Analysts tend to get complacent when their favorite asset goes into ranging mode for an extended period of time. BTC has been range bound for more than thirteen weeks, hovering about $10,300, as if “low volatility” was its middle and last name. We have seen a dearth of recent outlandish predictions of how high the market leading crypto could go, if only given half a chance. The few analysts that expect fireworks in short order have fastened upon the Bakkt launch on Monday, as the catalyst for a new blast off.

Another group of the analyst community, however, is fearing the worst. When the CME opened shop with its “cash settled” futures contracts in late 2017, the sky began to fall soon thereafter. Crypto Winter ensued, and the rest is history. Could the advent of the Bakkt crypto futures exchange, to be settled “in kind”, usher in a new period of shorts from the professionals trained in this fine art that inhabit institutional hedge funds?

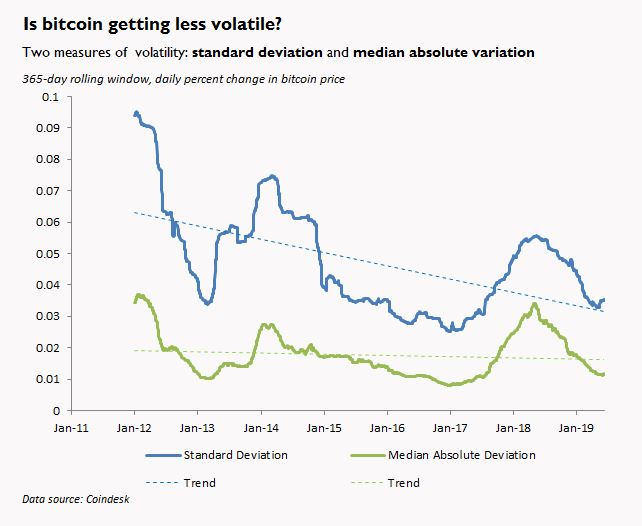

The jury may be out on this one, but there is one certainty that cannot be ignored – BTC volatility has been in decline and has been hitting levels not seen since May and before. This fall may be a sign that Bitcoin is actually maturing as an asset class, but there is more to it than that notion. Bollinger Bands are contracting. The “Average True Range” (ATR) indicator is also falling, but these short-term indications signal that a major move in pricing behavior is imminent. The timing of such a move is uncertain. It could be days, weeks, or months down the road, but the move could go in either direction.

Is there any other information that we can glean from the above chart, provided courtesy of Coindesk? Noelle Anderson, Director of Research at Coindesk, recently released a treatise that discussed in depth the vagaries of Bitcoin’s history of volatility and what it all means when it comes to the asset’s valuation. Her first contention is that, if you observe volatility measured from a “median” value and not an “average”, the lower of the two curves suggests that volatility is really not falling over time, but fluctuations remain wild.

The reason for the inherent “wildness” has to do with how Bitcoin valuations arise from market forces. There have been many attempts to develop an analytical “rubric” for assessing the “fair value” of Bitcoin, but none have been consistent enough to warrant support. The Bitcoin market still has a ways to go to mature. Until then, market sentiment will drive prices, and sentiment in turn is a result of the prevailing narrative in the financial marketplace. In this environment, values can wildly gyrate, as the narrative shifts.

Low periods of short-term volatility, however, are always followed by severe breakouts, a proposition that traders and investors need to keep in mind these days. Here are five factors that could overly influence Bitcoin’s fundamental narrative and therefore price:

- Market Sentiment: Let’s start with the obvious. Recent renderings of the “Fear and Greed Index” have overly impacted investor sentiment, as have attacks on Facebook’s Libra, potential bans in China and India, and regulators that love to use all things crypto as the latest “whipping post”;

- Blockchain Developments: Bitcoin does not own a patent on blockchain technology, but favorable stories about it confers favorable long-term perspectives on the future prosperity of cryptocurrencies and related crypto development efforts;

- Price Manipulation: Mass accumulations of Bitcoins are concentrated in the top few hundreds of addresses. The concern is what might happen if any one or many of these “Whales” begin dumping or maneuvering for advantage in the market. Will there be a tsunami when the waves hit valuations?

- Safe Haven Status: Much has been written about institutional investors recognizing Bitcoin as a temporary “safe harbor” when chaos hits the global stage, as in trade wars, fiat devaluations, or thoughts of a global recession. BTC will benefit from the front end capital flows, but withdrawals will soon follow;

- Bakkt “Go Live”: Lastly, we have to mention once more the Bakkt launch date on the 23rd of September. Anything can happen and will, before, during, and after. Be prepared for whatever comes. More ranging behavior would be a surprise.

The next week could be very interesting for both Bitcoin and its altcoin brethren, but so could the following weeks and months. There will be a breakout. It’s time to prepare.