:

The first time Bitcoin crossed the $9,000 mark was in November 2017. That price movement was largely driven by international retail demand – South Korea, for example – in addition to hype around initial coin offerings. This time around, however, we believe that institutional money is playing a much bigger role than it did in 2017, which is evidenced by CME’s record of futures volumes.

Investors are not blind, nor are the gurus of Wall Street. The S&P 500 index and crude oil are barely up double digits for 2019, and Gold, the supreme store of value and safe haven in times of stress, is struggling to gain a meager 5% return. Bitcoin, however, is already topping 150%, and if you really want to go out on the risk/reward spectrum, then how can one ignore Litecoin, which has actually more than doubled the BTC experience, scoring an amazing 353% return to date.

Demand is arising in several quarters, due not only to Bitcoin’s perceived role as both a speculative asset and a store of value, but also to its value as a hedge for a stock portfolio. Analysts have recently commented on the reverse correlation with equities that BTC has exhibited, a valid reason why institutional investors would conclude that Bitcoin is an excellent hedge. According to Morgan Creek Digital’s Anthony Pompliano:

Bitcoin has emerged as a hedge from the uncertainty given that it does not trade in a correlated fashion to other investment categories. This is why institutional investors should have exposure to the cryptocurrency.

Geopolitical tensions are also at work in the background, stimulating demand as well, but the impending launch of the Bakkt futures exchange next month could have a major impact. Bakkt’s contracts will settle physically “in-kind”, not in cash as at the CME and CBoE exchanges. At the end of the day, however, Bitcoin adds a multitude of attractive features, which only add to its mystique. Rayne Steinberg, the chief executive for the crypto investment management firm Arca, noted:

In this digital world where you have an unseizable, unmanipulatable, uninflatable asset that acts as a store of value, there is going to be a demand for that.

There is also one other consideration, which has more to do with the idiosyncrasies within the crypto-verse. There is a natural ebb and flow between Bitcoin and the other major crypto tokens at play. When altcoins rally and Bitcoin’s market share dominance recedes, then there is an expectation of a reverse rally taking place. Experienced crypto analysts like Mati Greenspan, senior market analyst at brokerage eToro, has observed the emergence of Litecoin and foretold in a tweet last week that we might see a sudden Bitcoin resurgence:

If litecoin is indeed the leader, let’s look out for a bitcoin breakout this week.

It looks like Mati was spot on, when other analysts were caught sitting on their hands, but Bitcoin must still work through a multitude of profit taking orders before assaulting $10,000. It is also amazing how quickly the analysts’ narrative of a 30%+ correction has dissipated like snow in the desert, but the BTC rollercoaster, having writ, moves on.