After a trial on Demo environment which we reported began last month, Swiss based retail forex broker Dukascopy has announced that its new type of binary options – Touch Binaries – has been released on Live and is now available to binary options trading account holders in Dukascopy Bank and Dukascopy Europe.

Trading conditions and instruments range are identical to demo.

Touch Binaries are binary options on FX currency pairs with 2 remote strike prices set around the open price of the option. At order initiation the client defines a target price level (which is the strike price that makes the option mature with profit, i.e. ITM) and the contract duration. At the same time the system automatically sets the second target price level (which is strike that makes the option mature at a loss, i.e. OTM) on the other side of the current instrument price and on the same distance from it.

Client is setting the target price level by indicating the distance from the instrument’s price at order start. Distance to both strike prices is calculated based on the Ask price at contract initiation for CALL (Up) options and based on the Bid price for PUT (Down) options.

Constraints apply to the strike distance that can be set. Each instrument has its own Minimum and Maximum strike distance. Client is setting the target strike within this range, which is automatically validated by the trading platform.

A Touch Binary is active until any of the strike prices is reached. Touch Binaries contract duration is always last until the settlement time (at 21:00/22:00 GMT depending on the summer/winter season). Option outcome is defined by the first event out of the following 3 to take place:

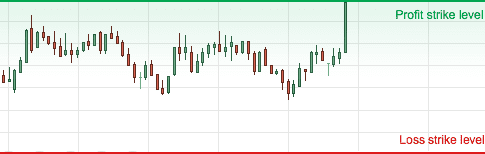

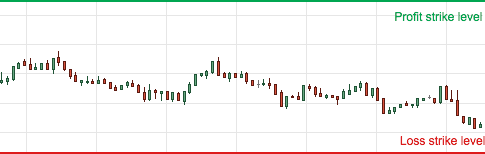

Visualized examples below demonstrate possible outcomes of a CALL (Up) touch binary option

- If the option’s underlying instrument reaches or exceeds the Profit strike level at any time prior to expiry – the option would be executed with profit, which is in-the-money.

- If Loss strike level is hit – the option is executed at a loss, which is an out-of-the-money outcome.

- In case the option’s underlying instrument price does not reach either of the strike prices during the entire period of contract’s duration the option is cancelled without settlement (i.e. without any trading profit or loss) and the contract amount is returned to the client.

Limitations applied to contract duration, contract amounts and exposure are identical to the ones used for regular Binary Options.