It is often said that politics and religion should never be discussed in mixed company, but in today’s digital age, you might want to refrain from discussing comparisons between Bitcoin and Gold, especially if there are any Gold Bugs in the room. The fact that comparisons are made is a mystery, but ever since its inception, Bitcoin has often been referred to as “Digital Gold” or “Gold 2.0”. Perhaps, this unfortunate association had a nice ring to it at one time, but Bitcoin is still in its early development stages. Gold has been with us since the dawn of mankind.

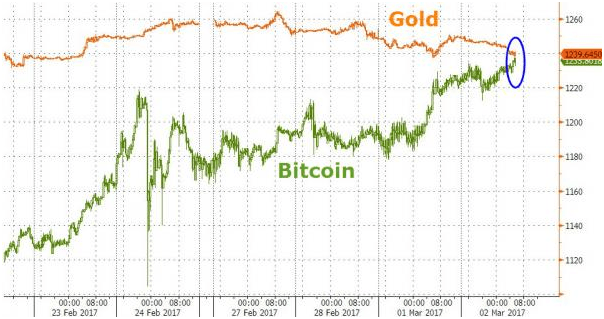

It was not that long ago that the market values for each item, at least when comparing one ounce of Gold to one Bitcoin, were equivalent. The crossover occurred back in March of 2017, as depicted in the chart below. To place both on a chart of this kind is along the lines of comparing apples and oranges, but for crypto advocates, it made for a nice argument that Bitcoin had arrived as a “store of value” and should be accorded the credibility and acceptance that such a description deserves. The only problem with this statement is that central banks are not buying into that argument.

From that auspicious convergence in March or 2017, Bitcoin has never looked back, although a multitude of cynics have suggested its valuation should have returned to this price level after its epic rise in 2017 and its equally epic fall in 2018, euphemistically referred to as “Crypto Winter”. A number of Nobel Laureate economists have also argued that the value should be zero, but that is another story.

In a recent article that reviewed this ongoing debate, the author concluded: “The two assets rightfully draw many comparisons – they both have a finite supply that’s mined, and can be used as both a means of exchange and store of value. Oftentimes, the comparison sparks debate as to if Bitcoin could potentially flip the market cap of Gold, which would take the price of Bitcoin to over $350,000 per BTC.” If the global hoard of Gold is valued at $8 trillion, then BTC might need to be $450,000, but who is counting?

It appears that Gold sellers are the ones doing most of the counting, as well as bond sellers and anyone else that suspects a drop in demand for his or her asset class is due to some crossover to Bitcoin and its altcoin brethren. The debate can get awfully heated under these circumstances.

Grayscale Investments is a trusted authority on digital currency investing and runs a private placement fund called the Bitcoin Trust, publicly traded under the “GBTC” call sign. The firm’s current advertising campaign actually says that investors should “Drop Gold” and substitute Bitcoin. Obviously, Gold sellers take issue with this premise and have taken to the streets vociferously decrying such a notion. One amusing quote that received airtime this past week was that: “The big picture is that bitcoin has been corrupted because it is a creation of man and gold cannot be corrupted because it is a creation of God.” Looks like a religious reference just entered the conversation.

Bitcoin and Gold comparisons seem to have marketing overtones that are adversely affecting someone’s paycheck, and they are not happy about it. We could walk through a list of comparison categories, such as demand, volatility, liquidity, usefulness as a hedge, appreciation/depreciation potential, counterparty risk, financial safety, and on and on, but, hopefully, you get the picture. Both assets remain different for various reasons and offer different risk/reward characteristics for investors to consider. What more is there to discuss?