Bitcoin has continued its assault upon the $12,000 barrier, while expanding its crypto market share dominance to 68.8%. Its share had been 66.5% only a few weeks back, but analysts are now projecting an 80% target, as altcoins weaken and fade away. A final reckoning may be occurring, where poor use cases may finally dictate failure, but most analysts believe that Bitcoin’s “safe haven” status is gaining momentum from institutional investors and worried citizens across the globe.

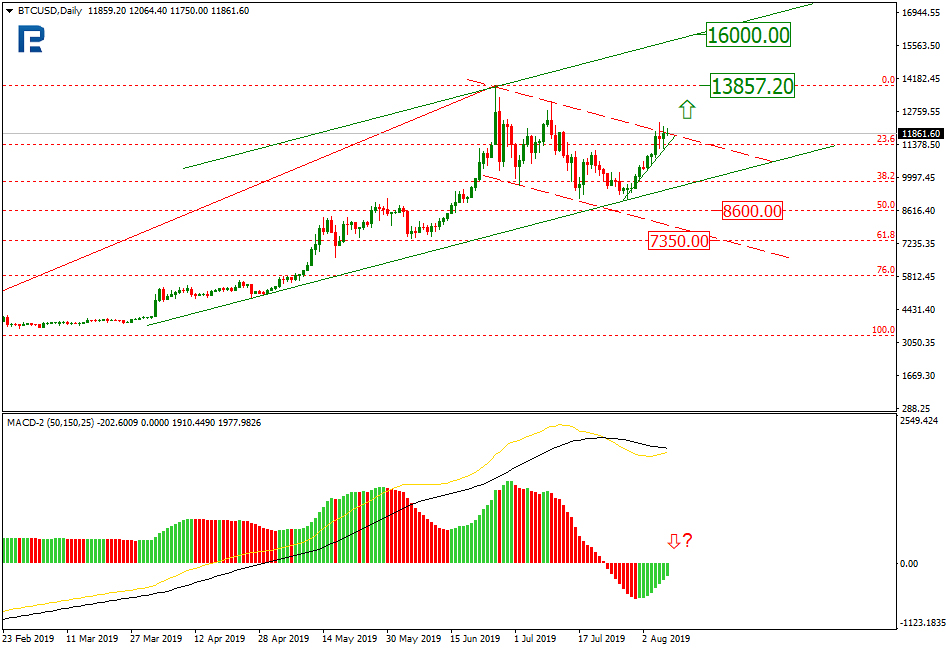

Over the past four days, the world’s favorite cryptocurrency has blasted through $12,000 on two occasions, retained its gain for an hour or two, and then pulled back to safety in the high $11,000s. It currently rests at $11,734. For the month of August, it has bolted from $9,500 to $12,000 in a matter of days, reminiscent of its parabolic path assimilated in June. History demonstrated that the massive gains in June were too much too fast, and from that point, the road down became very rocky… until August.

The current Bitcoin rally appears to many to be a “one man show”. Max Keiser, former Wall Street trader and present-day host of the show Keizer Report, believes that, “The time of altcoins is almost up.” He is also expecting the current momentum to push Bitcoin in a breakaway move to $15,000, leaving its altcoin brethren gasping for air. Litecoin has barely budged, and per other reports:

Such digital assets as the Ethereum, Ripple, EOS and Bitcoin Cash look really unstable from the point of technical analysis, and it seems they are on the verge of another decline.

Is the current Bitcoin path sustainable? The strength of the present move has been a surprise to analysts. A subset is still forecasting a severe pull back at some juncture, but the majority of analysts is pointing to global trade war tensions as the primary driver, along with the fact that central bankers seem inclined to be more dovish going forward.

The Bank of Thailand just announced a 25 basis point cut. Central banks in major developed economies have also been easing back due to a declining global economy. Per one report:

Central banks across Asia are easing policy to boost growth and keep pace with the U.S. Federal Reserve, which cut its benchmark rate by 25 basis points last week. New Zealand and India cut interest rates earlier Wednesday — in both cases by more than forecast — while the Philippine central bank is expected to cut its key rate Thursday after inflation reached a two-year low in July.

Nigel Green, chief executive of financial consultancy firm deVere Group, explained:

Bitcoin is becoming a flight-to-safety asset during times of market uncertainty. Bitcoin is currently realising its reputation as a form of digital gold. Up to now, gold has been known as the ultimate safe-haven asset, but bitcoin – which shares its key characteristics of being a store of value and scarcity – could potentially dethrone gold in the future as the world becomes increasingly digitised.

Jeremy Allaire, CEO of one of the largest cryptocurrency payment firms Circle, echoed similar sentiments:

You can very clearly see some macro correlation there. Rising nationalism, rising amounts of currency conflict, trade wars, these all obviously are supportive of a non-sovereign, highly secure digital store of value.

Marcus Swanepoel, CEO at cryptocurrency firm Luno, added that investors are beginning to appreciate the appreciation potential of Bitcoin, in addition to its hedging benefits:

It is now clear that investors put money into cryptocurrency when the main markets are falling. The strategy of using gold or the yen as a safe-haven asset and at the same time buying digital assets to potentially produce a high return, is gaining momentum.

Sustainability is still the question of the day. As we have reported, having “safe haven” status can be a double-edged sword. When geopolitical tensions mount, weak hands will shift capital to safer climbs, but only on a temporary basis. When the risk climate adjusts, and investors’ appetite for risk improves, capital can shift out of safe havens in a swift movement that can be difficult to predict. If the recent Bitcoin rally is really due to investors favoring it for their short-term needs, then a sudden pull back may be imminent.