The first half of 2019 has concluded in Crypto-Land, and this event has been accompanied by new research reports that delve into the hidden corners of all things crypto. Coinshares and Circle, two crypto data analysis firms, have each issued reports that purport that the amazing push behind Bitcoin’s meteoric rise during the first six months of this year has largely been due to institutional investors. It is not one key data point but several that support this hypothesis. They conclude that there is no doubt that at least some portion of the trillions in assets managed by hedge funds, pension funds, and money managers are finding their way into the digital asset arena.

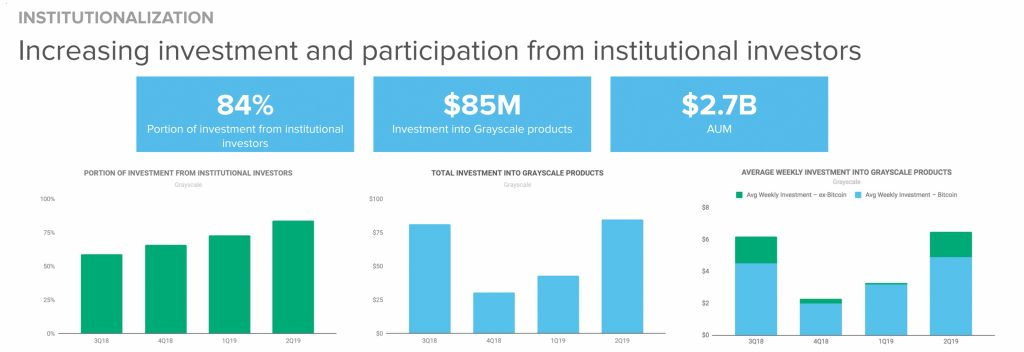

Circle’s analysts pointed to Grayscale data as confirmation that an “institutionalization” of the crypto arena is taking place:

Grayscale recently provided a second-quarter update, showcasing continued strength since market lows at the end of 2018. Assets under management were up 125% quarter over quarter (q/q), driven by an increase in underlying prices, among other factors. The portion of inflows from institutional investors has been experiencing step function growth, rising from 59% in 3Q18 to 84% in 2Q19 — Grayscale notes this figure was dominated by hedge funds.

Crypto enthusiasts have always looked forward to the day that banks, pension funds, labor unions, insurance companies, mutual and hedge funds, and large family trusts would look upon cryptocurrencies with favor, recognize the long-term potential of these assets, and then participate in the revolution to some degree. By the looks of these figures, a portion of the institutional investment community is not waiting for every bell and whistle that they expect to be in place before they establish a crypto beachhead.

In its H1 report, Coinshares has also determined that the retail trader and investor that had dominated support in the past has somewhat receded. Their participation in the recent surge in BTC price behavior has been “relatively tepid compared to 2017.” They also state that there has been a great deal of speculation for the reasons why cryptos have made a comeback, but there has been a respectable recovery: “The continuing professionalisation of the protocol services and corresponding technologies has been impressive and most assets have reacted by recovering substantially from last year’s brutal bear market.”

Coinshares does note the confluence of several favorable fundamental developments that have been obvious drivers in the news. It mentions what it terms as “anecdotal evidence” from its sales division that Fidelity Investments, the advent of Bakkt exchange and other competitors in the rush to issue “physically settled” futures contracts, and, of course, Facebook’s Libra project have been instrumental. It suggests that the Libra firestorm that erupted may have seemed detrimental, but it also raised awareness for the industry.

The firm notes that even though Libra will be a centralized approach, it may still be beneficial for the industry:

While Libra is centralised, permissioned, trust-based, not censorship-resistant, not scarce, and arguably not even a cryptocurrency at all (though this term is poorly defined). It does offer potential benefits to the world’s unbanked that currently don’t have access to services we take for granted in the West, such as online shopping.

Of the two reports, Circle’s 80-page tome delves into more detail. Aside from the data updates from the Grayscale Bitcoin Trust, its report also notes the growth in open interest and volumes in the CME futures sector, quoting Gareth MacLeod, partner at Gryphon Labs, who has said that increased volumes in crypto futures is more than likely due to “traditional finance taking a greater interest in bitcoin.” Circle also concludes that increased scrutiny by regulators is actually increasing the confidence among institutional investors that security and potential fraud concerns are being addressed.