Bitcoin is not a problem to be solved – It is a mystery to behold. Ancient writers may have writ this aphorism about life, but today it appears to apply to Bitcoin, as well. The entire analyst community is scratching its collective head today to ascertain the reasons why their beloved digital asset suddenly fell from the heavens and descended into the netherworld. In actual fact, the 11% plunge only ranks number three, when you review the “Top Ten” BTC daily crashes of 2019, but for some, the proverbial sky was falling.

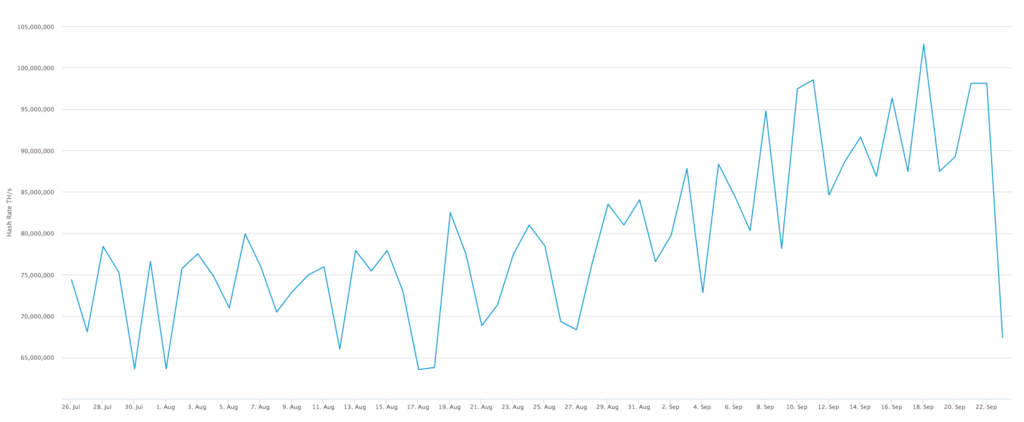

Perhaps, our collective memory was also short in the tooth. June 27 and July 16 had falls of 13.5% and 13.2%, respectively, but no one was perched on a second-story window, ready to call it quits, if only the wind would blow. Today, the sun did rise in the east, and Bitcoin was hanging to $8,300 for dear life. Analysts had been searching for causes through the midnight hours, choosing to believe that the coincidence of a crash in the S&P 500 index was not reason enough. Several theories have come forward, but the most interesting of them all is BTC’s hash rate. It fell precipitously the day before:

Source: blockchain.com

The hash rate, that mysterious measure that few people on the planet understand, but for those with a bent for the obscure, this variable can offer the benefit that a good leading indicator should – make valid predictions of what is to come. The “crash” in this statistic was a monstrous 40%, and to the wonderment of all, it occurred on the day that the Bakkt futures exchange opened its doors for business. Just a few days before, the hash rate had set a new All-Time-High (ATH) of 102 quintillion (tera) hashes (TH/S).

I will not attempt to explain what a “tera-hash” is, but for the record from Cointelegraph:

The hash rate of a cryptocurrency — sometimes referred to as hashing or computing power — is a parameter that gives the measure of the number of calculations that a given network can perform each second. A higher hash rate means greater competition among miners to validate new blocks; it also increases the number of resources needed for performing a 51% attack, making the network more secure.

Miners can also shift their focus by switching out software algorithms, if and when they perceive a greater opportunity with a competing token system. A few analysts surmised that miners did reposition efforts on Monday, firmly believing that Bakkt might change the Bitcoin world in a negative way. The hash rate dropped like a rock on Monday from 98 TH/S down to 57.7 TH/S. Ouch! The good news is that it later returned to 88.3 TH/S.

The sudden return to normalcy may have prevented analysts from heeding its clarion call for what was to transpire later in the day. Bitcoin crashed, and yes, hindsight was definitely “20/20”. But were the two “crashes” really connected at the hip? It turned out that a vast array of mining networks throughout Kyrgyzstan and Kazakhstan were without power, due to ongoing disputes with electrical utilities or general blackouts. For now, this explanation seems plausible, considering how the hash rate events played out.

What about the correlation between BTC price behavior and hash rate totals? According to Ryan Alfred, President of Digital Assets Data:

While it is indeed possible that the correlation is circumstantial, we feel that the hash rate responsiveness to the pullback in BTC/USD towards the end of 2018 along with the corresponding recovery of both throughout this year may be signaling a more persistent relationship.

Correlation coincidence is not proof of causation. More research is necessary, but for now, the jury may still be out.